|

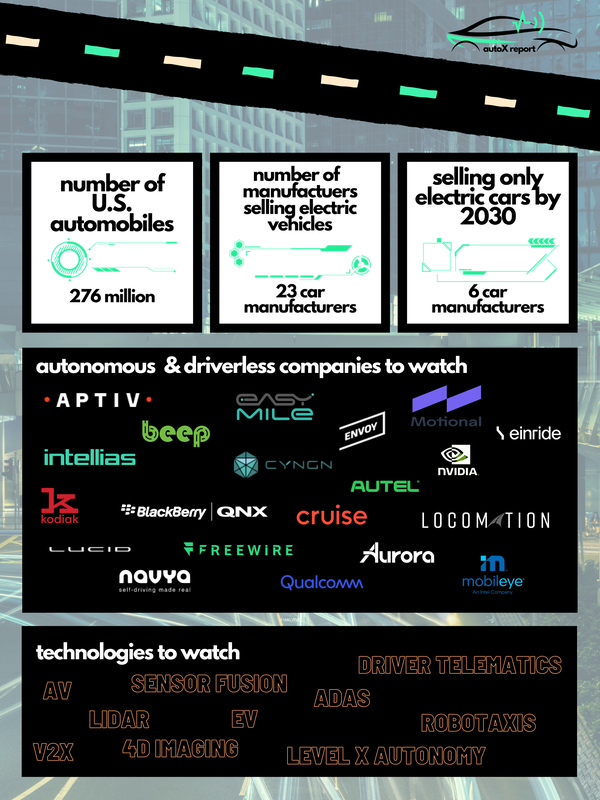

As we start the last month of December, Compass Intelligence has been thinking through the "What's Next" in technology. As a careful observer of funding, startups, announcements, news, and key happenings, I have noticed a very subtle trend of projects, press, announcements, new hires, and funding moving towards automotive, transportation, and the infrastructure that mobilizes these machines. Now you have to really dig a bit deeper, as the automotive space is vast and so is the technology sector. If you combine these 2 industries and focus in on the following trends, you will see an opportunity of a trillion plus market: Unlike other over-hyped industries, the autonomous, driverless, and electric vehicle markets are accelerating at an even faster pace than the experts predicted 5 years ago. This industry is now embracing the human machine interface and new driver experiences are on the horizon. The combination of advanced technologies and transportation is undergoing a massive METAmorphosis...Are you ready? When will we see Level 5 autonomous on the streets in your city?

Compass Intelligence likes to be one step ahead of the game, and while these markets are not necessarily new, the growth and opportunity is opening up due to advancements in technologies such as AI, HMI, data analytics, IoT, edge computing, 5G, and others. All of this said, we are announcing the launch of a number of new services, focus areas, and recognition programs targeted around the automotive technology sector. New services & programs will include:

How do you get involved?

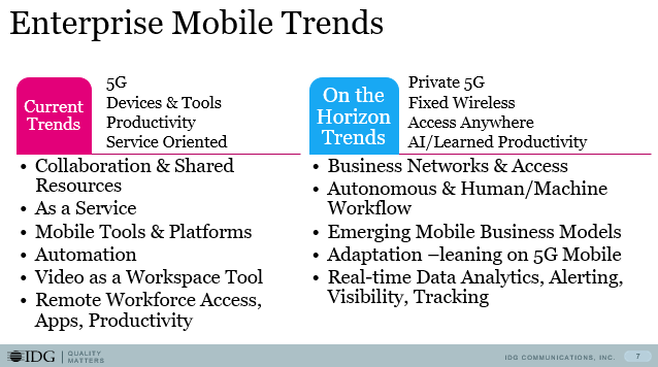

Learn more about why this research is important and review the award categories below, and be on the lookout for our press release in early December. On October 20th, a large group of industry analysts joined 5G Americas staff and members to discuss the state of 5G. Neville Ray of T-Mobile, Chair of 5G Americas, kicked off the event after a warm welcome and a setting of the stage by Chris Pearson (President of 5G Americas). Ray stated we are “In the next phase of 5G networks,” and “5G is finally starting to gain real traction.” A wide range of stats were shared along with some important factoids showing we are moving the needle in the Americas. Participating companies included Airspan, Cisco, Qualcomm, Samsung, T-Mobile, AT&T, Ciena, Mavenir, Nokia, Ericsson,Crown Castle, VMware, and Intel. While the foundational layer in 5G is located in the low band spectrum, mid-band 5G in the United States is now real…..but as all of us know, we need more mid-band spectrum to reach full potential of 5G use cases and applications. Currently, more than 66% of the geographic land mass is covered by 5G, while this same percentage of the population has access to 5G. Having a 5G enabled device is a bit underwhelming, with less than half of the U.S. population having access to a device with a 5G radio. With an investment of more than $100 billion over the last few years, 5G phones and subscriptions reached a total of 140 million, which remains less than half of the North American population. The most significant finding is that 5G is about increased data consumption, as Neville shared we are about 2.5 to 3 times higher data consumption with 5G compared to LTE. When thinking about the networks and advancements being made, we must remember we will rely on 4G/LTE for quite some time even though 5G networks are continuing to be deployed and improved. There are currently 14 total 5G networks running that enable streaming, gaming, social media and communications, and other business or enterprise-based applications. Outside of all of these data-intensive categories, Neville Ray mentioned for the industry to NOT forget about voice….yes, voice is still important for 5G and the advancements are really all around Voice over NR or New Radio (pronounced Vonar, aka Vo5G/Voice over 5G) (Related News: https://techblog.comsoc.org/2022/06/04/t-mobile-launches-voice-over-5g-nr-using-5g-sa-core-network/). 5G Americas noteworthy trends revolve around the following highlighted areas:

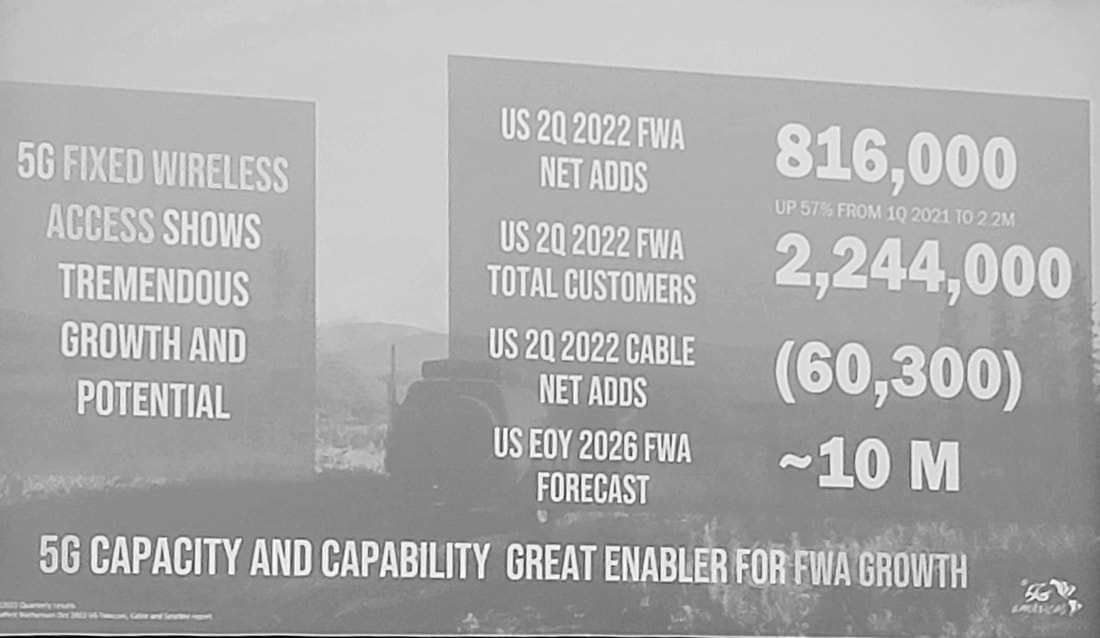

Fixed wireless access or FWA is being seen as an alternative to wired broadband and Wi-Fi (See Wi-Fi6) connectivity for a number of reasons. In many cases, the WISPs leveraged unlicensed spectrum to reach rural communities who lacked quality broadband, but over the past year the conversation has shifted to enterprise interest. Some believe it to be a complement or to augment existing connectivity options (especially cable). While FWA is creating capacity and new capabilities, especially for business use, additional and new spectrum is coming. FWA will continue to remain an available option for businesses in the US and internationally, but will continue to be squeezed by fiber and funding that may benefit fiber build out (Further Reading: WISPs embrace fiber as they face do or die moment). The carriers have been busy when it comes to FWA, especially in terms of their announcements and overall growth. Of course with that comes a bit of a reverse, as the overhype of FWA is now settling. “Verizon Communications…touted the addition of 234,000 fixed wireless access residential customers in the third quarter and another 108,000 FWA subscribers on the business-services side, upping its total FWA base to over 1 million users,” as seen on NextTV. T-Mobile will have their Q3 earnings call tomorrow but as Forbes shared, “T-Mobile has also made a dent in the broadband space, with its fixed wireless broadband offering adding an industry-leading 560,000 new broadband subscribers (last quarter),” while today they have more than 1.5 million FWA subscribers. Ericsson also shared, “UScellular was the first service provider to offer consumers and enterprise Fixed Wireless Access (FWA) services, using 5G extended-range millimeter-wave (mmWave) to target digital divide areas in rural America, reaching coverage of over 5 km.” While the activity for fixed wireless has expanded over the past year, spectrum access and fiber will remain critical factors for continued growth. Below is a slide that was shared at 5G Americas that highlights some of the overall FWA stats (Source: 5G Americas & Their Members). While some of you may be tired of tech acronyms, it is the way we lazy people essentially describe long-winded tech terms. Enter C-V2X or Cellular Vehicle-to-Everything). C-V2X is considered a mid-term opportunity and is expected to open up a range of opportunities driven by low latency, high performance 5G network services. Think about your car becoming your hub or essentially just like any other device. This hub will speak to the road, to traffic lights, to city traffic bodies, to public safety, to you and your passengers, to your auto dealership, to your car manufacturer and even to all your favorite content providers. In addition, these hubs will speak to each other building a network of communications across many sources. A range of entertainment, safety, location and routing, and interactive services will be launched and made available to drivers and passengers as a result. Your car needs reliable, high-speed wireless connectivity and 5G gets us there. We are in the earlier stages, but we do expect ongoing announcements well into 2023 to directly address the opportunities of 5G in C-V2X.

Network slicing is a near term focus across low, mid, and high-band spectrum. Enterprise and consumer applications focused on improved throughput, low latency, and other requirements see network slicing as a way to “carve out dimensional experiences,” shared Neville Ray. While we are in the early game of network slicing, we have yet to truly understand all the potential advantages and improvements that may come as we purpose-build the network. Aside from the key trends, and even more important, are the actual use cases for 5G. While the Analyst Forum had a strong emphasis on 5G for consumer and the growth in experiences there, I believe the true opportunity will lie with the enterprise and government sectors. Consumer 5G revolves around things like wearables, gaming, social communications, metaverse (not my favorite word), shopping, navigation, health/wellness, and sports. On the enterprise side, 5G presents new connectivity options for mass IoT and autonomous transportation, especially in use cases where the assets (fleets, products, equipment, people, machines, etc.) are mobile or meaning they are moving. These assets need to be monitored, measured, tracked, repaired, and acted upon for a variety of purposes and for reasons specific to the industry. Some of the vertical markets or industries where 5G opportunities exist include manufacturing, utilities, transportation, remote health care, digital cities, and education. For factories or logistics applications for example, mmWave is being used to enhance connectivity performance in robotics, as well as being used for sensing in agriculture or for farming applications. While 5G has been met with a sense of excitement and overall hype, we remain in the stage of improving overall network performance and build-out to meet enterprise and new customer experience expectations. There will always be hesitation for 5G adoption as a replacement to fiber, but for now we should think about applications where 5G is the only solution or where 5G will augment connectivity to provide better performance for things like robotics, transportation, supply chain monitoring, customer/digital experiences, etc. Lastly, the industry will continue to seek out additional mid-band spectrum as is needed to scale and to reach performance expectations. Special thank you to the 5G Americas team for hosting all of us analysts and for putting together great content. Contact Stephanie directly to learn more about other panel sessions and content that was shared at the event. Recommendations for further reading and research: Open RAN, Spectrum Policy and FCC Activities, mmWave, RedCap (Reduced Capacity) New Radio, Dynamic Spectrum Sharing, Unlicensed Spectrum. Please visit 5G Americas to learn more and to get access to their whitepapers and studies. To get access to further wireless research including 5G, please visit our WIRELESS RESEARCH store. Written by Stephanie Atkinson

In September 2022, Stephanie Atkinson visited the beautiful San Diego campus of Qualcomm. Please enjoy this executive chat with Jeff Lorbeck (SVP and GM, Connected Smart Systems at Qualcomm Technologies, Inc.) and listen to the guru himself share the latest trends in IoT, AI, smart cameras, autonomous vehicles and much more. Learn why and how Qualcomm is advancing the Connected Intelligent Edge!

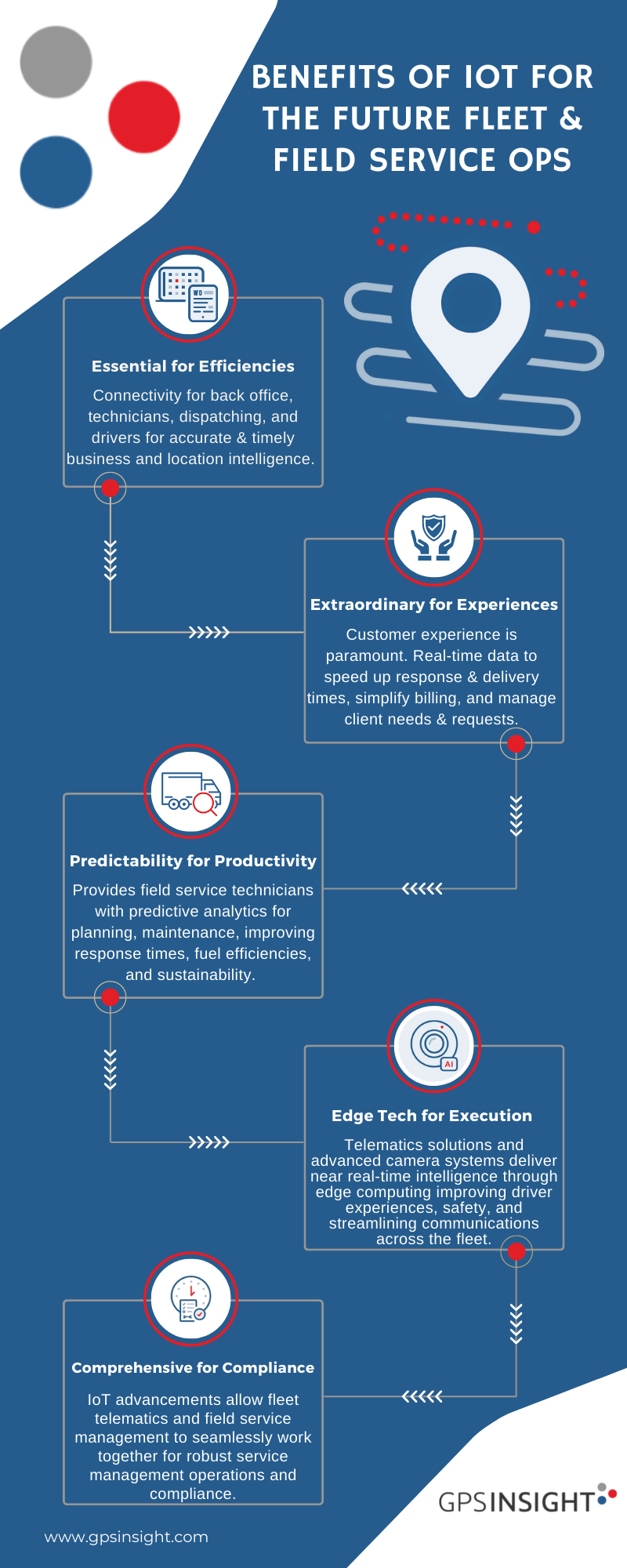

Related Blogs/Articles: How Qualcomm is Advancing AI and Internet of Things to Prepare Tomorrow’s Businesses and Cities Field services and fleet management go hand in hand, while IoT (Internet of Things) continues to provide essential real-time intelligence to improve visibility, safety, and operational efficiencies. Connectivity, tracking, and telematics are at the center of the advancements being made in these industries. When you think about field services, you think many moving parts that need coordination…you think a wide range of logistics synchronization, customer support, delivery operations, and other coordinated activities that are all collectively brought about to make sure products/goods and services are delivered on time, with superior customer service, and with complete accuracy and safety. Field services and operations may include activities such as collecting customer insights, scheduling/dispatching of fleets, bid and estimate calculations, work orders and troubleshooting, and other administrative functions such as billing, accounts receivable, client/customer relations, and more. In addition, some field service teams may also include repair, maintenance, installation, and other services where technicians are required. People, processes, planning, and profit remain the four critical components of field services. The industry continues to move towards a digital transformation journey embracing cloud, software as a service, and IoT.

On the other side you have fleet operations that may require tracking, safety protocols, management, compliance, and coordination. So many industries rely on fleet operations including public safety, construction, HVAC, energy (oil & gas), shipping/logistics, telecommunications, waste management, public transportation, and just about any industry that has repair/maintenance/technician operations. Once a technician needs to be dispatched or needs to complete a delivery, there are many facets to organizing, coordinating, and tracking assets across the fleet. Tracking may take place around the assets in the vehicle, the fleet vehicles, and the drivers or mobile workforce. The human element remains important as safety and compliance become a top priority for drivers, workers, and technicians. The innovation taking place across field service and fleet management is driven by technology, and more specifically IoT, smart cameras, GPS tracking, telematics and real-time intelligence garnered through automation (AI, machine learning), sensor systems, edge computing, and software. Moreover, are the platforms and software systems that enable transparency and management, providing visibility across the fleet and field operations. GPS Insight is one such company bringing together field services and fleet management. In January 2022, GPS Insight acquired FieldAware, and CEO Gary Fitzgerald shared, “Our focus has been on bringing together fleet data and telematics technology with field service management solutions.” Of course, there are vendors operating in these fields but very few provide a streamlined portfolio of services to serve both field service and fleet operations. GPS Insight continues to have a laser-targeted approach and states, “Joining forces with FieldAware not only extends our competitive advantage across the field service and fleet management landscape, but also provides new capabilities to transform customer satisfaction into a new standard: customer success.” Field service and fleet management industries were hampered over the last few years and still grappling with the pandemic impact and supply chain shortages. The U.S. is also facing labor shortages, which further creates constraints for hiring and maintaining worker satisfaction. Profit loss, worker retention, and supply chain issues remain top of mind for many leaders in these sectors. However, labor shortages will push us further into relying on technology, automation, and real-time intelligence to get things done efficiently. Compass Intelligence expects field service and fleet management to remain one of the largest contributors to IoT connections growth, as we increase connectivity and tracking of people, assets, and fleets. IoT is and will continue to be essential to meet these challenges head on and provide real-time intelligence for improved operations and supply chain visibility. Further Reading:

How Qualcomm is Advancing AI and Internet of Things to Prepare Tomorrow’s Businesses and Cities9/20/2022

In early July, I was honored to have a chat with Megha Daga, Senior Director of Product Management and AI/ML lead for the Internet of Things (IoT) at Qualcomm Technologies, Inc. . As a critical player in AI enablement across the IoT group at Qualcomm, Megha has been crucial in the development of cutting-edge AI solutions used around the world.

We dove right into what Qualcomm has been up to as it continues to advance IoT through the different core offerings, partnerships, and cutting-edge solutions that Qualcomm offers. To set the tone of our conversation, we discussed Edge AI. Edge AI is essentially intelligence moving to the data generator, according to Megha. Along with getting data faster, a host of other factors impact Edge AI, including privacy, cost, latency, reliability, and bandwidth. For businesses or enterprises, the simplicity of the technology revolves around business intelligence occurring on the device or close to the device itself to enable IoT. Qualcomm provides a portfolio of hardware technology, but even more exciting is their advancements in software design and embedded processing innovation. The company understands how heterogenous computing makes AI possible and is pushing the envelope to remain competitive in AI and IoT. Some of the stronger vertical markets and industries that Qualcomm is targeting include retail, logistics, energy, utilities, industrial, and robotics. To further advance into AI, Qualcomm launched the Vision AI Development Kit. This Azure IoT Starter kit is a vision AI developer kit for running artificial intelligence models on devices at the intelligent edge. With Edge AI, data is generated and pushed to the cloud. Legacy devices such as retail payment terminals and other industry specific devices are being digitized and modernized. Hardware or devices can be connected to a box, i.e., edge gateway. Megha shared that Qualcomm is taking metadata and compute to the box, implementing further compute as needed, then sending only the required data back to the cloud. The traditionally “dumb” environment is becoming more intelligent and bringing efficiencies to businesses and operations. Another Qualcomm AI example outside of retail is in logistics, more specifically warehouse operations. Robotics and drones may be used for picking and dropping, reducing overall payloads, and therefore reducing costs. Edge AI and IoT are coming together to minimize compute to the cloud, as the overall costs of sending massive data to the cloud is becoming more cost prohibitive, and a concern for larger enterprises. The issues of privacy, latency, and connectivity again remain important factors. Privacy not only affects consumers, it also impacts businesses and their customers’ experiences. As for latency, think of delivery robots on the street, providing sub-millisecond intelligence and information to enable operations and efficiency so consumers can get food, packages, products delivered (similar to same day delivery). Regarding connectivity, especially for operations in remote locations (construction, agriculture), having on-device or near device data intelligence can be critical. Examples Megha mentioned included drones connected to a gateway to enable crop intelligence, construction management, and mining operations. Qualcomm’s portfolio continues to evolve to support AI and Edge AI, with a stronger focus on software. Their hardware and chipsets will continue to be their foundation, as they grow their partnerships with Original Equipment Manufacturers (OEMs). Qualcomm is leading in the areas of enabling AI on traditional CPUs/DPUs or AI on SDKs. Another cutting-edge development includes AI on embedded processing (low power, high performance). According to Megha, a few exciting AI areas that Qualcomm has been innovating around includes drone robots, and camera technology. Taking regular cameras for example and making them intelligent, using technologies such as machine vision and AI running on heterogenous computing to completely disrupt its capabilities. Megha shared that Qualcomm is using hardware accelerators for neural network workloads. Furthermore, AMR devices (autonomous mobile robots, i.e., Bosch devices) is an area where Qualcomm is developing chipsets and reference designs to further advance delivery. For example, they recently launched the RB6, a high-end chipset with an accelerator card allowing the robot to greatly improve throughput (i.e., delivery robots). As far as software goes, Qualcomm is investing and innovating to provide seamless software across the Qualcomm AI stack. Qualcomm is providing unification for developer building and changes, using Qualcomm Intelligence multimedia SDKs providing authentication and simplification for development and deployment, across multiple verticals. Developers and software tools remain a top priority for Qualcomm. Qualcomm realizes the end-customer (businesses and government) require and need end-to-end solutions and thus continues to build out its IoT partner portfolio (vendors, integrators, industry focused providers) focused on software/applications, platforms, and other solutions I’ll end with a great use case example shared by Megha. The Qualcomm AI Engine runs ML models in IoT devices, such as a security camera that recognizes a family member and activates a smart lock to allow entry. Or an office building that allows employees onto an elevator based on a touchpad. This context showcases the importance of how Qualcomm is advancing AI and IoT to prepare tomorrow’s businesses and cities. For more reading, please check out, “Qualcomm Advances Development of Smarter and Safer Autonomous Robots for Logistics, Industry 4.0, and Urban Aerial Mobility with Next-Generation 5G and AI Robotics Solutions” Written by Stephanie Atkinson, CEO of Compass Intelligence Furthermore, IoT offers predictive analytics so that field service businesses may plan and carry out routine maintenance, reduce wasted travel time, fuel costs, and environmental impact—all without needing a client to make the initial request. Our video telematics camera platforms are amazing cutting-edge devices that do all processing on an edge computing device. They intelligently detect what a driver is experiencing and provide instant feedback to the driver as well as the fleet manager. The artificial intelligence and machine learning coach a driver and capture the context of what is happening to field technicians on the road.

In regard to your company/organization, what are some of the near-term goals you and your team are focused on when it comes to your product portfolio and business solutions, particularly for enterprise and government clients? How do these goals support the scale and roll-out of connected/IoT solutions (including asset tracking/monitoring) and play a role in recent acquisitions or partnerships? This year, our focus has been on bringing together fleet data and telematics technology with field service management solutions. A major step toward this initiative began in January of 2022 when we acquired FieldAware, the leader in made-for-mobile, cloud-based field service software. This acquisition allows us to offer clients a more robust digital means of managing their service operations—and when that software is paired with GPS tracking or a smart dash cams— it adds a deeper layer of insight so service organizations can also see how their drivers and assets are performing in real-time. Our FieldAware solution also uses a hub approach model, which allows the software to integrate seamlessly with ERP platforms and other systems our customers already use, as well as other connected/IoT solutions including electronic logging devices and video telematics. We’ve also inked a strategic partnership with a major fleet telematics leader to bring some exciting new products to market in the coming months. It’s too soon to share specifics, but stay tuned. In regard to your clients and prospects, please share some of the key use cases or core applications your clients are focused on to better understand what is driving current and upcoming adoption trends...provide examples of recent projects, how you are solving challenges or problems and providing business value. Are you seeing any surprising requests or challenges? The M.E.S.O story is a great example of how pairing telematics data with our field service management solution, FieldAware, can really help an organization grow their business and improve the customer experience. M.E.S.O. used the FieldAware mobile field service hub to build strong partnerships and develop their Uptime-as-a-Service platform to better serve their end customer. This platform has transformed operations, significantly increased efficiencies, and helped improve customer service and success. M.E.S.O. uses telematics data and IoT monitoring capabilities to collect real-time information about where their customer’s assets are located, the asset’s current health, and how they are being used. The open architecture of the FieldAware service hub then leverages that asset data and provides the core workflow platform to manage all service activities. This solution gives M.E.S.O. account managers access to insights that let them plan and predict the next steps for their customers based on real-world conditions. Through this Uptime-as-a-Service platform, M.E.S.O. can provide its customers with a predictive and proactive solution that reduces downtime, minimizes maintenance and repair expenditures, and extends the equipment lifespan. M.E.S.O. views this capability as core to its business and an essential part of their value proposition. GPS Insight has been in the fleet management and telematics space for years, but it’s always exciting to hear customer stories about an organization that gets more from the technology than its intended daily use. For instance, our customer in the public sector, Tacoma Public Utilities, was recently able to recover a stolen vehicle using our GPS tracking technology. TPU manages 1400 pieces of equipment, including heavy construction equipment, specially outfitted trucks, and boats. When a fleet pickup truck was discovered missing, TPU went straight to their GPS Insight tracking platform. Due to the mapping, real-time, and history data collected, they knew the truck had been stolen, driven to a hospital, and then parked at a residence. They easily located the vehicle and turned over all their information to the police. GPS tracking has also helped TPU save taxpayer dollars, improve dispatching, and significantly boost driver safety. And with the increasing energy requirements and plans to incorporate alternative energy-fueled vehicles into its fleet over time, TPU is also using GPS Insight data to generate reports to understand how solutions like electric and hybrid vehicles will impact fleet operations in the future. Please describe some of the most exciting and innovative products/services/solutions you are providing to your clients, and what is on the agenda to build out your portfolio in terms of new products, partnerships, alliances. At GPS Insight, we are revolutionizing how businesses run both in the field and on the road. We provide critical insights that influence how our economy operates, ensuring safety and sustainability for our customers and their employees across all industries. Our most innovative products include the AI-enabled, Driveri smart camera and our field service management solution. As I mentioned earlier, our FSM solution has expanded in scope as a result of our recent acquisition of FieldAware, allowing us to serve clients of all sizes–particularly in the mid-enterprise category. When we pair our telematics data with our FSM solution, we can provide service organizations with high-quality analytics and insights that increase productivity and profitability while also allowing them to provide their clients with an exceptional end-to-end experience. Part of our FSM solution includes our proprietary dispatch software, Smart Scheduler. Smart Scheduler helps ensure that teams and vehicles are where they need to be–when they need to be there–and assists service managers in streamlining essential operations, improving efficiency, and reducing unnecessary costs. When dispatchers assign jobs manually–that’s when errors happen. Smart Scheduler gives service managers a complete view of the team and tracks arrival times, locations, and supply inventory. So as an example, if your qualified tech is late getting to the job site, Smart Scheduler can help a dispatcher quickly pinpoint and assign a new qualified worker to step in based on their location and expertise. On the fleet management side, our Driveri smart camera is equipped with AI and edge computing and one of the most cutting-edge dash cams on the market. Most smart cameras aim to address objectives reactively–Driveri goes a step further by automatically analyzing every minute on the road and only sending alerts for risky driving behaviors, which allows managers to spend more time instructing drivers and less time watching hours of film. Driveri also keeps an eye out for managers by providing clear administrative dashboards that can be used to steer the fleet toward unprecedented levels of safety. Driveri empowers drivers, too. The app gives users access to driver scores, summarizes overall driving behaviors, enables self-correction and self- management by drivers, and only alerts managers when drivers go beyond certain limits for a range of behaviors. What’s really great about this camera is that it can also detect what drivers are doing right. If a driver slows down to let another car merge, it can see that and award a driver star. This helps drivers see the Driveri camera as less of a tool to spy on them for negative behaviors, and more as a coaching tool that fosters professional development. Please provide the top 3 trends you are most excited about that will impact the business/enterprise market over the next 5 years. In the coming years, GPS Insight anticipates widespread adoption of electric and alternative-fuel vehicles across fleet and field service organizations, increased emphasis on environmental and sustainability goals, and greater dependence upon data as a tool to maximize profit and efficiency. The concept of doing more with less, and with less impact on our environment, are significant drivers that will help shape our product roadmap. Final Word GPS Insight is the first company to publish a comprehensive, accessible “For Dummies” book on field service management with Wiley publishing. This exciting collaboration in field service management makes the journey to digitization simpler and guarantees that all service organizations, no matter how big or small, know how to use FSM software to achieve their business goals. We wrote this book for operations executives, business owners, and service managers, and this book covers a broad range of topics like how to choose the right solution for your business, extend the impact of your investment, and tips to successfully implement your software. Organizations with a fleet would also be interested in this book if they’re looking for ways to improve their operations. You can download that on our website here Here are a few recent chats and articles: ● TRAILER TRACKING TIPS TO ADDRESS THEFT - Fleet Equipment ● How will regulations drive digital transformation requirements for field service companies? - Field Service News ● To Clean the Air, Let’s First Green Our Fleets - WorkTruck ● Guard Your Company’s Revenue as Gas Prices Soar - Cleaning & Maintenance Management ● Seven Ways Construction Fleet Managers Can Keep Costs at a Minimum as Gas Prices Soar - Construction Executive ●LOOKING TO STRENGTHEN YOUR LANDSCAPE BUSINESS? START WITH MEASURING THE RIGHT KPIS - Landscape Business ● Will 3G's Farewell Cripple Trucking Fleets? - Supply Chain Brain ● Why telematics should extend from tractor to trailer - Fleet Maintenance Brochures & Resources ● 2022 Fleet Safety Report ● GPS Insight & FieldAware Join Forces to Drive Customer Success ● Think Tank Sessions: What Drives Customer Success at Your Organization? ● GPS Insight & FieldAware: Better Dispatching Equals Better Results ● Tacoma Public Utilities ● MESO Case Study ● 2022 Fleet and Telematics Buyer’s Guide For more on GPS Insight, please visit their website at www.gpsinsight.com. As seen in Edge Industry Review, written by Stephanie Atkinson The buzz in 2021 rang super loud around the topic of edge computing, and the excitement and hype are continuing in 2022. The reason for the hype: edge computing is game-changing for businesses and government customers for many reasons. But first, let’s talk about data.

The industry transitioned from data silos to cloud computing, which allowed businesses to push data off-site and into data centers that provided a centralized architecture. This data was used to make decisions, analyzed for trending and anomalies, and provided information back to the business or government agency to support improvements, efficiencies, quality control, and customer delivery. IN THIS EPISODE, STEPHANIE TALKS ABOUT THE HYPE BEHIND EDGE COMPUTING, THE FUTURE OF IOT, THE IMPORTANCE AND APPLICATIONS OF AUTOMATION, AND PROVIDES ADVICE FOR WOMEN WORKING IN TECHNOLOGY.

Businesses across varying sizes and industries are at different stages of moving from the left side of this diagram to the right, but we can say most businesses are progressively moving to the right. Historically, businesses have focused primarily on closed, static systems and leaned primarily around legacy systems and software including a focus on data being informational. Business work activities were much more labor and people intensive and driven respectively. Now we are entering into a phase of open businesses leveraging data for real-time intelligence and actions, along with leaning on technology including mobile, IoT, and edge computing. This advanced stage of business transformation is more connected than ever, and mobile is the primary foundation of this transformation. Small and large businesses are mobile and portable, as we work, sell, and serve clients from anywhere and at sometimes at any time. These past few years have shown how important mobile is as our employees work from home or anywhere (and many will stay working from home), AND we seek to automate mundane work activities, and build intelligent operations while providing digital and virtual customer experiences. Mobile technology including mobile devices and services again sits at the foundation of the mobile economy. Employees continue to seek work-life balance and prefer to work around their children’s schedules, family activities, wellness routines, and much more AND mobile is the only technology to fill this need.

WATCH THE ON-DEMAND WEBINAR FOR MORE (download the full presentation here as well) Sponsored by T-Mobile for Business and Produced by IDG IntroductionWithin the city construct there are a lot of considerations to delivering "Smart Solutions and Services". In this white paper we will explore the opportunities and benefits from a foundational perspective of connectivity strategies that leverage Fiber as the backbone for “Smart” service delivery. Executive SummarySince the initial use of Fiber Optic Cable in the mid 70’s to connect US Government computers, we have seen an increase over the years in the use of fiber networking. However, it has not been as broadly recognized until recently just how integral the fiber backbone is to reliable, resilient broadband communications infrastructure is for the future of cities and municipalities alike.

While fiber networks are not new, the technology has continued to advance, and they are indeed the catalyst to just about every use case where “Smart” is included, supporting critical infrastructure and beyond. Fiber networks are not just for the purpose of faster internet, but think about latency sensitive solutions such as traffic monitoring and general multi-modal transportation, first responder services in the city and likewise utility distribution services to improve utility reliability and outage management. Pre-pandemic, cities across North America were deploying Municipal Wi-Fi as a means of improving connectivity and access for citizens. These municipal networks often times leverage city deployed fiber but were typically only in the metropolitan downtown areas. This was shown to be an oversight, as with a bit more consideration, additional investment and partnership, the thousands of underserved citizens could have benefited from connectivity where there was none. Distance learning and the huge uptick in bandwidth utilization due to the pandemic have caused cities to rethink their connectivity strategy. Fiber networks, again, are the supporting foundation to service delivery to the cities and communities at large Smart city solutions across the board depend on reliable communications infrastructure. For each application there is an endpoint that then requires the data to be backhauled to the cloud. Data analysis for any real-time insights depends heavily on receiving the data in a timely fashion, edge computing and the analytic insights will falter without the speed and throughput delivered by a fiber backbone. Written by Bill Pugh of Smart Connections Consulting |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed