|

In today’s connected world, seamless and reliable indoor cellular coverage is a necessity. As technology advances and the industry transitions from 4G to 5G, enterprises and cities face challenges in providing consistent and ubiquitous connectivity. In partnership with industry analyst, Stephanie Atkinson, of Compass Intelligence, we dive deep into these challenges and explore solutions to ensure reliable, secure, end-to-end connectivity for businesses and communities in my latest position paper: “Industry Insights: Streamlining Indoor Connectivity.”

Read report: https://denseair.net/news How crazy is it that traditional broadband providers are seeing record growth in adding wireless subscribers (MVNO services), while carriers are seeing record growth in broadband subscriber adds (FWA or fixed wireless access aka 5G Home Internet or 5G Business Internet)? Should cable broadband operators work up a reseller agreement and sell fixed wireless access as an MVNO?

The industry is clearly showcasing the stronger trust, energy, and value proposition of wireless overall. We are finally seeing the reach of wireless overtake traditional fiber and wireline GROWTH as the industry matures and 5G delivers connectivity options across business and consumer. Fixed wireless access (FWA) is currently seeing a bit of a battle between Verizon and T-Mobile, while AT&T places its bet on fiber after pulling away from a fixed wireless strategy from 2021. FWA is not new and certainly been around for a while as WISPs (Wireless Internet Service Providers) have been serving rural America with these services for quite some time. Fixed wireless access or FWA in the most simplest terms provides consumers and business with an alternative or complete replacement to traditional broadband services (DSL, Cable, Fiber, T-1s, etc.). Customers can essentially be up and running with a hardware installation at the home or office (radio/receiver, antenna, cat 5 wiring, and connectivity to your WiFi router, etc.). Of course getting access from a WISP versus a carrier will have differing installations based on the nature of point-to-point and multi-directional access. The service essentially provides broadband over the wireless network or over wireless radios that communicate to the base stations or towers. As microcell, small cell, and mmWave technologies improve and enhance, we will see improved hardware and installation strategies impact overall revenue for the carriers and WISPs offering fixed wireless services. FWA can be seen as an alternative to wired broadband, but today we are seeing both consumers and businesses look to FWA as a complete replacement to their broadband services (T-Mobile shares in a recent report that their customers are replacing cable). While WISPs generally target rural and remote areas where fiber, cable and DSL is not an option, Verizon and T-Mobile for example are targeting cities and suburban areas, as well as the SMB market. In addition to looking at FWA as a alternative or replacement, customers are also evaluating and implementing fixed wireless to complement or provide additional connectivity options (failover) for their homes or business locations. From a branding perspective you may see the services being called 5G Home Internet or something similar. Outside of Verizon and T-Mobile, US Cellular also provides the service to its customers along with many WISPs. While FWA has traditionally been sold to homes and rural areas, today carriers are targeting businesses more than they have in the past, and the SMB sector is a primary target. There is an estimated 500K total business FWA subscribers today, with an expectation to grow to over a million very quickly as both Verizon and T-Mobile are adding 100s of thousands business customers each quarter. According to Ericsson's most recent Mobility Report, the global FWA market is expected to reach 300 million by 2028 and be driven my international markets, and more specifically India. They claim we will reach roughly 100 million FWA connections globally by the end of this year. As for the carriers, CompassIntel shares a summary of the key happenings for the top FWA carriers. T-Mobile is currently winning the race and has done a very good job at releasing new FWA business offerings that will provide them with continued runway as they have a very strong customer base of SMBs, who we believe will be more likely to replace their broadband service. T-Mobile – T-Mobile states they have more than 2M FWA customers, with a goal of 7-8 million FWA customers by 2025. Their most recent quarter net adds totaled 578K and they have experienced continued quarter to quarter growth in 2022. T-Mobile targets both consumers and businesses and recently announced their T-Mobile Business Internet services offering both primary and failover Internet packages. The packages range from unlimited to those based on data ranging from 10GB to 300GB. Their business strategy revolves around a focus on cyclical or temporary businesses, point of sale operations, pop up shops, and hybrid workforces. They will continue to leverage mmWave capacity for enhancements to its coverage and reach. Verizon - Verizon offers FWA to both consumers and businesses and their business services aka '5G Business Internet' is available at 2 million locations today, and is scaling to 14-25M locations by 2025. Fierce Wireless states that "Verizon’s 5G FWA service is available to about 30 million homes." Today Verizon shares they serve 1.06M FWA customers and have a target of 4 million to 5 million by the end of 2025. Their most recent quarter experienced additions of 342K net adds in Q3 with an estimated 32% of those adds going to business customers or subscribers. Offerings start at 300Mbps and go to 1-gig while they leverage both millimeter wave (mmWave) spectrum and C-Band mid-band spectrum for their coverage. AT&T – AT&T shifted their focus away from FWA from 2021 to focus more on their overall fiber buildout and strategy. Compass Intelligence estimates AT&T serves an estimated 700K FWA subscribers today. UScellular – US Cellular currently serves around 57K FWA subscribers on 4G, and is focusing on the expansion of 5G FWA over mmWave spectrum in 10 cities. They claim to have 23% annual growth for their FWA services from 2021 to 2022. To wrap up, pay attention to the advancements in mmWave and small cell equipment and radio hardware solutions. These advancements will help further improve capacity, installation efficiencies, and better serve business quality broadband services that are needed to help close the digital divide and improve connectivity across the globe. On October 20th, a large group of industry analysts joined 5G Americas staff and members to discuss the state of 5G. Neville Ray of T-Mobile, Chair of 5G Americas, kicked off the event after a warm welcome and a setting of the stage by Chris Pearson (President of 5G Americas). Ray stated we are “In the next phase of 5G networks,” and “5G is finally starting to gain real traction.” A wide range of stats were shared along with some important factoids showing we are moving the needle in the Americas. Participating companies included Airspan, Cisco, Qualcomm, Samsung, T-Mobile, AT&T, Ciena, Mavenir, Nokia, Ericsson,Crown Castle, VMware, and Intel. While the foundational layer in 5G is located in the low band spectrum, mid-band 5G in the United States is now real…..but as all of us know, we need more mid-band spectrum to reach full potential of 5G use cases and applications. Currently, more than 66% of the geographic land mass is covered by 5G, while this same percentage of the population has access to 5G. Having a 5G enabled device is a bit underwhelming, with less than half of the U.S. population having access to a device with a 5G radio. With an investment of more than $100 billion over the last few years, 5G phones and subscriptions reached a total of 140 million, which remains less than half of the North American population. The most significant finding is that 5G is about increased data consumption, as Neville shared we are about 2.5 to 3 times higher data consumption with 5G compared to LTE. When thinking about the networks and advancements being made, we must remember we will rely on 4G/LTE for quite some time even though 5G networks are continuing to be deployed and improved. There are currently 14 total 5G networks running that enable streaming, gaming, social media and communications, and other business or enterprise-based applications. Outside of all of these data-intensive categories, Neville Ray mentioned for the industry to NOT forget about voice….yes, voice is still important for 5G and the advancements are really all around Voice over NR or New Radio (pronounced Vonar, aka Vo5G/Voice over 5G) (Related News: https://techblog.comsoc.org/2022/06/04/t-mobile-launches-voice-over-5g-nr-using-5g-sa-core-network/). 5G Americas noteworthy trends revolve around the following highlighted areas:

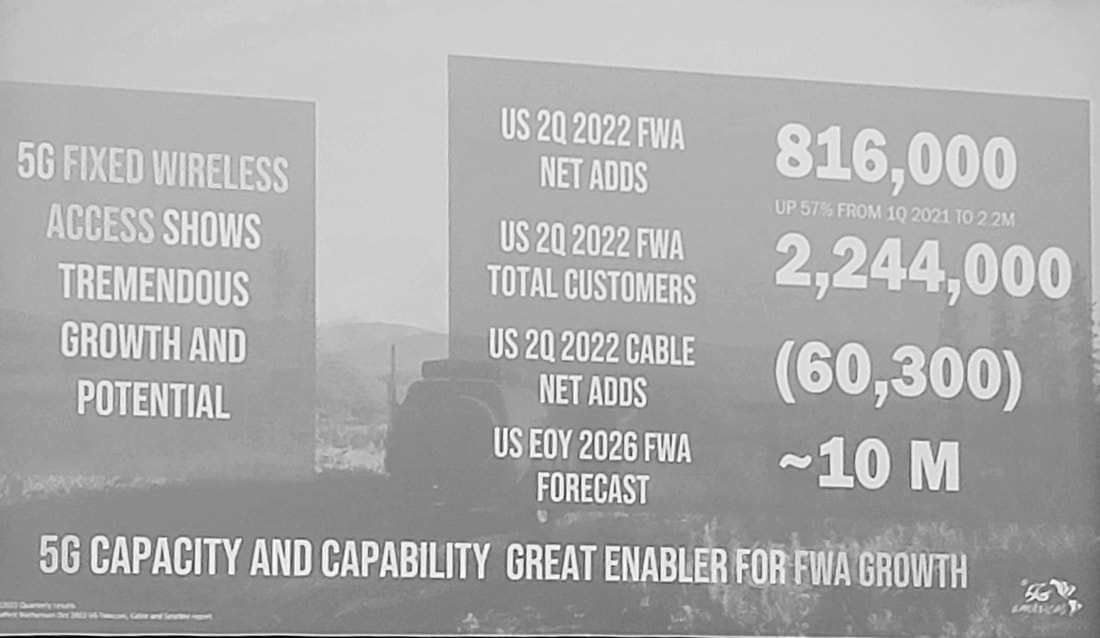

Fixed wireless access or FWA is being seen as an alternative to wired broadband and Wi-Fi (See Wi-Fi6) connectivity for a number of reasons. In many cases, the WISPs leveraged unlicensed spectrum to reach rural communities who lacked quality broadband, but over the past year the conversation has shifted to enterprise interest. Some believe it to be a complement or to augment existing connectivity options (especially cable). While FWA is creating capacity and new capabilities, especially for business use, additional and new spectrum is coming. FWA will continue to remain an available option for businesses in the US and internationally, but will continue to be squeezed by fiber and funding that may benefit fiber build out (Further Reading: WISPs embrace fiber as they face do or die moment). The carriers have been busy when it comes to FWA, especially in terms of their announcements and overall growth. Of course with that comes a bit of a reverse, as the overhype of FWA is now settling. “Verizon Communications…touted the addition of 234,000 fixed wireless access residential customers in the third quarter and another 108,000 FWA subscribers on the business-services side, upping its total FWA base to over 1 million users,” as seen on NextTV. T-Mobile will have their Q3 earnings call tomorrow but as Forbes shared, “T-Mobile has also made a dent in the broadband space, with its fixed wireless broadband offering adding an industry-leading 560,000 new broadband subscribers (last quarter),” while today they have more than 1.5 million FWA subscribers. Ericsson also shared, “UScellular was the first service provider to offer consumers and enterprise Fixed Wireless Access (FWA) services, using 5G extended-range millimeter-wave (mmWave) to target digital divide areas in rural America, reaching coverage of over 5 km.” While the activity for fixed wireless has expanded over the past year, spectrum access and fiber will remain critical factors for continued growth. Below is a slide that was shared at 5G Americas that highlights some of the overall FWA stats (Source: 5G Americas & Their Members). While some of you may be tired of tech acronyms, it is the way we lazy people essentially describe long-winded tech terms. Enter C-V2X or Cellular Vehicle-to-Everything). C-V2X is considered a mid-term opportunity and is expected to open up a range of opportunities driven by low latency, high performance 5G network services. Think about your car becoming your hub or essentially just like any other device. This hub will speak to the road, to traffic lights, to city traffic bodies, to public safety, to you and your passengers, to your auto dealership, to your car manufacturer and even to all your favorite content providers. In addition, these hubs will speak to each other building a network of communications across many sources. A range of entertainment, safety, location and routing, and interactive services will be launched and made available to drivers and passengers as a result. Your car needs reliable, high-speed wireless connectivity and 5G gets us there. We are in the earlier stages, but we do expect ongoing announcements well into 2023 to directly address the opportunities of 5G in C-V2X.

Network slicing is a near term focus across low, mid, and high-band spectrum. Enterprise and consumer applications focused on improved throughput, low latency, and other requirements see network slicing as a way to “carve out dimensional experiences,” shared Neville Ray. While we are in the early game of network slicing, we have yet to truly understand all the potential advantages and improvements that may come as we purpose-build the network. Aside from the key trends, and even more important, are the actual use cases for 5G. While the Analyst Forum had a strong emphasis on 5G for consumer and the growth in experiences there, I believe the true opportunity will lie with the enterprise and government sectors. Consumer 5G revolves around things like wearables, gaming, social communications, metaverse (not my favorite word), shopping, navigation, health/wellness, and sports. On the enterprise side, 5G presents new connectivity options for mass IoT and autonomous transportation, especially in use cases where the assets (fleets, products, equipment, people, machines, etc.) are mobile or meaning they are moving. These assets need to be monitored, measured, tracked, repaired, and acted upon for a variety of purposes and for reasons specific to the industry. Some of the vertical markets or industries where 5G opportunities exist include manufacturing, utilities, transportation, remote health care, digital cities, and education. For factories or logistics applications for example, mmWave is being used to enhance connectivity performance in robotics, as well as being used for sensing in agriculture or for farming applications. While 5G has been met with a sense of excitement and overall hype, we remain in the stage of improving overall network performance and build-out to meet enterprise and new customer experience expectations. There will always be hesitation for 5G adoption as a replacement to fiber, but for now we should think about applications where 5G is the only solution or where 5G will augment connectivity to provide better performance for things like robotics, transportation, supply chain monitoring, customer/digital experiences, etc. Lastly, the industry will continue to seek out additional mid-band spectrum as is needed to scale and to reach performance expectations. Special thank you to the 5G Americas team for hosting all of us analysts and for putting together great content. Contact Stephanie directly to learn more about other panel sessions and content that was shared at the event. Recommendations for further reading and research: Open RAN, Spectrum Policy and FCC Activities, mmWave, RedCap (Reduced Capacity) New Radio, Dynamic Spectrum Sharing, Unlicensed Spectrum. Please visit 5G Americas to learn more and to get access to their whitepapers and studies. To get access to further wireless research including 5G, please visit our WIRELESS RESEARCH store. Written by Stephanie Atkinson How Qualcomm is Advancing AI and Internet of Things to Prepare Tomorrow’s Businesses and Cities9/20/2022

In early July, I was honored to have a chat with Megha Daga, Senior Director of Product Management and AI/ML lead for the Internet of Things (IoT) at Qualcomm Technologies, Inc. . As a critical player in AI enablement across the IoT group at Qualcomm, Megha has been crucial in the development of cutting-edge AI solutions used around the world.

We dove right into what Qualcomm has been up to as it continues to advance IoT through the different core offerings, partnerships, and cutting-edge solutions that Qualcomm offers. To set the tone of our conversation, we discussed Edge AI. Edge AI is essentially intelligence moving to the data generator, according to Megha. Along with getting data faster, a host of other factors impact Edge AI, including privacy, cost, latency, reliability, and bandwidth. For businesses or enterprises, the simplicity of the technology revolves around business intelligence occurring on the device or close to the device itself to enable IoT. Qualcomm provides a portfolio of hardware technology, but even more exciting is their advancements in software design and embedded processing innovation. The company understands how heterogenous computing makes AI possible and is pushing the envelope to remain competitive in AI and IoT. Some of the stronger vertical markets and industries that Qualcomm is targeting include retail, logistics, energy, utilities, industrial, and robotics. To further advance into AI, Qualcomm launched the Vision AI Development Kit. This Azure IoT Starter kit is a vision AI developer kit for running artificial intelligence models on devices at the intelligent edge. With Edge AI, data is generated and pushed to the cloud. Legacy devices such as retail payment terminals and other industry specific devices are being digitized and modernized. Hardware or devices can be connected to a box, i.e., edge gateway. Megha shared that Qualcomm is taking metadata and compute to the box, implementing further compute as needed, then sending only the required data back to the cloud. The traditionally “dumb” environment is becoming more intelligent and bringing efficiencies to businesses and operations. Another Qualcomm AI example outside of retail is in logistics, more specifically warehouse operations. Robotics and drones may be used for picking and dropping, reducing overall payloads, and therefore reducing costs. Edge AI and IoT are coming together to minimize compute to the cloud, as the overall costs of sending massive data to the cloud is becoming more cost prohibitive, and a concern for larger enterprises. The issues of privacy, latency, and connectivity again remain important factors. Privacy not only affects consumers, it also impacts businesses and their customers’ experiences. As for latency, think of delivery robots on the street, providing sub-millisecond intelligence and information to enable operations and efficiency so consumers can get food, packages, products delivered (similar to same day delivery). Regarding connectivity, especially for operations in remote locations (construction, agriculture), having on-device or near device data intelligence can be critical. Examples Megha mentioned included drones connected to a gateway to enable crop intelligence, construction management, and mining operations. Qualcomm’s portfolio continues to evolve to support AI and Edge AI, with a stronger focus on software. Their hardware and chipsets will continue to be their foundation, as they grow their partnerships with Original Equipment Manufacturers (OEMs). Qualcomm is leading in the areas of enabling AI on traditional CPUs/DPUs or AI on SDKs. Another cutting-edge development includes AI on embedded processing (low power, high performance). According to Megha, a few exciting AI areas that Qualcomm has been innovating around includes drone robots, and camera technology. Taking regular cameras for example and making them intelligent, using technologies such as machine vision and AI running on heterogenous computing to completely disrupt its capabilities. Megha shared that Qualcomm is using hardware accelerators for neural network workloads. Furthermore, AMR devices (autonomous mobile robots, i.e., Bosch devices) is an area where Qualcomm is developing chipsets and reference designs to further advance delivery. For example, they recently launched the RB6, a high-end chipset with an accelerator card allowing the robot to greatly improve throughput (i.e., delivery robots). As far as software goes, Qualcomm is investing and innovating to provide seamless software across the Qualcomm AI stack. Qualcomm is providing unification for developer building and changes, using Qualcomm Intelligence multimedia SDKs providing authentication and simplification for development and deployment, across multiple verticals. Developers and software tools remain a top priority for Qualcomm. Qualcomm realizes the end-customer (businesses and government) require and need end-to-end solutions and thus continues to build out its IoT partner portfolio (vendors, integrators, industry focused providers) focused on software/applications, platforms, and other solutions I’ll end with a great use case example shared by Megha. The Qualcomm AI Engine runs ML models in IoT devices, such as a security camera that recognizes a family member and activates a smart lock to allow entry. Or an office building that allows employees onto an elevator based on a touchpad. This context showcases the importance of how Qualcomm is advancing AI and IoT to prepare tomorrow’s businesses and cities. For more reading, please check out, “Qualcomm Advances Development of Smarter and Safer Autonomous Robots for Logistics, Industry 4.0, and Urban Aerial Mobility with Next-Generation 5G and AI Robotics Solutions” Written by Stephanie Atkinson, CEO of Compass Intelligence A week ago, I sat down virtually with Brandon Branham, Chief Technology Officer and Assistant City Manager of Peachtree Corners (PTC, one of the first cities in the United States powered by real-world smart city infrastructure, which also features ‘Curiosity Lab at Peachtree Corners’) to get an update on all of the progress being made in making the city smarter, more interactive, and inviting to technology innovators around the globe. Peachtree Corners launched an innovative living smart city lab about 1 year back that leverages autonomous technology, IoT, AI, machine learning, edge computing, virtual reality, and other advanced technologies to advance city operations, mobility, and introduce economic development. Some of the more interesting key facts about PTC include the following:

The innovation being embraced at PTC comes with the value it is placing in partnerships, leading technology company initiatives, and the live testing environment it provides to tech companies, OEMs, and startups around the globe. They currently have roughly 10 vendors with 15 different device types generating data across their network across around 15 or so different software systems. On the embracing of global companies, it is also working with a Tel Aviv company called IPgallery, that brings together city insights and intelligence using a real-time AI data platform that provides visualization (visual map) across PTC to monitor, analyze and secure all IoT devices across the ecosystem, buses, cameras, applications, etc. In addition, traffic flow and pattern data are being collected to adjust and make real-time rerouting decisions to improve public transportation.

PTC recently announced a partnership with Bosch, where they are implementing a sensor connected intersection and intelligent traffic management system to capture video including vehicle identification, vehicle recognition of objects (car, bus, scooters with drivers or without, pedestrians, etc. using machine vision). This partnership will allow real-time adjustments to traffic signaling, share the flow of traffic activity, and identify the type of vehicle in that flow for improved traffic management. PTC's Curiosity Lab will allow for a living city environment for Bosch to leverage its leading edge solution within a live, real municipality. A few other projects on the horizon include the following:

All of these activities would not be anywhere without the public-private partnerships (3Ps) in place. PTC has a process to test in their live environment, receive funding from 3rd parties or commercial entities (for some projects), decide on whether the project is scalable, and then the city decides and will invest as needed. This is a prime example of how business and government can and should work together to advance the smart city vision. On a final note, below is a list of key differentiators that enable PTC be the groundbreaking innovator in smart city solutions:

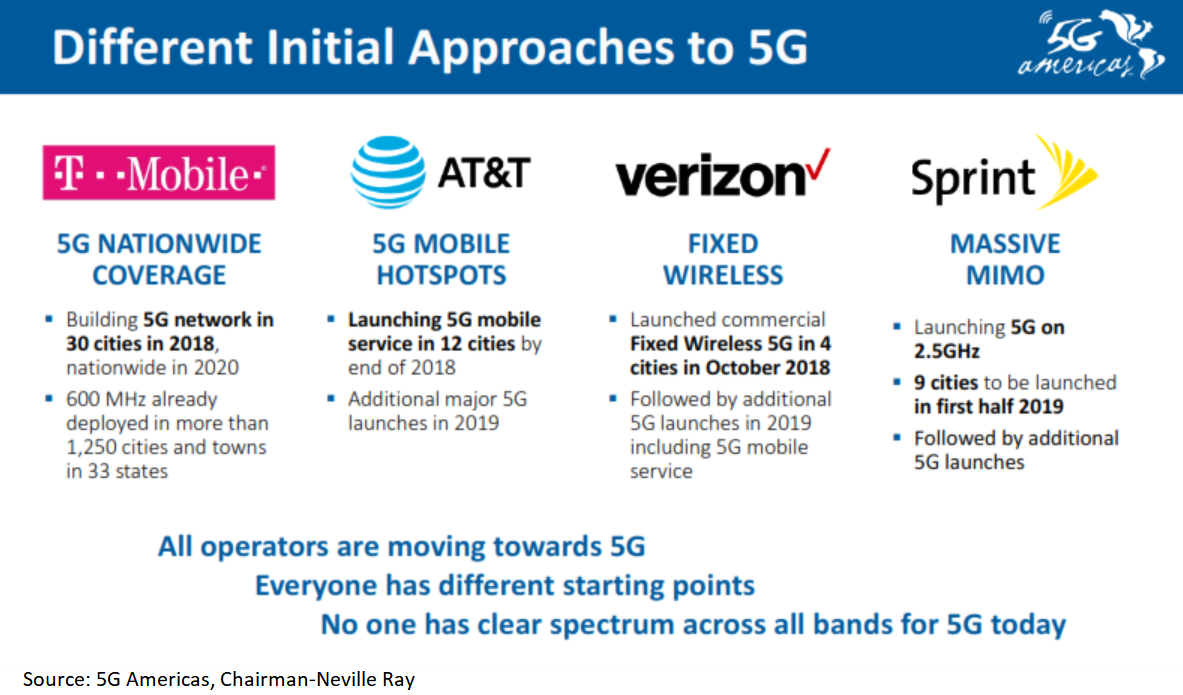

Platform U.S. wireless carriers have made significant strides in rolling out 5G services across major cities, but all are on different paces using varying spectrum strategies to reach both consumers and business end-users. According to a recent article on SDxCentral, "Earlier this month, T-Mobile US leapfrogged all of its competitors with a nationwide 5G network running on 600 MHz spectrum. The operator’s low-band 5G network covers about 200 million people, or about 61% of the total population, spanning a geographic range of more than 1 million square miles." They also share that AT&T will reach part of 30 cities by early 2020 with AT&T confusing some in the industry by using the term “5G E” brand in select cities, while using “5G” brand for 5G running over low-band spectrum, and “5G+” for those running on mmWave spectrum. Verizon recently announced reaching 30 cities and 14 NFL stadiums by the end of this year. Lastly, Sprint started out 2019 with a strong leading roll-out of 5G but is expected to end the year covering roughly 11 million people. Also, U.S. Cellular shares it will launch 5G service in Q1 of 2020.

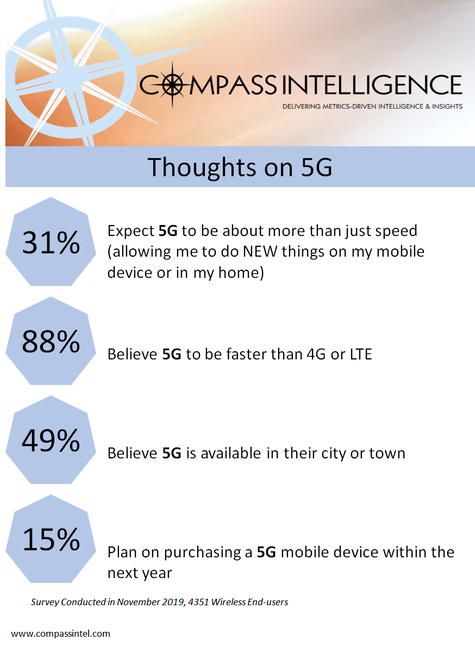

Meanwhile, a recent survey conducted by Compass Intelligence shows roughly 49% of those 4K+ wireless end-users surveyed across the U.S. believe 5G is available within their city or town, with 15% planning on purchasing a 5G enabled smartphones or devices in 2020. As consumers plan upgrades, phone replacements, and trade-ins on their smartphones, it only makes sense to make sure your device is 5G ready or enabled. Most wireless end-users, 88% of the 4,351 surveyed, believe 5G will be faster than 4G or LTE, with 31% believing 5G will be much more than just a faster or speed upgrade when compared to 4G or LTE services. Wireless carriers have not really been effective at communicating what these other advantages are to consumers at this stage, as most of the marketing and communication has been about the coming advantages to business solutions yet consumers will see brand new customer experiences with 5G like they have not seen in the past. As for now, experiences within venues like airports, stadiums and event venues, shopping/retail, and engaging within a city has the potential to offer brand new real-time and personalized experiences. Many ideas have been shared at a high-level, but think about seamless buying and shopping catered to your needs and wants with better location, routing, checkout, and service. Within a city, interacting with public transportation or city services may be enhanced as 5G brings speeds that better leverage video, virtual reality (think 3D virtual city tours or interactive Uber ride experiences), and immersive experiences. Stay tuned next week to the latest in plans to switch carriers ...survey research rocks! This holiday season and the heightened economy has given rise to purchasing and this holiday season saw a spike in spending overall. According to recent tracking, "Retailers have much to cheer about this holiday season. According to Mastercard SpendingPulseTM, holiday retail sales increased 3.4 percent (ex auto) with online sales growing 18.8 percent compared to 2018." Online purchasing of electronic devices have also seen promising results including Black Friday, Cyber Monday, and overall Christmas shopping. Consumers are spending and this provided opportunities for those selling smartphones, tablets, and computing devices.

Compass Intelligence recently completed a survey with over four-thousand wireless end-users (4,351) and dove into a number of topics including planned purchases, perceptions of 5G, current ownership of devices, payment structures, and other related wireless services including insurance, prepaid, and leasing. This survey highlight included a snapshot of plans to purchase for smartphones, tablets, and computing devices. As shown, below is a roundup of purchasing plans for the next 3 to 4 months:

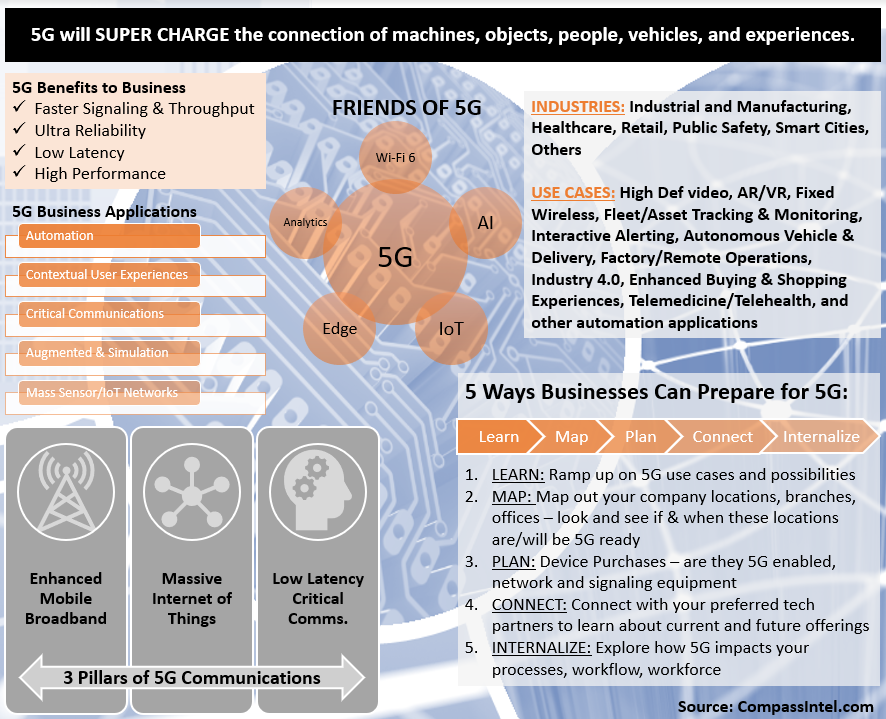

Note: Online survey conducted in late November 2019 with 4,351 (18 and older) wireless end-users in the United States. There are two notable driving forces expected to bring significant change to the tech industry. First, we are at the emergence of 5G realization as networks are being upgraded and new devices enter into the market. Secondly, edge computing is taking over the past discussions of the cloud as the answer to bring analytics and insights in a real-time and automated manner. Let's skip the mechanics and deep tech discussion. Below are some basic thoughts around these two areas and why they are important to the future of work, smart cities, consumer entertainment, and much more. View the related 5G in Business Infographic below, podcast coming soon! CLICK TO DOWNLOAD NOW The Basics of 5G

As 5G networks are being launched in select cities, the industry is embracing new changes compared to 4G/LTE speeds. 5G brings the dawn of a new era where we connect machines, objects, people, cars, and more. The 5G infrastructure market brings new opportunities and potential applications that we have yet to unveil, and the industry is bracing for speeds that bring mass IoT to fruition, low latency critical communications that is ultra-reliable, and enhanced mobile broadband. Fixed wireless also becomes more of a reality across the nation, as 5G brings speeds that are expected to directly compete with cable and other high-speed Internet services. At this stage we are at the cusp of exploring new use cases, hard-hitting applications, and new device roll-out (smartphones launching middle of 2019 and some hotspot devices). Even more important is what this means to businesses, consumers, and even government customers. Businesses are expected to leverage 5G for industrial and supply chain automation, connected vehicle enhancements, massive 5G IoT enabled sensor networks and systems, and much more. Consumers will experience new entertainment experiences on their phones, cars, and in the home that bring speeds we have yet to experience, and content that bring new levels of entertainment. Governments will leverage 5G for critical communications, smart city applications, and new city services. The opportunities are endless and the market is prime to engage, learn, and explore what 5G brings to the world. The Basics of The Edge Edge computing is an explosive topic for the tech industry, as we push intelligence to network end-points and devices as opposed to pushing data to the core/centralized cloud or to a remote server/datacenter. Chipset technologies have advanced where data analytics and decisions are being made at the equipment or device for critical decision making, business process improvement, and important action enablement. Edge computing combined with Internet of Things, brings simplification and new possibilities for immediate and real-time decision making for things like fleet management, asset tracking, supply chain management, advance manufacturing, building management, and improvements to smart cities. Additional technologies such as artificial intelligence (AI) and machine learning solutions elevate automatic decision-making and are further executed to bring automation to new levels for businesses and government. Edge computing coupled with the convergence of AI and IoT (AIoT) will lead to “thinking” networks and systems that are becoming increasingly more capable of solving a wide range of problems across a diverse number of industry verticals. Additional benefits anticipated include creation of new customer experiences and improved consumer applications such as within the entertainment industry. RELATED RESEARCH: 5G Research Reports Edge Computing Research Reports  By Stephanie Atkinson, CEO CompassIntel/Chair IoT6 www.5gamericas.org | @5GAmericas Last week was the annual 5G Americas annual Analyst Forum held in Dallas, Texas. The event was kicked off by the Chairman and CTO of T-Mobile US, Neville Ray (@NevilleRay). Just a few highlights to start off with regarding Neville's keynote, which clearly showcased the global and nationwide competitive angle 5G is being championed for and towards (also heard at MWCA in LA).

ARTIFICIAL INTELLIGENCE AND 5G

One of the first sessions I sat in on was focused around the impact of Artificial Intelligence (AI) to 5G and future growth in IoT. Ericsson is utilizing AI tools and software to improve their radio access network (RAN) specific to configuration and optimization, while Samsung mentioned heavily investing (see Softbank news on AI investments) in AI at the cloud level to support in new customer experiences (cX) and improve video content services (noted example of having video content follow users). Cisco's perspective was a bit different as they are looking at AI to support in new learning algorithms (inference and information theory) around operations, as well as using AI tools and software for social impact initiatives. Lastly, Sprint mentioned leveraging AI to improve data quality, enhance machine learning tools, generating automatic code, and simplifying for categorization (think automated text categorization, read more here). Sprint also mentioned there may be a challenge with the human input and training is an issue. 5G AND ENTERPRISE IoT On the low band, 5G is expected to support in scaling massive IoT, specific to low latency connected and sensor solutions, specific to industrial, infrastructure, operations, and even smart cities. The use cases revolve around asset tracking and monitoring, fleet tracking and monitoring, some transportation and container tracking, and applications specific to agriculture, factory automation/manufacturing (mass production), and others. DEVICE ECOSYSTEM Enhanced Mobile Broadband (eMBB) has been a focus for companies like AT&T, as they made announcements this year. As shown earlier, the carriers all have different approaches to device roll-out, yet 5G smartphones is not expected until mid-2019. On another note, there are some upcoming changes to 5G devices and antenna placement. Devices may have 3 to 4 mmWave antennas as part of 5G enhancements, and this will help to manage hand cover up issues from a user experience perspective. Qualcomm mentioned that some devices still have 2G, and that the OEMs they work with are choosing what bands to include in the devices. The 3G to 4G shift was more concentrated around power management, while that will not be as much of an issue for the shift from 4G to 5G. New RF modules will be an area of focus for 5G devices. This session had participants from Qualcomm, Samsung, and Sprint. 5G, MORE USE CASES Focusing beyond MBB, the industry participants mentioned we need to look above and beyond broadband and smartphone devices. Sprint is focused around the mid-band, so 5G smartphones is key to their 5G strategy. Sprint is currently looking at the partnership model for 5G use cases. The foundational use cases are centered around mobility and fixed wireless. Many are in the exploratory stage from an ecosystem perspective and are seeking support from partners, research analysts, advisors, and customers. Carriers will be seeking use cases to better monetize traffic, as current smartphone revenues and the growth trajectory remains fairly stable or flat. Consumer is behind overall, and Enterprise is leading in 5G use cases at this time. Smart cities is an area to explore as well, and CityBrain (by Alibaba) was mentioned as a good use case to explore in terms of true ROI. MY TWO CENTS

Related 5G Research and Reports: 5G Optimization: Mobile Edge Computing and Network Slicing 2018 – 2023 Voice over 5G (Vo5G) Market 5G Security Market: Technologies, Solutions, and Market Outlook 2018 - 2023 |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed