|

IoT is NOT dead, but the game is changing. When the term "IoT" took off, some experts and analyst firms categorized it as an industry. Some of us, especially the crew at IoT Coffee Talk, would get so aggravated at the blanket term of IoT when used to describe a narrowed market or a myopic description of the technology. IoT remains a blanket term used to describe things (i.e. assets, structures, tangible objects, mobile vehicles, items, etc.) being connected to the Internet. In 2010, Ericsson first shared there would be a projected 50 billion connected devices by 2020. That later was cut to 25 billion, and in the end was not the important factor. All of that, in my opinion missed the mark. Connections are connections are connections...Are the tech firms making money and are the businesses (clients) adopting and rolling out "IoT" seeing value?

While being connected is important...assets, for example, being connected really gain value when there are actionable insights, viable analytics, and the data can be used for business value. In addition, the tech companies providing IoT services and solutions (hardware, software, services, etc.) need to make money. So many businesses have come for the hype and left in debt, as they were never able to scale or offered no business value that made them margin. Now, let's get back to business value. Business value may include reducing costs, preventing failure or disruption, improving operations, bringing new revenue, offering asset visibility, meeting compliance requirements, and much more. The other important business aspect, is when we connect these "things," the business value becomes important only if it contributes financially to the business, presents a trackable ROI, and/or provides relevant business incentives. Many in the industry believe the hype of IoT is over, and it really is. Why though do I say that IoT is NOT dead. The industry is now transitioning away from using the terms IoT and IoT as a marketing term is fading, especially among other hype tech areas. IoT has always been about a particular industry and automating that industry. Technologists are realizing they must dive deeper and apply the technology to the specific industry, and apply context to how the tech will:

Automation can be defined as many things depending on who you talk to and what industry you are discussing, and "IoT" is just a tool in the tech tool belt at this point to support digital transformation, automation, and elevate the future of work. Yes, we can connect things but businesses and government organizations have reached a point of "so what."

IoT is NOT dead, the game is just changing. It is changing because we are moving to a point where we no longer call it "IoT." Those delivering solutions will just do what they should have been doing in the first place, and that is talking about the client's needs and applying the conversation to the value proposition to the industry, sub-industry, etc. In addition, AI has taken over as the new shiny thing. Artificial Intelligence and machine learning (models) essentially enable an IoT solution or further provide actionable insights, automation, and real-time intelligence. For those "IoT" companies that are still around, you have survived but you also will need to adapt. My advice is to not jump on the next shiny thing (many have been utilizing AI long before the hype entered), but to continue to provide context of your products and services and how it applies to your customer. If your customer is in the hospitality industry, then dive deep into that industry (travel, hotel experiences, occupancy optimization) and understand the traveler needs, apply your business development delivery in an intentional manner. Immerse yourself, do your research, train your teams, hire the experts, and be intentional. Find ISVs, VARs, and other partners to help your go-to-market, especially those that specialize in specific industries as they may "own" the customer. Collaboration will be essential. Just as in the rap industry, you have to collaborate to stay relevant! STAY TUNED, the IoT Innovator Awards by CompassIntel will open for nominations this fall! On October 20th, a large group of industry analysts joined 5G Americas staff and members to discuss the state of 5G. Neville Ray of T-Mobile, Chair of 5G Americas, kicked off the event after a warm welcome and a setting of the stage by Chris Pearson (President of 5G Americas). Ray stated we are “In the next phase of 5G networks,” and “5G is finally starting to gain real traction.” A wide range of stats were shared along with some important factoids showing we are moving the needle in the Americas. Participating companies included Airspan, Cisco, Qualcomm, Samsung, T-Mobile, AT&T, Ciena, Mavenir, Nokia, Ericsson,Crown Castle, VMware, and Intel. While the foundational layer in 5G is located in the low band spectrum, mid-band 5G in the United States is now real…..but as all of us know, we need more mid-band spectrum to reach full potential of 5G use cases and applications. Currently, more than 66% of the geographic land mass is covered by 5G, while this same percentage of the population has access to 5G. Having a 5G enabled device is a bit underwhelming, with less than half of the U.S. population having access to a device with a 5G radio. With an investment of more than $100 billion over the last few years, 5G phones and subscriptions reached a total of 140 million, which remains less than half of the North American population. The most significant finding is that 5G is about increased data consumption, as Neville shared we are about 2.5 to 3 times higher data consumption with 5G compared to LTE. When thinking about the networks and advancements being made, we must remember we will rely on 4G/LTE for quite some time even though 5G networks are continuing to be deployed and improved. There are currently 14 total 5G networks running that enable streaming, gaming, social media and communications, and other business or enterprise-based applications. Outside of all of these data-intensive categories, Neville Ray mentioned for the industry to NOT forget about voice….yes, voice is still important for 5G and the advancements are really all around Voice over NR or New Radio (pronounced Vonar, aka Vo5G/Voice over 5G) (Related News: https://techblog.comsoc.org/2022/06/04/t-mobile-launches-voice-over-5g-nr-using-5g-sa-core-network/). 5G Americas noteworthy trends revolve around the following highlighted areas:

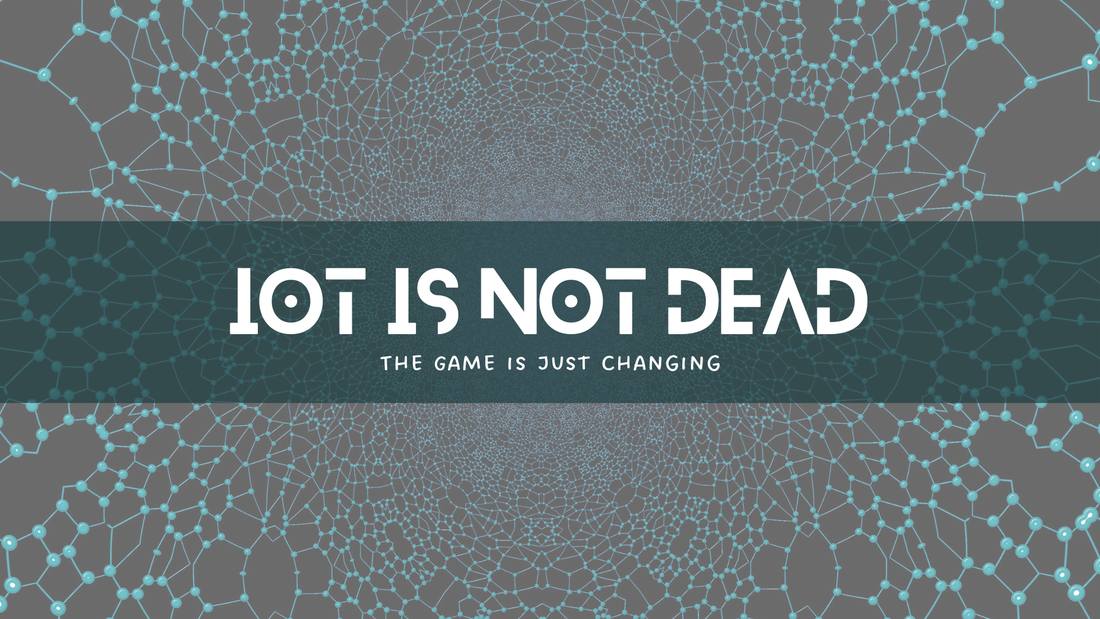

Fixed wireless access or FWA is being seen as an alternative to wired broadband and Wi-Fi (See Wi-Fi6) connectivity for a number of reasons. In many cases, the WISPs leveraged unlicensed spectrum to reach rural communities who lacked quality broadband, but over the past year the conversation has shifted to enterprise interest. Some believe it to be a complement or to augment existing connectivity options (especially cable). While FWA is creating capacity and new capabilities, especially for business use, additional and new spectrum is coming. FWA will continue to remain an available option for businesses in the US and internationally, but will continue to be squeezed by fiber and funding that may benefit fiber build out (Further Reading: WISPs embrace fiber as they face do or die moment). The carriers have been busy when it comes to FWA, especially in terms of their announcements and overall growth. Of course with that comes a bit of a reverse, as the overhype of FWA is now settling. “Verizon Communications…touted the addition of 234,000 fixed wireless access residential customers in the third quarter and another 108,000 FWA subscribers on the business-services side, upping its total FWA base to over 1 million users,” as seen on NextTV. T-Mobile will have their Q3 earnings call tomorrow but as Forbes shared, “T-Mobile has also made a dent in the broadband space, with its fixed wireless broadband offering adding an industry-leading 560,000 new broadband subscribers (last quarter),” while today they have more than 1.5 million FWA subscribers. Ericsson also shared, “UScellular was the first service provider to offer consumers and enterprise Fixed Wireless Access (FWA) services, using 5G extended-range millimeter-wave (mmWave) to target digital divide areas in rural America, reaching coverage of over 5 km.” While the activity for fixed wireless has expanded over the past year, spectrum access and fiber will remain critical factors for continued growth. Below is a slide that was shared at 5G Americas that highlights some of the overall FWA stats (Source: 5G Americas & Their Members). While some of you may be tired of tech acronyms, it is the way we lazy people essentially describe long-winded tech terms. Enter C-V2X or Cellular Vehicle-to-Everything). C-V2X is considered a mid-term opportunity and is expected to open up a range of opportunities driven by low latency, high performance 5G network services. Think about your car becoming your hub or essentially just like any other device. This hub will speak to the road, to traffic lights, to city traffic bodies, to public safety, to you and your passengers, to your auto dealership, to your car manufacturer and even to all your favorite content providers. In addition, these hubs will speak to each other building a network of communications across many sources. A range of entertainment, safety, location and routing, and interactive services will be launched and made available to drivers and passengers as a result. Your car needs reliable, high-speed wireless connectivity and 5G gets us there. We are in the earlier stages, but we do expect ongoing announcements well into 2023 to directly address the opportunities of 5G in C-V2X.

Network slicing is a near term focus across low, mid, and high-band spectrum. Enterprise and consumer applications focused on improved throughput, low latency, and other requirements see network slicing as a way to “carve out dimensional experiences,” shared Neville Ray. While we are in the early game of network slicing, we have yet to truly understand all the potential advantages and improvements that may come as we purpose-build the network. Aside from the key trends, and even more important, are the actual use cases for 5G. While the Analyst Forum had a strong emphasis on 5G for consumer and the growth in experiences there, I believe the true opportunity will lie with the enterprise and government sectors. Consumer 5G revolves around things like wearables, gaming, social communications, metaverse (not my favorite word), shopping, navigation, health/wellness, and sports. On the enterprise side, 5G presents new connectivity options for mass IoT and autonomous transportation, especially in use cases where the assets (fleets, products, equipment, people, machines, etc.) are mobile or meaning they are moving. These assets need to be monitored, measured, tracked, repaired, and acted upon for a variety of purposes and for reasons specific to the industry. Some of the vertical markets or industries where 5G opportunities exist include manufacturing, utilities, transportation, remote health care, digital cities, and education. For factories or logistics applications for example, mmWave is being used to enhance connectivity performance in robotics, as well as being used for sensing in agriculture or for farming applications. While 5G has been met with a sense of excitement and overall hype, we remain in the stage of improving overall network performance and build-out to meet enterprise and new customer experience expectations. There will always be hesitation for 5G adoption as a replacement to fiber, but for now we should think about applications where 5G is the only solution or where 5G will augment connectivity to provide better performance for things like robotics, transportation, supply chain monitoring, customer/digital experiences, etc. Lastly, the industry will continue to seek out additional mid-band spectrum as is needed to scale and to reach performance expectations. Special thank you to the 5G Americas team for hosting all of us analysts and for putting together great content. Contact Stephanie directly to learn more about other panel sessions and content that was shared at the event. Recommendations for further reading and research: Open RAN, Spectrum Policy and FCC Activities, mmWave, RedCap (Reduced Capacity) New Radio, Dynamic Spectrum Sharing, Unlicensed Spectrum. Please visit 5G Americas to learn more and to get access to their whitepapers and studies. To get access to further wireless research including 5G, please visit our WIRELESS RESEARCH store. Written by Stephanie Atkinson Field services and fleet management go hand in hand, while IoT (Internet of Things) continues to provide essential real-time intelligence to improve visibility, safety, and operational efficiencies. Connectivity, tracking, and telematics are at the center of the advancements being made in these industries. When you think about field services, you think many moving parts that need coordination…you think a wide range of logistics synchronization, customer support, delivery operations, and other coordinated activities that are all collectively brought about to make sure products/goods and services are delivered on time, with superior customer service, and with complete accuracy and safety. Field services and operations may include activities such as collecting customer insights, scheduling/dispatching of fleets, bid and estimate calculations, work orders and troubleshooting, and other administrative functions such as billing, accounts receivable, client/customer relations, and more. In addition, some field service teams may also include repair, maintenance, installation, and other services where technicians are required. People, processes, planning, and profit remain the four critical components of field services. The industry continues to move towards a digital transformation journey embracing cloud, software as a service, and IoT.

On the other side you have fleet operations that may require tracking, safety protocols, management, compliance, and coordination. So many industries rely on fleet operations including public safety, construction, HVAC, energy (oil & gas), shipping/logistics, telecommunications, waste management, public transportation, and just about any industry that has repair/maintenance/technician operations. Once a technician needs to be dispatched or needs to complete a delivery, there are many facets to organizing, coordinating, and tracking assets across the fleet. Tracking may take place around the assets in the vehicle, the fleet vehicles, and the drivers or mobile workforce. The human element remains important as safety and compliance become a top priority for drivers, workers, and technicians. The innovation taking place across field service and fleet management is driven by technology, and more specifically IoT, smart cameras, GPS tracking, telematics and real-time intelligence garnered through automation (AI, machine learning), sensor systems, edge computing, and software. Moreover, are the platforms and software systems that enable transparency and management, providing visibility across the fleet and field operations. GPS Insight is one such company bringing together field services and fleet management. In January 2022, GPS Insight acquired FieldAware, and CEO Gary Fitzgerald shared, “Our focus has been on bringing together fleet data and telematics technology with field service management solutions.” Of course, there are vendors operating in these fields but very few provide a streamlined portfolio of services to serve both field service and fleet operations. GPS Insight continues to have a laser-targeted approach and states, “Joining forces with FieldAware not only extends our competitive advantage across the field service and fleet management landscape, but also provides new capabilities to transform customer satisfaction into a new standard: customer success.” Field service and fleet management industries were hampered over the last few years and still grappling with the pandemic impact and supply chain shortages. The U.S. is also facing labor shortages, which further creates constraints for hiring and maintaining worker satisfaction. Profit loss, worker retention, and supply chain issues remain top of mind for many leaders in these sectors. However, labor shortages will push us further into relying on technology, automation, and real-time intelligence to get things done efficiently. Compass Intelligence expects field service and fleet management to remain one of the largest contributors to IoT connections growth, as we increase connectivity and tracking of people, assets, and fleets. IoT is and will continue to be essential to meet these challenges head on and provide real-time intelligence for improved operations and supply chain visibility. Further Reading:

IN THIS EPISODE, STEPHANIE TALKS ABOUT THE HYPE BEHIND EDGE COMPUTING, THE FUTURE OF IOT, THE IMPORTANCE AND APPLICATIONS OF AUTOMATION, AND PROVIDES ADVICE FOR WOMEN WORKING IN TECHNOLOGY.

Smart cities or intelligent cities are not only about technology improving city services, but they are about improving the community experience as you live, work, and play. Yes, much has changed over the past 18 months, but city projects are moving forward and with a boost of energy because of the pandemic and new funding sources. The industry as a whole is finding new project opportunities centered around automation, remote operations, contactless services, public health and safety, and new ways to deliver legacy services to avoid the face-to-face interaction for safety purposes. A few key technologies directly aiding in smart city initiatives include Internet of Things (sensors, connecting assets, tracking assets, real-time alerting or intelligence), mobile applications, augmented or virtual reality, artificial intelligence, and machine learning.

Historically, smart city projects have centered around traffic management, smart lighting, and city asset management, and while those areas are expected to continue to be areas of focus, new use cases are coming into the mix. Under the American Rescue Plan and Coronavirus Relief Fund (CARES ACT), cities and public schools are receiving emergency funding to support in projects related to safety, healthcare, and administering city services in new and safe ways. READ MORE AT EXECUTIVE VIEWPOINT A week ago, I sat down virtually with Brandon Branham, Chief Technology Officer and Assistant City Manager of Peachtree Corners (PTC, one of the first cities in the United States powered by real-world smart city infrastructure, which also features ‘Curiosity Lab at Peachtree Corners’) to get an update on all of the progress being made in making the city smarter, more interactive, and inviting to technology innovators around the globe. Peachtree Corners launched an innovative living smart city lab about 1 year back that leverages autonomous technology, IoT, AI, machine learning, edge computing, virtual reality, and other advanced technologies to advance city operations, mobility, and introduce economic development. Some of the more interesting key facts about PTC include the following:

The innovation being embraced at PTC comes with the value it is placing in partnerships, leading technology company initiatives, and the live testing environment it provides to tech companies, OEMs, and startups around the globe. They currently have roughly 10 vendors with 15 different device types generating data across their network across around 15 or so different software systems. On the embracing of global companies, it is also working with a Tel Aviv company called IPgallery, that brings together city insights and intelligence using a real-time AI data platform that provides visualization (visual map) across PTC to monitor, analyze and secure all IoT devices across the ecosystem, buses, cameras, applications, etc. In addition, traffic flow and pattern data are being collected to adjust and make real-time rerouting decisions to improve public transportation.

PTC recently announced a partnership with Bosch, where they are implementing a sensor connected intersection and intelligent traffic management system to capture video including vehicle identification, vehicle recognition of objects (car, bus, scooters with drivers or without, pedestrians, etc. using machine vision). This partnership will allow real-time adjustments to traffic signaling, share the flow of traffic activity, and identify the type of vehicle in that flow for improved traffic management. PTC's Curiosity Lab will allow for a living city environment for Bosch to leverage its leading edge solution within a live, real municipality. A few other projects on the horizon include the following:

All of these activities would not be anywhere without the public-private partnerships (3Ps) in place. PTC has a process to test in their live environment, receive funding from 3rd parties or commercial entities (for some projects), decide on whether the project is scalable, and then the city decides and will invest as needed. This is a prime example of how business and government can and should work together to advance the smart city vision. On a final note, below is a list of key differentiators that enable PTC be the groundbreaking innovator in smart city solutions:

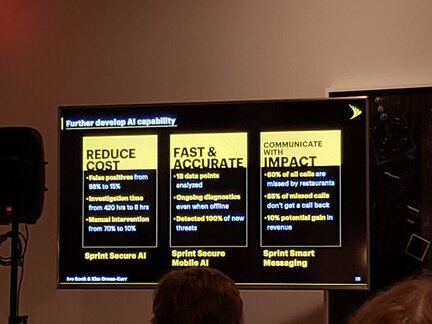

Platform  In late June, a group of analysts (including myself) and consultants attended the annual Sprint Business Analyst Day in New York. This event provides an update on the business group including business wireless products and services, wireline (yes they are still operating in this space!) services, and of course IoT solutions. The theme this year was focused on how Sprint Business connects people, places, and things or branded as #worksforbusiness. We kicked off the event the first evening at The Knickerbocker Hotel with a reception to meet, greet, enjoy roof-top beverages and food. Jan Geldmacher (@JanGeld), Sprint Business President, kicked off the evening with a few words on expectations the next day, and a highlight of the sessions and content. The evening was enjoyable meeting up with old colleagues, fellow analysts, good friends, and catching up with Sprint executives. The next morning was held at Sprint's NY offices with a slightly wet commute a few blocks away as the rain helped wake up our day. Mr. Geldmacher again kicked off our morning sharing again the highlights of the day and thoughts on 5G network progress, merger expectations, IoT solutions, and more. Jan stressed his high expectations of winning merger approval, along with the challenges of attorney generals suing yet sharing of the job growth that the merger will bring. Sprint Business reached 17% year over year growth in gross adds, with net adds up 34% y-o-y despite experiencing higher churn compared to competitors. Geldmacher mentioned focus areas and goals including increased contribution from Sprint Business with improved convergence of organization for selling across portfolio, stating the organization will continue the "Sprint Way of Selling" (i.e. solution selling focus, & automation/digitization of operations). Geldmacher shared they are working government and local companies including Peachtree Corners, GA and Greenville, SC on 5G and/or IoT use cases including Autonomous Vehicles.  Next up, we heard from Dr. John Saw, CTO of Sprint (@SprintCTO), who shared their mobile 5G progress. Sprint continued to roll out 5G in several cities using massive MIMO antenna systems (assets include 2.5 GHz spectrum assets) noting in Dallas, Houston, Atlanta, and Kansas City (4 cities currently, with 5 cities coming online soon) there are over 1000 sq miles already covered with 5G. Meanwhile AT&T and Verizon are leaning on mmWave a 5G coverage approach. The primary differentiator is the ability to serve Advanced LTE and 5G customers simultaneously on a single existing antenna in split mode. Sprint essentially has an advantage on leaning towards its heavy spectrum assets to provide 5G network leadership, which will in turn be better for businesses and government. Outside of mass IoT and business use cases, 5G also brings consumer use cases noted Saw...sharing mobile gaming use case leveraging 5G and Hatch (spinoff from Rovio) edge computing centers and Sprint infrastructure. (See related article: https://www.section.io/blog/edge-computing-gaming-benefits/)  Ivo Rook, Sprint Business SVP of IoT and Product Development, provided an update on overall Sprint Business activities, IoT, and Sprint Curiosity (TM)...OS, Platform, and Core), and placing Sprint outside of being just a wireless operator but focused on software and AI. Rook shared more on bringing data to the edge, going global, a focus on talent/training, deal pipeline growth, nationwide Cat M, and #smartcities partners including AWS @awscloud, Mapbox @Mapbox, Spireon @Spireon, Nauto, Arm @Arm, and Dynamics @dynamicsinc (recently signed). Sprint closed smarty city deals with Peachtree GA, Phoenix, AZ, Detroit MI, Greenville, SC, and Sacramento, CA. Rook also noted growth in SMB customers, up 24%, transitioning clients off CDMA. 5G was also a source of discussion, especially as it relates to autonomous vehicles (AV), where 5G can increase accuracy from 9 feet to 1 inch stated Ivo. Ivo shared 4 primary focus areas along with 5G emphasis including communication, security using #AI, engagement between colleagues, and client communications to enable business. Additional 5G use cases may include mobile wireless access points, #enterprise wireless backup, and #SMB collaboration. The software and AI discussion continued as #AI application=reduce production costs stated Rook. #ArtificialIntelligence is expected to balance accuracy/speed providing relative #context to intelligence. New AI products announced include #Sprint Secure AI, Sprint Secure Mobile AI, and Sprint Smart Messaging all with a focus on reducing human intervention with #flatfee incentives and #endpointsecurity. Sprint Smart Messaging is helping #restaurants recapture lost reservations and field missed calls (great restaurant use case). Kim Green-Kerr, SVP of Sprint Business, was also a speaker and shared live client examples of new #Sprint #AI products and solutions, with a highlight of service industry use case. She shared 60% of service industry experiences missed calls result in lost business to other companies or vendors (hair salons, restaurants) and Kim stated Sprint can help recapture #lostrevenue #lostcalls #lostbusiness using #AI #artificialintelligence (Sprint Smart Messaging). While sharing customer examples, Kim (@KimGreenKerr) introduced client Ron of @NationwideComm1 NCL Networks to share his experience working with Sprint Business. Ron mentioned NCL Networks maintains the largest base of Business Placement Outsourcing #BPO clients and nearshore and offshore customers in #singapore #philippines #manila #cebu sharing successes #3nodes.

Kim wrapped up by sharing a demo on Sprint Solutions Customization Tool which supports in helping those browsing #IoT solutions to a #guidedsell approach. This easy approach to find solutions, enables a no rep sale with #IoTFactory and can run full decision and close deal online #CuriosityMarketplace. Partners include Spireon, Mapbox (Using Live mapping with @Mapbox @ericg and Curiosity(TM) platform, designed for people and things, rich data sets, near real-time intelligent data), among others...Sprint is also working with @Accenture Innovation Centers, running #Curiosity #IoT. Curiosity and Sprint's IoT Factory (launched in May 2018) continues to experience progress, noting after the launch of the #IoT Factory the focus is to (1) Engage with Developer community (2) Gather and learn from Insights in how customers think with IoT (3) Produce IoT Leads. IoT factory currently has 26 solutions added on Factory 2.0 with 368 activations in FY19, also sharing 42 new customers (added in Q1), 127% sales growth (QoQ). #SprintCuriosity is live in #SanJose and #Ashburn with data collection nodes in 10 cities now, rolling out on weekly basis. The goal is to get data to the core (#SDN) as quickly as possible (19 Intelligent production nodes (Uber and Accenture)). #closetocustomers #sensordata #mL #AI Sprint is launching #Curiosity Labs, a public-private partnership (#3Ps #PPP) with Peachtree Corners @PCCityYes working with city Manager, Brian Johnson (#connected #smartcity #V2X #autonmous #500acres #smartcityexpo) and the expected date launch is set for Sept 9th...more can be found here vimeo.com/336207235 . As for what's next, Sprint also continues to focus on international expansion. Sprint shared both casual and permanent roaming in 152 countries and has deployed EYCC centralized solution with continued work on roll-out and deals in 135 countries enabling local profiles activated OTA partnering with @ericsson and @TelnaGlobal. Final thoughts on connecting PEOPLE, PLACES, and THINGS...

#IoT #IIoT #SDN #5G #certification #massIoT #IoTactivation #missioncriticalIoT #IoTSLAs

In case you didn't know, BlackBerry is not only ramping up its portfolio around IoT security services and solutions, but they are also in the asset/fleet/cargo tracking market. Based on telematics research available on compassintel.com, total global asset tracking market will reach $27.1B by 2023, growing at 14.8% compound annual growth rate, with North America holding a strong 37% of the market share. When you add fleet tracking and cold chain tracking to this, it become an even larger market opportunity.

"The BlackBerry® Radar family of products is an all-encompassing asset tracking solution that gives fleet assets such as trailers, vans, containers, flatbeds, chassis and equipment the intelligence to securely communicate in near real-time."

Blackberry introduced BlackBerry® Radar (two versions including Radar-M and Radar-L) in 2016, and has really struggled to get to the market growth it needs to compete with the likes of Verizon Connect, Omnitracs (Qualcomm subsidiary), and others. This is a highly saturated market with 100s of companies competing just in the U.S. alone. The devices offer both an AT&T SIM and Orange SIM for connectivity, and customers can choose to pay all up front through a capital investment or pay a smaller up-front fee for the equipment and monthly recurring fee (MRC) for the services. There is also a lease option available for customers who prefer not to "own" the equipment. The primary telematics focus for BlackBerry is non-powered assets including cargo, low and high value shipping assets, and even cold chain assets. In an article in FleetOwner magazine BlackBerry SVP and General Manager Phillip Poulidis stated, "Radar customers are improving fleet efficiency on average between 7% and 10%." BlackBerry also stated a goal of reaching $100 million in revenue over the next three years from the telematics product.

A few additional notes...

All in all, BlackBerry will need to continue to push branding awareness in a very competitive marketplace, which may be challenging as it is not very well-known compared to the larger market players. The real opportunity would be for BlackBerry to set up a reseller/partnership ecosystem to push BlackBerry Radar (branded or white-labeled) to the masses, and this would mean partnering with other IoT telematics companies and wireless carriers, as well as non-traditional technology companies. Get this research! Asset Tracking Market by Technology, Connection Type, Mobility, Location Determination, and Industry Verticals 2018 – 2023  By Stephanie Atkinson, CEO CompassIntel/Chair IoT6 www.5gamericas.org | @5GAmericas Last week was the annual 5G Americas annual Analyst Forum held in Dallas, Texas. The event was kicked off by the Chairman and CTO of T-Mobile US, Neville Ray (@NevilleRay). Just a few highlights to start off with regarding Neville's keynote, which clearly showcased the global and nationwide competitive angle 5G is being championed for and towards (also heard at MWCA in LA).

ARTIFICIAL INTELLIGENCE AND 5G

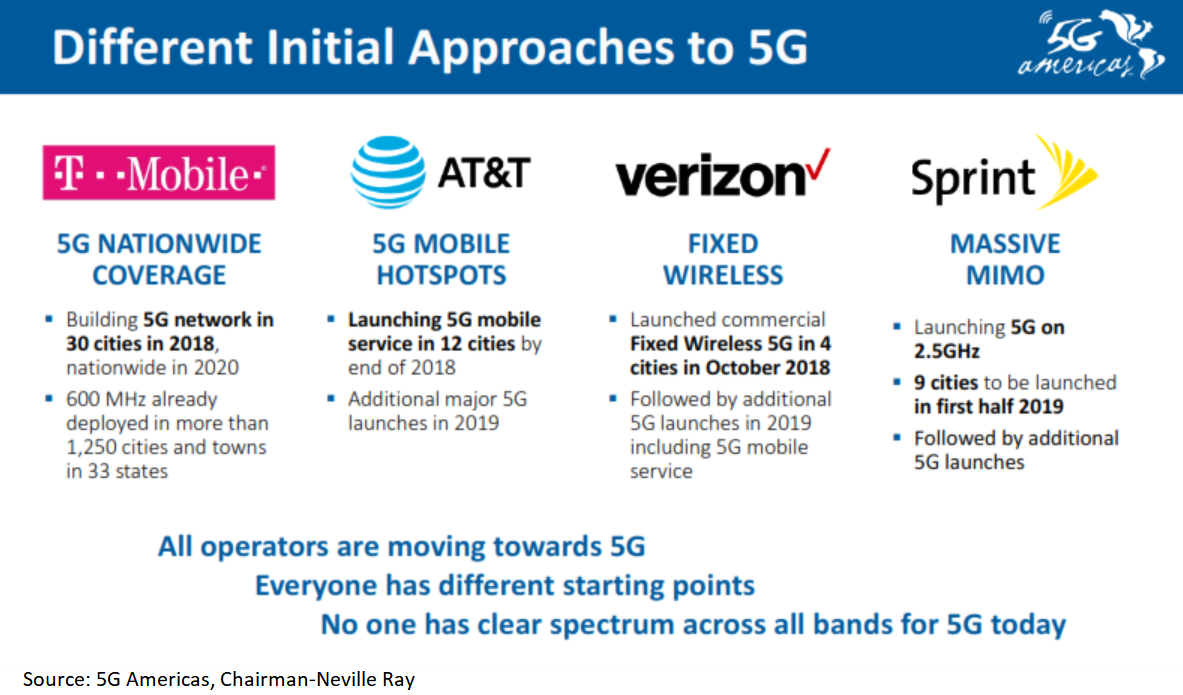

One of the first sessions I sat in on was focused around the impact of Artificial Intelligence (AI) to 5G and future growth in IoT. Ericsson is utilizing AI tools and software to improve their radio access network (RAN) specific to configuration and optimization, while Samsung mentioned heavily investing (see Softbank news on AI investments) in AI at the cloud level to support in new customer experiences (cX) and improve video content services (noted example of having video content follow users). Cisco's perspective was a bit different as they are looking at AI to support in new learning algorithms (inference and information theory) around operations, as well as using AI tools and software for social impact initiatives. Lastly, Sprint mentioned leveraging AI to improve data quality, enhance machine learning tools, generating automatic code, and simplifying for categorization (think automated text categorization, read more here). Sprint also mentioned there may be a challenge with the human input and training is an issue. 5G AND ENTERPRISE IoT On the low band, 5G is expected to support in scaling massive IoT, specific to low latency connected and sensor solutions, specific to industrial, infrastructure, operations, and even smart cities. The use cases revolve around asset tracking and monitoring, fleet tracking and monitoring, some transportation and container tracking, and applications specific to agriculture, factory automation/manufacturing (mass production), and others. DEVICE ECOSYSTEM Enhanced Mobile Broadband (eMBB) has been a focus for companies like AT&T, as they made announcements this year. As shown earlier, the carriers all have different approaches to device roll-out, yet 5G smartphones is not expected until mid-2019. On another note, there are some upcoming changes to 5G devices and antenna placement. Devices may have 3 to 4 mmWave antennas as part of 5G enhancements, and this will help to manage hand cover up issues from a user experience perspective. Qualcomm mentioned that some devices still have 2G, and that the OEMs they work with are choosing what bands to include in the devices. The 3G to 4G shift was more concentrated around power management, while that will not be as much of an issue for the shift from 4G to 5G. New RF modules will be an area of focus for 5G devices. This session had participants from Qualcomm, Samsung, and Sprint. 5G, MORE USE CASES Focusing beyond MBB, the industry participants mentioned we need to look above and beyond broadband and smartphone devices. Sprint is focused around the mid-band, so 5G smartphones is key to their 5G strategy. Sprint is currently looking at the partnership model for 5G use cases. The foundational use cases are centered around mobility and fixed wireless. Many are in the exploratory stage from an ecosystem perspective and are seeking support from partners, research analysts, advisors, and customers. Carriers will be seeking use cases to better monetize traffic, as current smartphone revenues and the growth trajectory remains fairly stable or flat. Consumer is behind overall, and Enterprise is leading in 5G use cases at this time. Smart cities is an area to explore as well, and CityBrain (by Alibaba) was mentioned as a good use case to explore in terms of true ROI. MY TWO CENTS

Related 5G Research and Reports: 5G Optimization: Mobile Edge Computing and Network Slicing 2018 – 2023 Voice over 5G (Vo5G) Market 5G Security Market: Technologies, Solutions, and Market Outlook 2018 - 2023

As published on csuitepodcast.com

"Produced in partnership with the European PR agency Tyto, in this episode, we Tyto’s Hype Report on the Internet of Things (IoT), hearing from a number of experts who contributed to it. For the main part of the show, Russell Goldsmith spoke to Practical Futurist, Andrew Grill and Abraham Joseph, Founder of IOT insights, plus Stephanie Atkinson, CEO of Compass Intelligence also joined the discussion in the studio via Skype from her offices in San Antonio in Texas. We also hear from two more IoT experts from the US, Dan Yarmoluk, Director of Business Development for IoT and Data Science at ATEK Access Technologies and Rich Rogers, who at the time of recording, was Senior Vice President for IoT Product & Engineering at Hitachi Vantara. Finally, Tyto’s Managing Partner Brendon Craigie explains why he put this report together. To download the full report, go to www.tytopr.com/iot To begin with, Brendon explained that this was the first in a series of reports that Tyto intend to publish, looking at the hottest technology, science and innovation trends. He said that they picked IoT first because it’s one of the top five technology discussions that’s been going on over the past five years. It’s at the top of the Gartner Hype Cycle, with around a quarter of a million articles in 2017 focused on IoT, which is more than double the 100,000 there were in 2015. Brendon added that IoT is very much a rising trend and the objective of Tyto’s reports is to cut beneath the hype to understand what’s really going on to understand the positive success stories as well as some of the barriers and challenges.

Data Collection

Given that making sense of data is a key part of Stephanie’s business, we went to her with the first question on whether we are set up to cope with all of the data that’s about to be thrown at us? Stephanie had written in the report that “connected devices and assets alone are not what is revolutionary but what we can do with the information data and analysis of things that are connected is where we expect progress” and in fact, a lot of the comments made in the report naturally talked about the amount of data that’s being generated, which course is the bedrock of which IoT is built. Also, according to IHS Markit, a global business research analytics provider, there will be more than 31 billion IoT connected devices in 2018 and just looking at the Automotive Industry as one example, Intel had previously put out a stat that said just one autonomous car will create 4000 gigabytes of data a day. Stephanie said that one of the big things that we have to think about is that we can’t be in a position just to collect all of this data and it really not do anything, so that definitely is an issue from a carrier perspective as we have too much data being collected. She added that we have to really think about this systematically – we have to look through each and every component. First of all, how often are we collecting the data, is it monthly, is it weekly, is it hourly, is it ongoing? We also have to think about the priority, is this something that could take down our network? Is this something that could take down our supply chain, our business operations? Will this affect our customers? So those are other things that Stephanie said you have to think about. And the last piece, she said, is, as we start to look through the data, some data might need to be combined with other pieces of information to really bring that level of intelligence to the business and really make it actionable. So, all these things are what’s really driving the data collection piece. But right now there’s a concern in the industry because we can’t be in a position where we’re collecting everything, we have to think about this in a systematic approach." READ MORE Listen to the podcast: http://www.csuitepodcast.com/podcasts/show-71-internet-of-things-2018/ or https://soundcloud.com/thecsuitepodcasts/show-71-internet-of-things-2018 |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed