|

On October 20th, a large group of industry analysts joined 5G Americas staff and members to discuss the state of 5G. Neville Ray of T-Mobile, Chair of 5G Americas, kicked off the event after a warm welcome and a setting of the stage by Chris Pearson (President of 5G Americas). Ray stated we are “In the next phase of 5G networks,” and “5G is finally starting to gain real traction.” A wide range of stats were shared along with some important factoids showing we are moving the needle in the Americas. Participating companies included Airspan, Cisco, Qualcomm, Samsung, T-Mobile, AT&T, Ciena, Mavenir, Nokia, Ericsson,Crown Castle, VMware, and Intel. While the foundational layer in 5G is located in the low band spectrum, mid-band 5G in the United States is now real…..but as all of us know, we need more mid-band spectrum to reach full potential of 5G use cases and applications. Currently, more than 66% of the geographic land mass is covered by 5G, while this same percentage of the population has access to 5G. Having a 5G enabled device is a bit underwhelming, with less than half of the U.S. population having access to a device with a 5G radio. With an investment of more than $100 billion over the last few years, 5G phones and subscriptions reached a total of 140 million, which remains less than half of the North American population. The most significant finding is that 5G is about increased data consumption, as Neville shared we are about 2.5 to 3 times higher data consumption with 5G compared to LTE. When thinking about the networks and advancements being made, we must remember we will rely on 4G/LTE for quite some time even though 5G networks are continuing to be deployed and improved. There are currently 14 total 5G networks running that enable streaming, gaming, social media and communications, and other business or enterprise-based applications. Outside of all of these data-intensive categories, Neville Ray mentioned for the industry to NOT forget about voice….yes, voice is still important for 5G and the advancements are really all around Voice over NR or New Radio (pronounced Vonar, aka Vo5G/Voice over 5G) (Related News: https://techblog.comsoc.org/2022/06/04/t-mobile-launches-voice-over-5g-nr-using-5g-sa-core-network/). 5G Americas noteworthy trends revolve around the following highlighted areas:

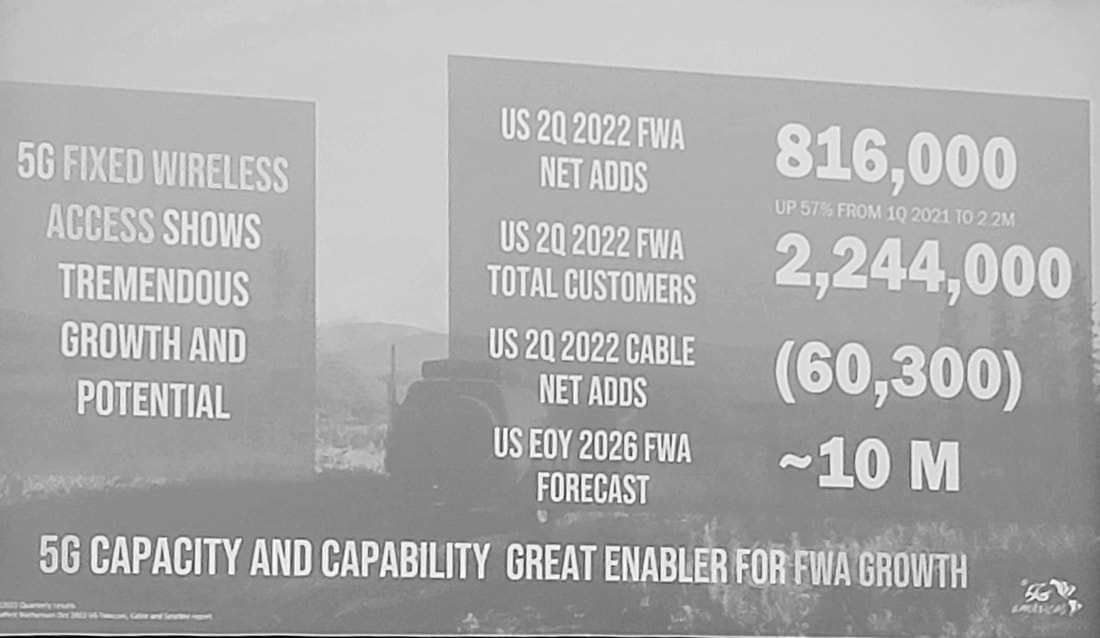

Fixed wireless access or FWA is being seen as an alternative to wired broadband and Wi-Fi (See Wi-Fi6) connectivity for a number of reasons. In many cases, the WISPs leveraged unlicensed spectrum to reach rural communities who lacked quality broadband, but over the past year the conversation has shifted to enterprise interest. Some believe it to be a complement or to augment existing connectivity options (especially cable). While FWA is creating capacity and new capabilities, especially for business use, additional and new spectrum is coming. FWA will continue to remain an available option for businesses in the US and internationally, but will continue to be squeezed by fiber and funding that may benefit fiber build out (Further Reading: WISPs embrace fiber as they face do or die moment). The carriers have been busy when it comes to FWA, especially in terms of their announcements and overall growth. Of course with that comes a bit of a reverse, as the overhype of FWA is now settling. “Verizon Communications…touted the addition of 234,000 fixed wireless access residential customers in the third quarter and another 108,000 FWA subscribers on the business-services side, upping its total FWA base to over 1 million users,” as seen on NextTV. T-Mobile will have their Q3 earnings call tomorrow but as Forbes shared, “T-Mobile has also made a dent in the broadband space, with its fixed wireless broadband offering adding an industry-leading 560,000 new broadband subscribers (last quarter),” while today they have more than 1.5 million FWA subscribers. Ericsson also shared, “UScellular was the first service provider to offer consumers and enterprise Fixed Wireless Access (FWA) services, using 5G extended-range millimeter-wave (mmWave) to target digital divide areas in rural America, reaching coverage of over 5 km.” While the activity for fixed wireless has expanded over the past year, spectrum access and fiber will remain critical factors for continued growth. Below is a slide that was shared at 5G Americas that highlights some of the overall FWA stats (Source: 5G Americas & Their Members). While some of you may be tired of tech acronyms, it is the way we lazy people essentially describe long-winded tech terms. Enter C-V2X or Cellular Vehicle-to-Everything). C-V2X is considered a mid-term opportunity and is expected to open up a range of opportunities driven by low latency, high performance 5G network services. Think about your car becoming your hub or essentially just like any other device. This hub will speak to the road, to traffic lights, to city traffic bodies, to public safety, to you and your passengers, to your auto dealership, to your car manufacturer and even to all your favorite content providers. In addition, these hubs will speak to each other building a network of communications across many sources. A range of entertainment, safety, location and routing, and interactive services will be launched and made available to drivers and passengers as a result. Your car needs reliable, high-speed wireless connectivity and 5G gets us there. We are in the earlier stages, but we do expect ongoing announcements well into 2023 to directly address the opportunities of 5G in C-V2X.

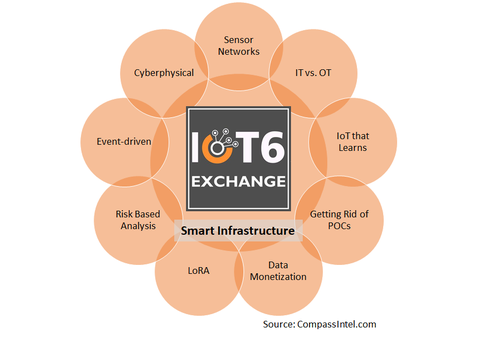

Network slicing is a near term focus across low, mid, and high-band spectrum. Enterprise and consumer applications focused on improved throughput, low latency, and other requirements see network slicing as a way to “carve out dimensional experiences,” shared Neville Ray. While we are in the early game of network slicing, we have yet to truly understand all the potential advantages and improvements that may come as we purpose-build the network. Aside from the key trends, and even more important, are the actual use cases for 5G. While the Analyst Forum had a strong emphasis on 5G for consumer and the growth in experiences there, I believe the true opportunity will lie with the enterprise and government sectors. Consumer 5G revolves around things like wearables, gaming, social communications, metaverse (not my favorite word), shopping, navigation, health/wellness, and sports. On the enterprise side, 5G presents new connectivity options for mass IoT and autonomous transportation, especially in use cases where the assets (fleets, products, equipment, people, machines, etc.) are mobile or meaning they are moving. These assets need to be monitored, measured, tracked, repaired, and acted upon for a variety of purposes and for reasons specific to the industry. Some of the vertical markets or industries where 5G opportunities exist include manufacturing, utilities, transportation, remote health care, digital cities, and education. For factories or logistics applications for example, mmWave is being used to enhance connectivity performance in robotics, as well as being used for sensing in agriculture or for farming applications. While 5G has been met with a sense of excitement and overall hype, we remain in the stage of improving overall network performance and build-out to meet enterprise and new customer experience expectations. There will always be hesitation for 5G adoption as a replacement to fiber, but for now we should think about applications where 5G is the only solution or where 5G will augment connectivity to provide better performance for things like robotics, transportation, supply chain monitoring, customer/digital experiences, etc. Lastly, the industry will continue to seek out additional mid-band spectrum as is needed to scale and to reach performance expectations. Special thank you to the 5G Americas team for hosting all of us analysts and for putting together great content. Contact Stephanie directly to learn more about other panel sessions and content that was shared at the event. Recommendations for further reading and research: Open RAN, Spectrum Policy and FCC Activities, mmWave, RedCap (Reduced Capacity) New Radio, Dynamic Spectrum Sharing, Unlicensed Spectrum. Please visit 5G Americas to learn more and to get access to their whitepapers and studies. To get access to further wireless research including 5G, please visit our WIRELESS RESEARCH store. Written by Stephanie Atkinson Adopting innovative and smart infrastructure will enable businesses and government to enhance asset, infrastructure, and building performance. These physical structures are transforming into intelligence, cognitive, and predictive assets through existing and emerging technologies including Internet of Things, machine-to-machine communications, artificial intelligence, virtual reality, robotics, and deep learning. This spring’s, “Advancing Smart Infrastructure and IoT” IoT6 Exchange Summit brought together thought leaders, executives, advisory board members, and vendors to explore, learn, exchange best-in-class ideas, technology, solutions, and solve real issues around smart infrastructure. From retrofitting legacy assets and infrastructure to building smart and intelligence infrastructure from the ground up, this event presented hard hitting and actionable best-in-class learnings, and brought smart infrastructure ideas, projects, and use cases to life. The event enlightened our attendees by capturing all the technology and innovation elements as the industry transition from unintelligent, static physical structures and assets to intelligence, learning, and digital structures and assets. DOWNLOAD THE FULL SUMMARY HERE.

|

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed