|

In today’s connected world, seamless and reliable indoor cellular coverage is a necessity. As technology advances and the industry transitions from 4G to 5G, enterprises and cities face challenges in providing consistent and ubiquitous connectivity. In partnership with industry analyst, Stephanie Atkinson, of Compass Intelligence, we dive deep into these challenges and explore solutions to ensure reliable, secure, end-to-end connectivity for businesses and communities in my latest position paper: “Industry Insights: Streamlining Indoor Connectivity.”

Read report: https://denseair.net/news Hope on over to our AWARDS page to get your nominations in for the 11th annual CompassIntel awards. Let us know if you have any questions, just simply email us directly at [email protected]. How crazy is it that traditional broadband providers are seeing record growth in adding wireless subscribers (MVNO services), while carriers are seeing record growth in broadband subscriber adds (FWA or fixed wireless access aka 5G Home Internet or 5G Business Internet)? Should cable broadband operators work up a reseller agreement and sell fixed wireless access as an MVNO?

The industry is clearly showcasing the stronger trust, energy, and value proposition of wireless overall. We are finally seeing the reach of wireless overtake traditional fiber and wireline GROWTH as the industry matures and 5G delivers connectivity options across business and consumer. Fixed wireless access (FWA) is currently seeing a bit of a battle between Verizon and T-Mobile, while AT&T places its bet on fiber after pulling away from a fixed wireless strategy from 2021. FWA is not new and certainly been around for a while as WISPs (Wireless Internet Service Providers) have been serving rural America with these services for quite some time. Fixed wireless access or FWA in the most simplest terms provides consumers and business with an alternative or complete replacement to traditional broadband services (DSL, Cable, Fiber, T-1s, etc.). Customers can essentially be up and running with a hardware installation at the home or office (radio/receiver, antenna, cat 5 wiring, and connectivity to your WiFi router, etc.). Of course getting access from a WISP versus a carrier will have differing installations based on the nature of point-to-point and multi-directional access. The service essentially provides broadband over the wireless network or over wireless radios that communicate to the base stations or towers. As microcell, small cell, and mmWave technologies improve and enhance, we will see improved hardware and installation strategies impact overall revenue for the carriers and WISPs offering fixed wireless services. FWA can be seen as an alternative to wired broadband, but today we are seeing both consumers and businesses look to FWA as a complete replacement to their broadband services (T-Mobile shares in a recent report that their customers are replacing cable). While WISPs generally target rural and remote areas where fiber, cable and DSL is not an option, Verizon and T-Mobile for example are targeting cities and suburban areas, as well as the SMB market. In addition to looking at FWA as a alternative or replacement, customers are also evaluating and implementing fixed wireless to complement or provide additional connectivity options (failover) for their homes or business locations. From a branding perspective you may see the services being called 5G Home Internet or something similar. Outside of Verizon and T-Mobile, US Cellular also provides the service to its customers along with many WISPs. While FWA has traditionally been sold to homes and rural areas, today carriers are targeting businesses more than they have in the past, and the SMB sector is a primary target. There is an estimated 500K total business FWA subscribers today, with an expectation to grow to over a million very quickly as both Verizon and T-Mobile are adding 100s of thousands business customers each quarter. According to Ericsson's most recent Mobility Report, the global FWA market is expected to reach 300 million by 2028 and be driven my international markets, and more specifically India. They claim we will reach roughly 100 million FWA connections globally by the end of this year. As for the carriers, CompassIntel shares a summary of the key happenings for the top FWA carriers. T-Mobile is currently winning the race and has done a very good job at releasing new FWA business offerings that will provide them with continued runway as they have a very strong customer base of SMBs, who we believe will be more likely to replace their broadband service. T-Mobile – T-Mobile states they have more than 2M FWA customers, with a goal of 7-8 million FWA customers by 2025. Their most recent quarter net adds totaled 578K and they have experienced continued quarter to quarter growth in 2022. T-Mobile targets both consumers and businesses and recently announced their T-Mobile Business Internet services offering both primary and failover Internet packages. The packages range from unlimited to those based on data ranging from 10GB to 300GB. Their business strategy revolves around a focus on cyclical or temporary businesses, point of sale operations, pop up shops, and hybrid workforces. They will continue to leverage mmWave capacity for enhancements to its coverage and reach. Verizon - Verizon offers FWA to both consumers and businesses and their business services aka '5G Business Internet' is available at 2 million locations today, and is scaling to 14-25M locations by 2025. Fierce Wireless states that "Verizon’s 5G FWA service is available to about 30 million homes." Today Verizon shares they serve 1.06M FWA customers and have a target of 4 million to 5 million by the end of 2025. Their most recent quarter experienced additions of 342K net adds in Q3 with an estimated 32% of those adds going to business customers or subscribers. Offerings start at 300Mbps and go to 1-gig while they leverage both millimeter wave (mmWave) spectrum and C-Band mid-band spectrum for their coverage. AT&T – AT&T shifted their focus away from FWA from 2021 to focus more on their overall fiber buildout and strategy. Compass Intelligence estimates AT&T serves an estimated 700K FWA subscribers today. UScellular – US Cellular currently serves around 57K FWA subscribers on 4G, and is focusing on the expansion of 5G FWA over mmWave spectrum in 10 cities. They claim to have 23% annual growth for their FWA services from 2021 to 2022. To wrap up, pay attention to the advancements in mmWave and small cell equipment and radio hardware solutions. These advancements will help further improve capacity, installation efficiencies, and better serve business quality broadband services that are needed to help close the digital divide and improve connectivity across the globe. How Qualcomm is Advancing AI and Internet of Things to Prepare Tomorrow’s Businesses and Cities9/20/2022

In early July, I was honored to have a chat with Megha Daga, Senior Director of Product Management and AI/ML lead for the Internet of Things (IoT) at Qualcomm Technologies, Inc. . As a critical player in AI enablement across the IoT group at Qualcomm, Megha has been crucial in the development of cutting-edge AI solutions used around the world.

We dove right into what Qualcomm has been up to as it continues to advance IoT through the different core offerings, partnerships, and cutting-edge solutions that Qualcomm offers. To set the tone of our conversation, we discussed Edge AI. Edge AI is essentially intelligence moving to the data generator, according to Megha. Along with getting data faster, a host of other factors impact Edge AI, including privacy, cost, latency, reliability, and bandwidth. For businesses or enterprises, the simplicity of the technology revolves around business intelligence occurring on the device or close to the device itself to enable IoT. Qualcomm provides a portfolio of hardware technology, but even more exciting is their advancements in software design and embedded processing innovation. The company understands how heterogenous computing makes AI possible and is pushing the envelope to remain competitive in AI and IoT. Some of the stronger vertical markets and industries that Qualcomm is targeting include retail, logistics, energy, utilities, industrial, and robotics. To further advance into AI, Qualcomm launched the Vision AI Development Kit. This Azure IoT Starter kit is a vision AI developer kit for running artificial intelligence models on devices at the intelligent edge. With Edge AI, data is generated and pushed to the cloud. Legacy devices such as retail payment terminals and other industry specific devices are being digitized and modernized. Hardware or devices can be connected to a box, i.e., edge gateway. Megha shared that Qualcomm is taking metadata and compute to the box, implementing further compute as needed, then sending only the required data back to the cloud. The traditionally “dumb” environment is becoming more intelligent and bringing efficiencies to businesses and operations. Another Qualcomm AI example outside of retail is in logistics, more specifically warehouse operations. Robotics and drones may be used for picking and dropping, reducing overall payloads, and therefore reducing costs. Edge AI and IoT are coming together to minimize compute to the cloud, as the overall costs of sending massive data to the cloud is becoming more cost prohibitive, and a concern for larger enterprises. The issues of privacy, latency, and connectivity again remain important factors. Privacy not only affects consumers, it also impacts businesses and their customers’ experiences. As for latency, think of delivery robots on the street, providing sub-millisecond intelligence and information to enable operations and efficiency so consumers can get food, packages, products delivered (similar to same day delivery). Regarding connectivity, especially for operations in remote locations (construction, agriculture), having on-device or near device data intelligence can be critical. Examples Megha mentioned included drones connected to a gateway to enable crop intelligence, construction management, and mining operations. Qualcomm’s portfolio continues to evolve to support AI and Edge AI, with a stronger focus on software. Their hardware and chipsets will continue to be their foundation, as they grow their partnerships with Original Equipment Manufacturers (OEMs). Qualcomm is leading in the areas of enabling AI on traditional CPUs/DPUs or AI on SDKs. Another cutting-edge development includes AI on embedded processing (low power, high performance). According to Megha, a few exciting AI areas that Qualcomm has been innovating around includes drone robots, and camera technology. Taking regular cameras for example and making them intelligent, using technologies such as machine vision and AI running on heterogenous computing to completely disrupt its capabilities. Megha shared that Qualcomm is using hardware accelerators for neural network workloads. Furthermore, AMR devices (autonomous mobile robots, i.e., Bosch devices) is an area where Qualcomm is developing chipsets and reference designs to further advance delivery. For example, they recently launched the RB6, a high-end chipset with an accelerator card allowing the robot to greatly improve throughput (i.e., delivery robots). As far as software goes, Qualcomm is investing and innovating to provide seamless software across the Qualcomm AI stack. Qualcomm is providing unification for developer building and changes, using Qualcomm Intelligence multimedia SDKs providing authentication and simplification for development and deployment, across multiple verticals. Developers and software tools remain a top priority for Qualcomm. Qualcomm realizes the end-customer (businesses and government) require and need end-to-end solutions and thus continues to build out its IoT partner portfolio (vendors, integrators, industry focused providers) focused on software/applications, platforms, and other solutions I’ll end with a great use case example shared by Megha. The Qualcomm AI Engine runs ML models in IoT devices, such as a security camera that recognizes a family member and activates a smart lock to allow entry. Or an office building that allows employees onto an elevator based on a touchpad. This context showcases the importance of how Qualcomm is advancing AI and IoT to prepare tomorrow’s businesses and cities. For more reading, please check out, “Qualcomm Advances Development of Smarter and Safer Autonomous Robots for Logistics, Industry 4.0, and Urban Aerial Mobility with Next-Generation 5G and AI Robotics Solutions” Written by Stephanie Atkinson, CEO of Compass Intelligence U.S. wireless carriers have made significant strides in rolling out 5G services across major cities, but all are on different paces using varying spectrum strategies to reach both consumers and business end-users. According to a recent article on SDxCentral, "Earlier this month, T-Mobile US leapfrogged all of its competitors with a nationwide 5G network running on 600 MHz spectrum. The operator’s low-band 5G network covers about 200 million people, or about 61% of the total population, spanning a geographic range of more than 1 million square miles." They also share that AT&T will reach part of 30 cities by early 2020 with AT&T confusing some in the industry by using the term “5G E” brand in select cities, while using “5G” brand for 5G running over low-band spectrum, and “5G+” for those running on mmWave spectrum. Verizon recently announced reaching 30 cities and 14 NFL stadiums by the end of this year. Lastly, Sprint started out 2019 with a strong leading roll-out of 5G but is expected to end the year covering roughly 11 million people. Also, U.S. Cellular shares it will launch 5G service in Q1 of 2020.

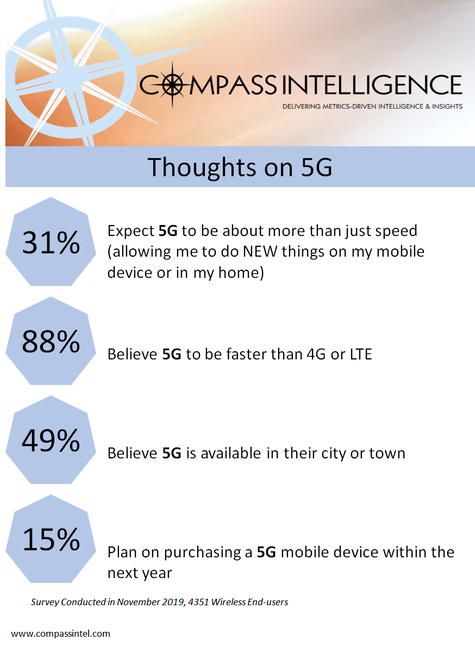

Meanwhile, a recent survey conducted by Compass Intelligence shows roughly 49% of those 4K+ wireless end-users surveyed across the U.S. believe 5G is available within their city or town, with 15% planning on purchasing a 5G enabled smartphones or devices in 2020. As consumers plan upgrades, phone replacements, and trade-ins on their smartphones, it only makes sense to make sure your device is 5G ready or enabled. Most wireless end-users, 88% of the 4,351 surveyed, believe 5G will be faster than 4G or LTE, with 31% believing 5G will be much more than just a faster or speed upgrade when compared to 4G or LTE services. Wireless carriers have not really been effective at communicating what these other advantages are to consumers at this stage, as most of the marketing and communication has been about the coming advantages to business solutions yet consumers will see brand new customer experiences with 5G like they have not seen in the past. As for now, experiences within venues like airports, stadiums and event venues, shopping/retail, and engaging within a city has the potential to offer brand new real-time and personalized experiences. Many ideas have been shared at a high-level, but think about seamless buying and shopping catered to your needs and wants with better location, routing, checkout, and service. Within a city, interacting with public transportation or city services may be enhanced as 5G brings speeds that better leverage video, virtual reality (think 3D virtual city tours or interactive Uber ride experiences), and immersive experiences. Stay tuned next week to the latest in plans to switch carriers ...survey research rocks! This holiday season and the heightened economy has given rise to purchasing and this holiday season saw a spike in spending overall. According to recent tracking, "Retailers have much to cheer about this holiday season. According to Mastercard SpendingPulseTM, holiday retail sales increased 3.4 percent (ex auto) with online sales growing 18.8 percent compared to 2018." Online purchasing of electronic devices have also seen promising results including Black Friday, Cyber Monday, and overall Christmas shopping. Consumers are spending and this provided opportunities for those selling smartphones, tablets, and computing devices.

Compass Intelligence recently completed a survey with over four-thousand wireless end-users (4,351) and dove into a number of topics including planned purchases, perceptions of 5G, current ownership of devices, payment structures, and other related wireless services including insurance, prepaid, and leasing. This survey highlight included a snapshot of plans to purchase for smartphones, tablets, and computing devices. As shown, below is a roundup of purchasing plans for the next 3 to 4 months:

Note: Online survey conducted in late November 2019 with 4,351 (18 and older) wireless end-users in the United States. A few weeks ago, I had the honor to attend the annual Xfinity Analyst Day event in Philadelphia located at both the Four Seasons Philadelphia hotel and the Comcast Technology Center. Thank you to Joel Shadle and team for inviting me and for the insanely wonderful hospitality. As we think about consumer needs and wants, the instant economy demands innovative customer experiences that cater to individual and contextual personalizations, and this is exactly what Comcast is doing with a suite of solutions, products, and services around broadband, WiFi access, Mobile services, and Content. I will share a few highlights of the day's activities below.

Dana Strong, President Xfinity Consumer Services, kicked off the event and shared a great summary of the Comcast/Xfinity innovation journey. Xfinity's primary focus is to push for differentiation around product innovation. It was clear throughout the event that Comcast is fully focused on positioning Xfinity Internet as its primary product; and counts around 26 million residential customers for the service as of Q219, compared to 22 million video customers and 1.4 million Xfinity Home customers. The trio of innovation areas include speed, coverage and control for broadband. Upcoming and new solutions include bringing Hulu to X1 customers in the first quarter of 2020, along with innovation around WiFi with Xfinity xFi Pods WiFi Extenders and a home suite that is fully integrated and searchable by voice with options for adding home security (#smarthome 1.4M home security customers), and innovation around the X1 cloud DVR and remote services. X1 is a platform of platforms with companies such as Cox, Shaw, Rogers all using it as the foundation for their video products. In addition for homes today, it is all about speed as we are consuming more streaming video than ever. In fact Dana mentioned Xfinity customers used 6 billion video on demand hours along with 9 Billion voice commands in 2018 alone. Innovation is also an area being explored within Xfinity Mobile, where the company serves 1.6 Million mobile lines and is currently expanding LTE with their partnership with Verizon. Family Gig packs (Unlimited and By the Gig packs) or bundles allow payment plans and options to add in home monitoring for existing broadband customers. It is important to understand that only Xfinity Internet customer can get Xfinity Mobile services. A great amount of innovation is centralized around the entire entertainment experience, which requires robust broadband and tools that can be leveraged with voice automation and an open system with access to services such as Netflix, Xumo, Pluto, Amazon Music, iHeartMusic, Amazon Prime video, YouTube, and again Hulu coming in Q1. Customers can use voice search across the entire ecosystem, not just linear tv, while search results default to free/complimentary and displays where you left off and recommends based on your history. This innovation around entertainment does not happen without a sound high-speed broadband experience. Tony Werner, President of Technology & Product at Comcast Cable, shared additional innovation details around its broadband and WiFi solutions. With 17 different speed upgrades over the course of 18 years and a strong portfolio of patents with 400 currently pending and 20 million WiFi hotspots, the company is well positioned to leverage these assets to a strong base of residential customers and drive business to the B2B market moving up market from a strong SMB base. A great stat was shared...there are currently 58M homes today that have access to 1Gbps broadband by Comcast today. Other innovation details shared by Patti Loyack (VP of IP Services) and Rui Costa (VP of Product, Design and CX) include some of the following:

Lastly, I will wrap up by sharing more around innovation specific to customer experience (cX). Charlie Herrin, Chief Customer Experience Officer for Comcast Cable, shared additional details around making the customer experience their best product. He shared four main components to personalized automation (Xfinity Assistant) including IDENTITY, INTELLIGENT AUTOMATION, PROACTIVE 2-WAY DIALOG, and CLOSING THE LOOP. Both self-care and administration are areas where Mr. Herrin is building out services and solutions. Some highlights include:

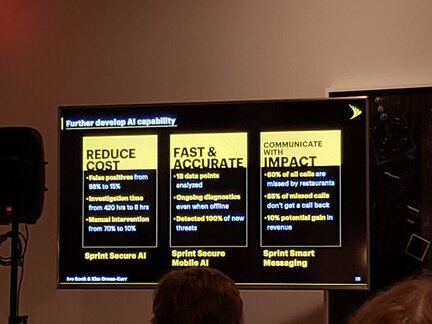

These short-list (many others taking place) of improvements have brought about tens of thousands of predictive recommendations produced via IVR for better servicing customers and reduction of calls into the call center, along with billions data elements captured daily. Many customer issues have been contained in the Xfinity Assistant, which has reduced agent handled chats substantially. This customer-first and simplicity approach is sure to enhance the overall customer experience and drive retention for residential clients. This summary does not include all the interactions and sessions attended, but provides a great review of things to come and the innovation in process and coming down the pipeline. It was clear throughout the event that Comcast is fully focused on positioning Xfinity Internet as its primary product; and counts around 26 million residential customers for the service as of Q219, compared to 22 million video customers and 1.4 million Xfinity Home customers. As part of this analyst day, we were also treated to product demos, Comcast Technology Center Tour, the Universal Sphere experience, and a great networking reception and dinner with showcase labs and interactions with executives. Thank you again to Comcast and the Xfinity team of executives and team who prepared and put this event together. I look forward to witnessing continued innovation and enhancements across the Xfinity portfolio. Written by: Stephanie Atkinson, CEO of Compass Intelligence  In late June, a group of analysts (including myself) and consultants attended the annual Sprint Business Analyst Day in New York. This event provides an update on the business group including business wireless products and services, wireline (yes they are still operating in this space!) services, and of course IoT solutions. The theme this year was focused on how Sprint Business connects people, places, and things or branded as #worksforbusiness. We kicked off the event the first evening at The Knickerbocker Hotel with a reception to meet, greet, enjoy roof-top beverages and food. Jan Geldmacher (@JanGeld), Sprint Business President, kicked off the evening with a few words on expectations the next day, and a highlight of the sessions and content. The evening was enjoyable meeting up with old colleagues, fellow analysts, good friends, and catching up with Sprint executives. The next morning was held at Sprint's NY offices with a slightly wet commute a few blocks away as the rain helped wake up our day. Mr. Geldmacher again kicked off our morning sharing again the highlights of the day and thoughts on 5G network progress, merger expectations, IoT solutions, and more. Jan stressed his high expectations of winning merger approval, along with the challenges of attorney generals suing yet sharing of the job growth that the merger will bring. Sprint Business reached 17% year over year growth in gross adds, with net adds up 34% y-o-y despite experiencing higher churn compared to competitors. Geldmacher mentioned focus areas and goals including increased contribution from Sprint Business with improved convergence of organization for selling across portfolio, stating the organization will continue the "Sprint Way of Selling" (i.e. solution selling focus, & automation/digitization of operations). Geldmacher shared they are working government and local companies including Peachtree Corners, GA and Greenville, SC on 5G and/or IoT use cases including Autonomous Vehicles.  Next up, we heard from Dr. John Saw, CTO of Sprint (@SprintCTO), who shared their mobile 5G progress. Sprint continued to roll out 5G in several cities using massive MIMO antenna systems (assets include 2.5 GHz spectrum assets) noting in Dallas, Houston, Atlanta, and Kansas City (4 cities currently, with 5 cities coming online soon) there are over 1000 sq miles already covered with 5G. Meanwhile AT&T and Verizon are leaning on mmWave a 5G coverage approach. The primary differentiator is the ability to serve Advanced LTE and 5G customers simultaneously on a single existing antenna in split mode. Sprint essentially has an advantage on leaning towards its heavy spectrum assets to provide 5G network leadership, which will in turn be better for businesses and government. Outside of mass IoT and business use cases, 5G also brings consumer use cases noted Saw...sharing mobile gaming use case leveraging 5G and Hatch (spinoff from Rovio) edge computing centers and Sprint infrastructure. (See related article: https://www.section.io/blog/edge-computing-gaming-benefits/)  Ivo Rook, Sprint Business SVP of IoT and Product Development, provided an update on overall Sprint Business activities, IoT, and Sprint Curiosity (TM)...OS, Platform, and Core), and placing Sprint outside of being just a wireless operator but focused on software and AI. Rook shared more on bringing data to the edge, going global, a focus on talent/training, deal pipeline growth, nationwide Cat M, and #smartcities partners including AWS @awscloud, Mapbox @Mapbox, Spireon @Spireon, Nauto, Arm @Arm, and Dynamics @dynamicsinc (recently signed). Sprint closed smarty city deals with Peachtree GA, Phoenix, AZ, Detroit MI, Greenville, SC, and Sacramento, CA. Rook also noted growth in SMB customers, up 24%, transitioning clients off CDMA. 5G was also a source of discussion, especially as it relates to autonomous vehicles (AV), where 5G can increase accuracy from 9 feet to 1 inch stated Ivo. Ivo shared 4 primary focus areas along with 5G emphasis including communication, security using #AI, engagement between colleagues, and client communications to enable business. Additional 5G use cases may include mobile wireless access points, #enterprise wireless backup, and #SMB collaboration. The software and AI discussion continued as #AI application=reduce production costs stated Rook. #ArtificialIntelligence is expected to balance accuracy/speed providing relative #context to intelligence. New AI products announced include #Sprint Secure AI, Sprint Secure Mobile AI, and Sprint Smart Messaging all with a focus on reducing human intervention with #flatfee incentives and #endpointsecurity. Sprint Smart Messaging is helping #restaurants recapture lost reservations and field missed calls (great restaurant use case). Kim Green-Kerr, SVP of Sprint Business, was also a speaker and shared live client examples of new #Sprint #AI products and solutions, with a highlight of service industry use case. She shared 60% of service industry experiences missed calls result in lost business to other companies or vendors (hair salons, restaurants) and Kim stated Sprint can help recapture #lostrevenue #lostcalls #lostbusiness using #AI #artificialintelligence (Sprint Smart Messaging). While sharing customer examples, Kim (@KimGreenKerr) introduced client Ron of @NationwideComm1 NCL Networks to share his experience working with Sprint Business. Ron mentioned NCL Networks maintains the largest base of Business Placement Outsourcing #BPO clients and nearshore and offshore customers in #singapore #philippines #manila #cebu sharing successes #3nodes.

Kim wrapped up by sharing a demo on Sprint Solutions Customization Tool which supports in helping those browsing #IoT solutions to a #guidedsell approach. This easy approach to find solutions, enables a no rep sale with #IoTFactory and can run full decision and close deal online #CuriosityMarketplace. Partners include Spireon, Mapbox (Using Live mapping with @Mapbox @ericg and Curiosity(TM) platform, designed for people and things, rich data sets, near real-time intelligent data), among others...Sprint is also working with @Accenture Innovation Centers, running #Curiosity #IoT. Curiosity and Sprint's IoT Factory (launched in May 2018) continues to experience progress, noting after the launch of the #IoT Factory the focus is to (1) Engage with Developer community (2) Gather and learn from Insights in how customers think with IoT (3) Produce IoT Leads. IoT factory currently has 26 solutions added on Factory 2.0 with 368 activations in FY19, also sharing 42 new customers (added in Q1), 127% sales growth (QoQ). #SprintCuriosity is live in #SanJose and #Ashburn with data collection nodes in 10 cities now, rolling out on weekly basis. The goal is to get data to the core (#SDN) as quickly as possible (19 Intelligent production nodes (Uber and Accenture)). #closetocustomers #sensordata #mL #AI Sprint is launching #Curiosity Labs, a public-private partnership (#3Ps #PPP) with Peachtree Corners @PCCityYes working with city Manager, Brian Johnson (#connected #smartcity #V2X #autonmous #500acres #smartcityexpo) and the expected date launch is set for Sept 9th...more can be found here vimeo.com/336207235 . As for what's next, Sprint also continues to focus on international expansion. Sprint shared both casual and permanent roaming in 152 countries and has deployed EYCC centralized solution with continued work on roll-out and deals in 135 countries enabling local profiles activated OTA partnering with @ericsson and @TelnaGlobal. Final thoughts on connecting PEOPLE, PLACES, and THINGS...

#IoT #IIoT #SDN #5G #certification #massIoT #IoTactivation #missioncriticalIoT #IoTSLAs IWCE and the PSTA Collaborate to Support Worldwide Open Public Safety Technology Standards

International Wireless Communications Expo (IWCE) (iwceexpo.com) is collaborating with the Public Safety Technology Alliance (PSTA) to support open technology public safety standards and open APIs for the critical communications industry worldwide. IWCE takes place March 4-8, 2019 at the Las Vegas Convention Center in Las Vegas, Nevada. IWCE is the premier annual event for communications technology professionals. Targeted to government, public safety, transportation, utilities and enterprises, IWCE offers a Conference Program with five-days of learning and an Exhibit Hall with 400+ exhibitors showcasing the latest products and trends in the communications technology industry. The event also offers networking opportunities to build industry relationships. PSTA’s mission as a non-profit organization is to bring public safety and industry together to support and promote the adoption of open, best-in-class technology standards and open APIs for the public safety user community. At IWCE, PSTA will be located in the Exhibit Hall in booth #MCT75 showcasing its technical subcommittees’ progress and the benefits for both industry and public safety of joining PSTA. TJ Kennedy, CEO of the PSTA, will present at the Town Hall meeting “Help is on the Way Roundtable: Public Safety Think Tank,” and Maggie Goodrich, Chair of the PSTA Board of Directors, will present at the General Session. PSTA will also host its quarterly board meeting at the conference. “By partnering with PSTA we will be able to reach a wider audience of public safety professionals to ensure that they have the vital knowledge and latest safety technologies necessary for them to succeed in the critical communications industry,” said Stacey Orlick, IWCE’s Director of Community and Conference Content. “We look forward to working closely with PSTA at IWCE.” Kennedy said, “We’re very excited to be working closely with IWCE to share our mission and progress on key technical issues with event attendees. As our industry continues its dynamic transformation, we are proud to support global open technology standards and open APIs to improve interoperability for public safety.” To register to attend IWCE, click here. Compass Intelligence is a proud media partner of #IWCE2019! |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed