|

In today’s connected world, seamless and reliable indoor cellular coverage is a necessity. As technology advances and the industry transitions from 4G to 5G, enterprises and cities face challenges in providing consistent and ubiquitous connectivity. In partnership with industry analyst, Stephanie Atkinson, of Compass Intelligence, we dive deep into these challenges and explore solutions to ensure reliable, secure, end-to-end connectivity for businesses and communities in my latest position paper: “Industry Insights: Streamlining Indoor Connectivity.”

Read report: https://denseair.net/news Hope on over to our AWARDS page to get your nominations in for the 11th annual CompassIntel awards. Let us know if you have any questions, just simply email us directly at [email protected]. How crazy is it that traditional broadband providers are seeing record growth in adding wireless subscribers (MVNO services), while carriers are seeing record growth in broadband subscriber adds (FWA or fixed wireless access aka 5G Home Internet or 5G Business Internet)? Should cable broadband operators work up a reseller agreement and sell fixed wireless access as an MVNO?

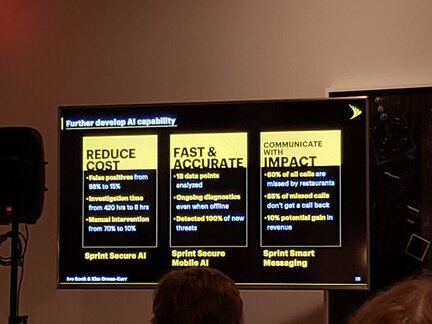

The industry is clearly showcasing the stronger trust, energy, and value proposition of wireless overall. We are finally seeing the reach of wireless overtake traditional fiber and wireline GROWTH as the industry matures and 5G delivers connectivity options across business and consumer. Fixed wireless access (FWA) is currently seeing a bit of a battle between Verizon and T-Mobile, while AT&T places its bet on fiber after pulling away from a fixed wireless strategy from 2021. FWA is not new and certainly been around for a while as WISPs (Wireless Internet Service Providers) have been serving rural America with these services for quite some time. Fixed wireless access or FWA in the most simplest terms provides consumers and business with an alternative or complete replacement to traditional broadband services (DSL, Cable, Fiber, T-1s, etc.). Customers can essentially be up and running with a hardware installation at the home or office (radio/receiver, antenna, cat 5 wiring, and connectivity to your WiFi router, etc.). Of course getting access from a WISP versus a carrier will have differing installations based on the nature of point-to-point and multi-directional access. The service essentially provides broadband over the wireless network or over wireless radios that communicate to the base stations or towers. As microcell, small cell, and mmWave technologies improve and enhance, we will see improved hardware and installation strategies impact overall revenue for the carriers and WISPs offering fixed wireless services. FWA can be seen as an alternative to wired broadband, but today we are seeing both consumers and businesses look to FWA as a complete replacement to their broadband services (T-Mobile shares in a recent report that their customers are replacing cable). While WISPs generally target rural and remote areas where fiber, cable and DSL is not an option, Verizon and T-Mobile for example are targeting cities and suburban areas, as well as the SMB market. In addition to looking at FWA as a alternative or replacement, customers are also evaluating and implementing fixed wireless to complement or provide additional connectivity options (failover) for their homes or business locations. From a branding perspective you may see the services being called 5G Home Internet or something similar. Outside of Verizon and T-Mobile, US Cellular also provides the service to its customers along with many WISPs. While FWA has traditionally been sold to homes and rural areas, today carriers are targeting businesses more than they have in the past, and the SMB sector is a primary target. There is an estimated 500K total business FWA subscribers today, with an expectation to grow to over a million very quickly as both Verizon and T-Mobile are adding 100s of thousands business customers each quarter. According to Ericsson's most recent Mobility Report, the global FWA market is expected to reach 300 million by 2028 and be driven my international markets, and more specifically India. They claim we will reach roughly 100 million FWA connections globally by the end of this year. As for the carriers, CompassIntel shares a summary of the key happenings for the top FWA carriers. T-Mobile is currently winning the race and has done a very good job at releasing new FWA business offerings that will provide them with continued runway as they have a very strong customer base of SMBs, who we believe will be more likely to replace their broadband service. T-Mobile – T-Mobile states they have more than 2M FWA customers, with a goal of 7-8 million FWA customers by 2025. Their most recent quarter net adds totaled 578K and they have experienced continued quarter to quarter growth in 2022. T-Mobile targets both consumers and businesses and recently announced their T-Mobile Business Internet services offering both primary and failover Internet packages. The packages range from unlimited to those based on data ranging from 10GB to 300GB. Their business strategy revolves around a focus on cyclical or temporary businesses, point of sale operations, pop up shops, and hybrid workforces. They will continue to leverage mmWave capacity for enhancements to its coverage and reach. Verizon - Verizon offers FWA to both consumers and businesses and their business services aka '5G Business Internet' is available at 2 million locations today, and is scaling to 14-25M locations by 2025. Fierce Wireless states that "Verizon’s 5G FWA service is available to about 30 million homes." Today Verizon shares they serve 1.06M FWA customers and have a target of 4 million to 5 million by the end of 2025. Their most recent quarter experienced additions of 342K net adds in Q3 with an estimated 32% of those adds going to business customers or subscribers. Offerings start at 300Mbps and go to 1-gig while they leverage both millimeter wave (mmWave) spectrum and C-Band mid-band spectrum for their coverage. AT&T – AT&T shifted their focus away from FWA from 2021 to focus more on their overall fiber buildout and strategy. Compass Intelligence estimates AT&T serves an estimated 700K FWA subscribers today. UScellular – US Cellular currently serves around 57K FWA subscribers on 4G, and is focusing on the expansion of 5G FWA over mmWave spectrum in 10 cities. They claim to have 23% annual growth for their FWA services from 2021 to 2022. To wrap up, pay attention to the advancements in mmWave and small cell equipment and radio hardware solutions. These advancements will help further improve capacity, installation efficiencies, and better serve business quality broadband services that are needed to help close the digital divide and improve connectivity across the globe.  In late June, a group of analysts (including myself) and consultants attended the annual Sprint Business Analyst Day in New York. This event provides an update on the business group including business wireless products and services, wireline (yes they are still operating in this space!) services, and of course IoT solutions. The theme this year was focused on how Sprint Business connects people, places, and things or branded as #worksforbusiness. We kicked off the event the first evening at The Knickerbocker Hotel with a reception to meet, greet, enjoy roof-top beverages and food. Jan Geldmacher (@JanGeld), Sprint Business President, kicked off the evening with a few words on expectations the next day, and a highlight of the sessions and content. The evening was enjoyable meeting up with old colleagues, fellow analysts, good friends, and catching up with Sprint executives. The next morning was held at Sprint's NY offices with a slightly wet commute a few blocks away as the rain helped wake up our day. Mr. Geldmacher again kicked off our morning sharing again the highlights of the day and thoughts on 5G network progress, merger expectations, IoT solutions, and more. Jan stressed his high expectations of winning merger approval, along with the challenges of attorney generals suing yet sharing of the job growth that the merger will bring. Sprint Business reached 17% year over year growth in gross adds, with net adds up 34% y-o-y despite experiencing higher churn compared to competitors. Geldmacher mentioned focus areas and goals including increased contribution from Sprint Business with improved convergence of organization for selling across portfolio, stating the organization will continue the "Sprint Way of Selling" (i.e. solution selling focus, & automation/digitization of operations). Geldmacher shared they are working government and local companies including Peachtree Corners, GA and Greenville, SC on 5G and/or IoT use cases including Autonomous Vehicles.  Next up, we heard from Dr. John Saw, CTO of Sprint (@SprintCTO), who shared their mobile 5G progress. Sprint continued to roll out 5G in several cities using massive MIMO antenna systems (assets include 2.5 GHz spectrum assets) noting in Dallas, Houston, Atlanta, and Kansas City (4 cities currently, with 5 cities coming online soon) there are over 1000 sq miles already covered with 5G. Meanwhile AT&T and Verizon are leaning on mmWave a 5G coverage approach. The primary differentiator is the ability to serve Advanced LTE and 5G customers simultaneously on a single existing antenna in split mode. Sprint essentially has an advantage on leaning towards its heavy spectrum assets to provide 5G network leadership, which will in turn be better for businesses and government. Outside of mass IoT and business use cases, 5G also brings consumer use cases noted Saw...sharing mobile gaming use case leveraging 5G and Hatch (spinoff from Rovio) edge computing centers and Sprint infrastructure. (See related article: https://www.section.io/blog/edge-computing-gaming-benefits/)  Ivo Rook, Sprint Business SVP of IoT and Product Development, provided an update on overall Sprint Business activities, IoT, and Sprint Curiosity (TM)...OS, Platform, and Core), and placing Sprint outside of being just a wireless operator but focused on software and AI. Rook shared more on bringing data to the edge, going global, a focus on talent/training, deal pipeline growth, nationwide Cat M, and #smartcities partners including AWS @awscloud, Mapbox @Mapbox, Spireon @Spireon, Nauto, Arm @Arm, and Dynamics @dynamicsinc (recently signed). Sprint closed smarty city deals with Peachtree GA, Phoenix, AZ, Detroit MI, Greenville, SC, and Sacramento, CA. Rook also noted growth in SMB customers, up 24%, transitioning clients off CDMA. 5G was also a source of discussion, especially as it relates to autonomous vehicles (AV), where 5G can increase accuracy from 9 feet to 1 inch stated Ivo. Ivo shared 4 primary focus areas along with 5G emphasis including communication, security using #AI, engagement between colleagues, and client communications to enable business. Additional 5G use cases may include mobile wireless access points, #enterprise wireless backup, and #SMB collaboration. The software and AI discussion continued as #AI application=reduce production costs stated Rook. #ArtificialIntelligence is expected to balance accuracy/speed providing relative #context to intelligence. New AI products announced include #Sprint Secure AI, Sprint Secure Mobile AI, and Sprint Smart Messaging all with a focus on reducing human intervention with #flatfee incentives and #endpointsecurity. Sprint Smart Messaging is helping #restaurants recapture lost reservations and field missed calls (great restaurant use case). Kim Green-Kerr, SVP of Sprint Business, was also a speaker and shared live client examples of new #Sprint #AI products and solutions, with a highlight of service industry use case. She shared 60% of service industry experiences missed calls result in lost business to other companies or vendors (hair salons, restaurants) and Kim stated Sprint can help recapture #lostrevenue #lostcalls #lostbusiness using #AI #artificialintelligence (Sprint Smart Messaging). While sharing customer examples, Kim (@KimGreenKerr) introduced client Ron of @NationwideComm1 NCL Networks to share his experience working with Sprint Business. Ron mentioned NCL Networks maintains the largest base of Business Placement Outsourcing #BPO clients and nearshore and offshore customers in #singapore #philippines #manila #cebu sharing successes #3nodes.

Kim wrapped up by sharing a demo on Sprint Solutions Customization Tool which supports in helping those browsing #IoT solutions to a #guidedsell approach. This easy approach to find solutions, enables a no rep sale with #IoTFactory and can run full decision and close deal online #CuriosityMarketplace. Partners include Spireon, Mapbox (Using Live mapping with @Mapbox @ericg and Curiosity(TM) platform, designed for people and things, rich data sets, near real-time intelligent data), among others...Sprint is also working with @Accenture Innovation Centers, running #Curiosity #IoT. Curiosity and Sprint's IoT Factory (launched in May 2018) continues to experience progress, noting after the launch of the #IoT Factory the focus is to (1) Engage with Developer community (2) Gather and learn from Insights in how customers think with IoT (3) Produce IoT Leads. IoT factory currently has 26 solutions added on Factory 2.0 with 368 activations in FY19, also sharing 42 new customers (added in Q1), 127% sales growth (QoQ). #SprintCuriosity is live in #SanJose and #Ashburn with data collection nodes in 10 cities now, rolling out on weekly basis. The goal is to get data to the core (#SDN) as quickly as possible (19 Intelligent production nodes (Uber and Accenture)). #closetocustomers #sensordata #mL #AI Sprint is launching #Curiosity Labs, a public-private partnership (#3Ps #PPP) with Peachtree Corners @PCCityYes working with city Manager, Brian Johnson (#connected #smartcity #V2X #autonmous #500acres #smartcityexpo) and the expected date launch is set for Sept 9th...more can be found here vimeo.com/336207235 . As for what's next, Sprint also continues to focus on international expansion. Sprint shared both casual and permanent roaming in 152 countries and has deployed EYCC centralized solution with continued work on roll-out and deals in 135 countries enabling local profiles activated OTA partnering with @ericsson and @TelnaGlobal. Final thoughts on connecting PEOPLE, PLACES, and THINGS...

#IoT #IIoT #SDN #5G #certification #massIoT #IoTactivation #missioncriticalIoT #IoTSLAs IWCE and the PSTA Collaborate to Support Worldwide Open Public Safety Technology Standards

International Wireless Communications Expo (IWCE) (iwceexpo.com) is collaborating with the Public Safety Technology Alliance (PSTA) to support open technology public safety standards and open APIs for the critical communications industry worldwide. IWCE takes place March 4-8, 2019 at the Las Vegas Convention Center in Las Vegas, Nevada. IWCE is the premier annual event for communications technology professionals. Targeted to government, public safety, transportation, utilities and enterprises, IWCE offers a Conference Program with five-days of learning and an Exhibit Hall with 400+ exhibitors showcasing the latest products and trends in the communications technology industry. The event also offers networking opportunities to build industry relationships. PSTA’s mission as a non-profit organization is to bring public safety and industry together to support and promote the adoption of open, best-in-class technology standards and open APIs for the public safety user community. At IWCE, PSTA will be located in the Exhibit Hall in booth #MCT75 showcasing its technical subcommittees’ progress and the benefits for both industry and public safety of joining PSTA. TJ Kennedy, CEO of the PSTA, will present at the Town Hall meeting “Help is on the Way Roundtable: Public Safety Think Tank,” and Maggie Goodrich, Chair of the PSTA Board of Directors, will present at the General Session. PSTA will also host its quarterly board meeting at the conference. “By partnering with PSTA we will be able to reach a wider audience of public safety professionals to ensure that they have the vital knowledge and latest safety technologies necessary for them to succeed in the critical communications industry,” said Stacey Orlick, IWCE’s Director of Community and Conference Content. “We look forward to working closely with PSTA at IWCE.” Kennedy said, “We’re very excited to be working closely with IWCE to share our mission and progress on key technical issues with event attendees. As our industry continues its dynamic transformation, we are proud to support global open technology standards and open APIs to improve interoperability for public safety.” To register to attend IWCE, click here. Compass Intelligence is a proud media partner of #IWCE2019! A few weeks back, we discussed where we are today with the two waves of "The Connected Vehicle." 1st we focused on bringing WiFi and 4G/LTE to the vehicle. Now let's jump into the power of the Autonomous Vehicle, the 2nd wave.

According to Techopedia, the definition of Autonomous Vehicles is, "An autonomous car is a vehicle that can guide itself without human conduction. This kind of vehicle has become a concrete reality and may pave the way for future systems where computers take over the art of driving. An autonomous car is also known as a driverless car, robot car, self-driving car or autonomous vehicle." For many out there, these concepts are so far out there that is is challenging to understand what this means to both us as consumers, as well as industry and businesses. Let's call the market AV for short, since we will be discussing scenarios throughout this blog. The AV market has the chance to disrupt industries in the transportation marketplace, as well as disrupt the way goods and services get transported and delivered throughout the world. Before we get too technical, lets focus on what this really means to us as consumers, consumers who drive our vehicles every day to work, school, leisure places, and events. Below are some real-world scenarios on how AV will impact the consumer, imagine this...

Recent Related News on AV:

For further reading, please check out the related blog regarding the 1st wave of The Connected Vehicle. For more information, please visit our RESEARCH page to explore other technologies and market indicators. Written by Stephanie Atkinson, CEO of Compass Intelligence, LLC |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed