|

How crazy is it that traditional broadband providers are seeing record growth in adding wireless subscribers (MVNO services), while carriers are seeing record growth in broadband subscriber adds (FWA or fixed wireless access aka 5G Home Internet or 5G Business Internet)? Should cable broadband operators work up a reseller agreement and sell fixed wireless access as an MVNO?

The industry is clearly showcasing the stronger trust, energy, and value proposition of wireless overall. We are finally seeing the reach of wireless overtake traditional fiber and wireline GROWTH as the industry matures and 5G delivers connectivity options across business and consumer. Fixed wireless access (FWA) is currently seeing a bit of a battle between Verizon and T-Mobile, while AT&T places its bet on fiber after pulling away from a fixed wireless strategy from 2021. FWA is not new and certainly been around for a while as WISPs (Wireless Internet Service Providers) have been serving rural America with these services for quite some time. Fixed wireless access or FWA in the most simplest terms provides consumers and business with an alternative or complete replacement to traditional broadband services (DSL, Cable, Fiber, T-1s, etc.). Customers can essentially be up and running with a hardware installation at the home or office (radio/receiver, antenna, cat 5 wiring, and connectivity to your WiFi router, etc.). Of course getting access from a WISP versus a carrier will have differing installations based on the nature of point-to-point and multi-directional access. The service essentially provides broadband over the wireless network or over wireless radios that communicate to the base stations or towers. As microcell, small cell, and mmWave technologies improve and enhance, we will see improved hardware and installation strategies impact overall revenue for the carriers and WISPs offering fixed wireless services. FWA can be seen as an alternative to wired broadband, but today we are seeing both consumers and businesses look to FWA as a complete replacement to their broadband services (T-Mobile shares in a recent report that their customers are replacing cable). While WISPs generally target rural and remote areas where fiber, cable and DSL is not an option, Verizon and T-Mobile for example are targeting cities and suburban areas, as well as the SMB market. In addition to looking at FWA as a alternative or replacement, customers are also evaluating and implementing fixed wireless to complement or provide additional connectivity options (failover) for their homes or business locations. From a branding perspective you may see the services being called 5G Home Internet or something similar. Outside of Verizon and T-Mobile, US Cellular also provides the service to its customers along with many WISPs. While FWA has traditionally been sold to homes and rural areas, today carriers are targeting businesses more than they have in the past, and the SMB sector is a primary target. There is an estimated 500K total business FWA subscribers today, with an expectation to grow to over a million very quickly as both Verizon and T-Mobile are adding 100s of thousands business customers each quarter. According to Ericsson's most recent Mobility Report, the global FWA market is expected to reach 300 million by 2028 and be driven my international markets, and more specifically India. They claim we will reach roughly 100 million FWA connections globally by the end of this year. As for the carriers, CompassIntel shares a summary of the key happenings for the top FWA carriers. T-Mobile is currently winning the race and has done a very good job at releasing new FWA business offerings that will provide them with continued runway as they have a very strong customer base of SMBs, who we believe will be more likely to replace their broadband service. T-Mobile – T-Mobile states they have more than 2M FWA customers, with a goal of 7-8 million FWA customers by 2025. Their most recent quarter net adds totaled 578K and they have experienced continued quarter to quarter growth in 2022. T-Mobile targets both consumers and businesses and recently announced their T-Mobile Business Internet services offering both primary and failover Internet packages. The packages range from unlimited to those based on data ranging from 10GB to 300GB. Their business strategy revolves around a focus on cyclical or temporary businesses, point of sale operations, pop up shops, and hybrid workforces. They will continue to leverage mmWave capacity for enhancements to its coverage and reach. Verizon - Verizon offers FWA to both consumers and businesses and their business services aka '5G Business Internet' is available at 2 million locations today, and is scaling to 14-25M locations by 2025. Fierce Wireless states that "Verizon’s 5G FWA service is available to about 30 million homes." Today Verizon shares they serve 1.06M FWA customers and have a target of 4 million to 5 million by the end of 2025. Their most recent quarter experienced additions of 342K net adds in Q3 with an estimated 32% of those adds going to business customers or subscribers. Offerings start at 300Mbps and go to 1-gig while they leverage both millimeter wave (mmWave) spectrum and C-Band mid-band spectrum for their coverage. AT&T – AT&T shifted their focus away from FWA from 2021 to focus more on their overall fiber buildout and strategy. Compass Intelligence estimates AT&T serves an estimated 700K FWA subscribers today. UScellular – US Cellular currently serves around 57K FWA subscribers on 4G, and is focusing on the expansion of 5G FWA over mmWave spectrum in 10 cities. They claim to have 23% annual growth for their FWA services from 2021 to 2022. To wrap up, pay attention to the advancements in mmWave and small cell equipment and radio hardware solutions. These advancements will help further improve capacity, installation efficiencies, and better serve business quality broadband services that are needed to help close the digital divide and improve connectivity across the globe. On October 20th, a large group of industry analysts joined 5G Americas staff and members to discuss the state of 5G. Neville Ray of T-Mobile, Chair of 5G Americas, kicked off the event after a warm welcome and a setting of the stage by Chris Pearson (President of 5G Americas). Ray stated we are “In the next phase of 5G networks,” and “5G is finally starting to gain real traction.” A wide range of stats were shared along with some important factoids showing we are moving the needle in the Americas. Participating companies included Airspan, Cisco, Qualcomm, Samsung, T-Mobile, AT&T, Ciena, Mavenir, Nokia, Ericsson,Crown Castle, VMware, and Intel. While the foundational layer in 5G is located in the low band spectrum, mid-band 5G in the United States is now real…..but as all of us know, we need more mid-band spectrum to reach full potential of 5G use cases and applications. Currently, more than 66% of the geographic land mass is covered by 5G, while this same percentage of the population has access to 5G. Having a 5G enabled device is a bit underwhelming, with less than half of the U.S. population having access to a device with a 5G radio. With an investment of more than $100 billion over the last few years, 5G phones and subscriptions reached a total of 140 million, which remains less than half of the North American population. The most significant finding is that 5G is about increased data consumption, as Neville shared we are about 2.5 to 3 times higher data consumption with 5G compared to LTE. When thinking about the networks and advancements being made, we must remember we will rely on 4G/LTE for quite some time even though 5G networks are continuing to be deployed and improved. There are currently 14 total 5G networks running that enable streaming, gaming, social media and communications, and other business or enterprise-based applications. Outside of all of these data-intensive categories, Neville Ray mentioned for the industry to NOT forget about voice….yes, voice is still important for 5G and the advancements are really all around Voice over NR or New Radio (pronounced Vonar, aka Vo5G/Voice over 5G) (Related News: https://techblog.comsoc.org/2022/06/04/t-mobile-launches-voice-over-5g-nr-using-5g-sa-core-network/). 5G Americas noteworthy trends revolve around the following highlighted areas:

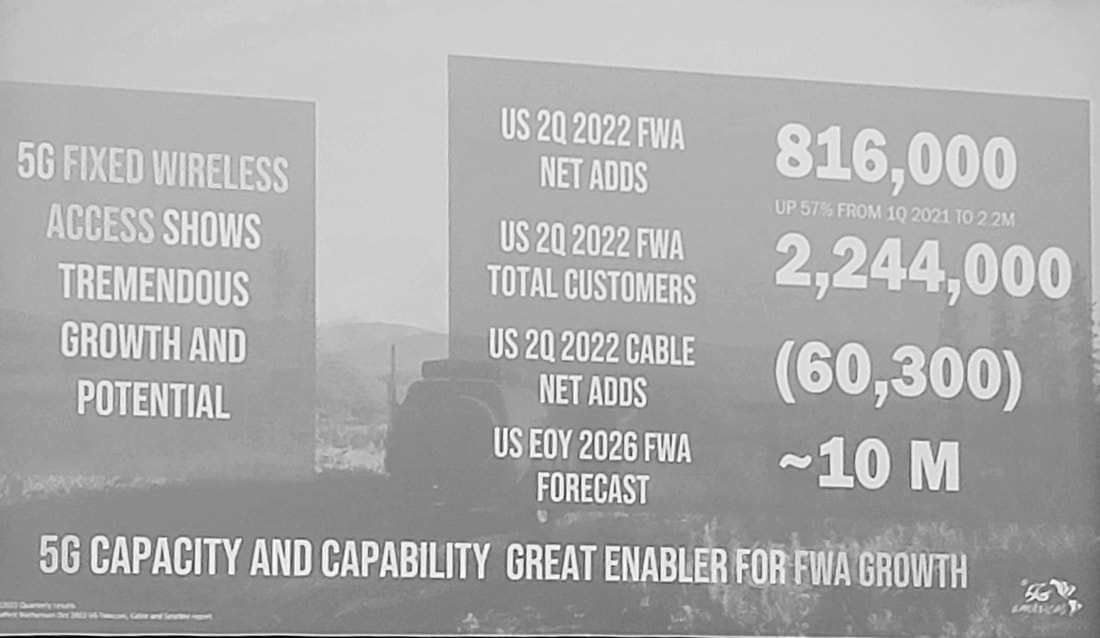

Fixed wireless access or FWA is being seen as an alternative to wired broadband and Wi-Fi (See Wi-Fi6) connectivity for a number of reasons. In many cases, the WISPs leveraged unlicensed spectrum to reach rural communities who lacked quality broadband, but over the past year the conversation has shifted to enterprise interest. Some believe it to be a complement or to augment existing connectivity options (especially cable). While FWA is creating capacity and new capabilities, especially for business use, additional and new spectrum is coming. FWA will continue to remain an available option for businesses in the US and internationally, but will continue to be squeezed by fiber and funding that may benefit fiber build out (Further Reading: WISPs embrace fiber as they face do or die moment). The carriers have been busy when it comes to FWA, especially in terms of their announcements and overall growth. Of course with that comes a bit of a reverse, as the overhype of FWA is now settling. “Verizon Communications…touted the addition of 234,000 fixed wireless access residential customers in the third quarter and another 108,000 FWA subscribers on the business-services side, upping its total FWA base to over 1 million users,” as seen on NextTV. T-Mobile will have their Q3 earnings call tomorrow but as Forbes shared, “T-Mobile has also made a dent in the broadband space, with its fixed wireless broadband offering adding an industry-leading 560,000 new broadband subscribers (last quarter),” while today they have more than 1.5 million FWA subscribers. Ericsson also shared, “UScellular was the first service provider to offer consumers and enterprise Fixed Wireless Access (FWA) services, using 5G extended-range millimeter-wave (mmWave) to target digital divide areas in rural America, reaching coverage of over 5 km.” While the activity for fixed wireless has expanded over the past year, spectrum access and fiber will remain critical factors for continued growth. Below is a slide that was shared at 5G Americas that highlights some of the overall FWA stats (Source: 5G Americas & Their Members). While some of you may be tired of tech acronyms, it is the way we lazy people essentially describe long-winded tech terms. Enter C-V2X or Cellular Vehicle-to-Everything). C-V2X is considered a mid-term opportunity and is expected to open up a range of opportunities driven by low latency, high performance 5G network services. Think about your car becoming your hub or essentially just like any other device. This hub will speak to the road, to traffic lights, to city traffic bodies, to public safety, to you and your passengers, to your auto dealership, to your car manufacturer and even to all your favorite content providers. In addition, these hubs will speak to each other building a network of communications across many sources. A range of entertainment, safety, location and routing, and interactive services will be launched and made available to drivers and passengers as a result. Your car needs reliable, high-speed wireless connectivity and 5G gets us there. We are in the earlier stages, but we do expect ongoing announcements well into 2023 to directly address the opportunities of 5G in C-V2X.

Network slicing is a near term focus across low, mid, and high-band spectrum. Enterprise and consumer applications focused on improved throughput, low latency, and other requirements see network slicing as a way to “carve out dimensional experiences,” shared Neville Ray. While we are in the early game of network slicing, we have yet to truly understand all the potential advantages and improvements that may come as we purpose-build the network. Aside from the key trends, and even more important, are the actual use cases for 5G. While the Analyst Forum had a strong emphasis on 5G for consumer and the growth in experiences there, I believe the true opportunity will lie with the enterprise and government sectors. Consumer 5G revolves around things like wearables, gaming, social communications, metaverse (not my favorite word), shopping, navigation, health/wellness, and sports. On the enterprise side, 5G presents new connectivity options for mass IoT and autonomous transportation, especially in use cases where the assets (fleets, products, equipment, people, machines, etc.) are mobile or meaning they are moving. These assets need to be monitored, measured, tracked, repaired, and acted upon for a variety of purposes and for reasons specific to the industry. Some of the vertical markets or industries where 5G opportunities exist include manufacturing, utilities, transportation, remote health care, digital cities, and education. For factories or logistics applications for example, mmWave is being used to enhance connectivity performance in robotics, as well as being used for sensing in agriculture or for farming applications. While 5G has been met with a sense of excitement and overall hype, we remain in the stage of improving overall network performance and build-out to meet enterprise and new customer experience expectations. There will always be hesitation for 5G adoption as a replacement to fiber, but for now we should think about applications where 5G is the only solution or where 5G will augment connectivity to provide better performance for things like robotics, transportation, supply chain monitoring, customer/digital experiences, etc. Lastly, the industry will continue to seek out additional mid-band spectrum as is needed to scale and to reach performance expectations. Special thank you to the 5G Americas team for hosting all of us analysts and for putting together great content. Contact Stephanie directly to learn more about other panel sessions and content that was shared at the event. Recommendations for further reading and research: Open RAN, Spectrum Policy and FCC Activities, mmWave, RedCap (Reduced Capacity) New Radio, Dynamic Spectrum Sharing, Unlicensed Spectrum. Please visit 5G Americas to learn more and to get access to their whitepapers and studies. To get access to further wireless research including 5G, please visit our WIRELESS RESEARCH store. Written by Stephanie Atkinson A few weeks ago, I had the honor to attend the annual Xfinity Analyst Day event in Philadelphia located at both the Four Seasons Philadelphia hotel and the Comcast Technology Center. Thank you to Joel Shadle and team for inviting me and for the insanely wonderful hospitality. As we think about consumer needs and wants, the instant economy demands innovative customer experiences that cater to individual and contextual personalizations, and this is exactly what Comcast is doing with a suite of solutions, products, and services around broadband, WiFi access, Mobile services, and Content. I will share a few highlights of the day's activities below.

Dana Strong, President Xfinity Consumer Services, kicked off the event and shared a great summary of the Comcast/Xfinity innovation journey. Xfinity's primary focus is to push for differentiation around product innovation. It was clear throughout the event that Comcast is fully focused on positioning Xfinity Internet as its primary product; and counts around 26 million residential customers for the service as of Q219, compared to 22 million video customers and 1.4 million Xfinity Home customers. The trio of innovation areas include speed, coverage and control for broadband. Upcoming and new solutions include bringing Hulu to X1 customers in the first quarter of 2020, along with innovation around WiFi with Xfinity xFi Pods WiFi Extenders and a home suite that is fully integrated and searchable by voice with options for adding home security (#smarthome 1.4M home security customers), and innovation around the X1 cloud DVR and remote services. X1 is a platform of platforms with companies such as Cox, Shaw, Rogers all using it as the foundation for their video products. In addition for homes today, it is all about speed as we are consuming more streaming video than ever. In fact Dana mentioned Xfinity customers used 6 billion video on demand hours along with 9 Billion voice commands in 2018 alone. Innovation is also an area being explored within Xfinity Mobile, where the company serves 1.6 Million mobile lines and is currently expanding LTE with their partnership with Verizon. Family Gig packs (Unlimited and By the Gig packs) or bundles allow payment plans and options to add in home monitoring for existing broadband customers. It is important to understand that only Xfinity Internet customer can get Xfinity Mobile services. A great amount of innovation is centralized around the entire entertainment experience, which requires robust broadband and tools that can be leveraged with voice automation and an open system with access to services such as Netflix, Xumo, Pluto, Amazon Music, iHeartMusic, Amazon Prime video, YouTube, and again Hulu coming in Q1. Customers can use voice search across the entire ecosystem, not just linear tv, while search results default to free/complimentary and displays where you left off and recommends based on your history. This innovation around entertainment does not happen without a sound high-speed broadband experience. Tony Werner, President of Technology & Product at Comcast Cable, shared additional innovation details around its broadband and WiFi solutions. With 17 different speed upgrades over the course of 18 years and a strong portfolio of patents with 400 currently pending and 20 million WiFi hotspots, the company is well positioned to leverage these assets to a strong base of residential customers and drive business to the B2B market moving up market from a strong SMB base. A great stat was shared...there are currently 58M homes today that have access to 1Gbps broadband by Comcast today. Other innovation details shared by Patti Loyack (VP of IP Services) and Rui Costa (VP of Product, Design and CX) include some of the following:

Lastly, I will wrap up by sharing more around innovation specific to customer experience (cX). Charlie Herrin, Chief Customer Experience Officer for Comcast Cable, shared additional details around making the customer experience their best product. He shared four main components to personalized automation (Xfinity Assistant) including IDENTITY, INTELLIGENT AUTOMATION, PROACTIVE 2-WAY DIALOG, and CLOSING THE LOOP. Both self-care and administration are areas where Mr. Herrin is building out services and solutions. Some highlights include:

These short-list (many others taking place) of improvements have brought about tens of thousands of predictive recommendations produced via IVR for better servicing customers and reduction of calls into the call center, along with billions data elements captured daily. Many customer issues have been contained in the Xfinity Assistant, which has reduced agent handled chats substantially. This customer-first and simplicity approach is sure to enhance the overall customer experience and drive retention for residential clients. This summary does not include all the interactions and sessions attended, but provides a great review of things to come and the innovation in process and coming down the pipeline. It was clear throughout the event that Comcast is fully focused on positioning Xfinity Internet as its primary product; and counts around 26 million residential customers for the service as of Q219, compared to 22 million video customers and 1.4 million Xfinity Home customers. As part of this analyst day, we were also treated to product demos, Comcast Technology Center Tour, the Universal Sphere experience, and a great networking reception and dinner with showcase labs and interactions with executives. Thank you again to Comcast and the Xfinity team of executives and team who prepared and put this event together. I look forward to witnessing continued innovation and enhancements across the Xfinity portfolio. Written by: Stephanie Atkinson, CEO of Compass Intelligence  By Stephanie Atkinson, CEO CompassIntel/Chair IoT6 www.5gamericas.org | @5GAmericas Last week was the annual 5G Americas annual Analyst Forum held in Dallas, Texas. The event was kicked off by the Chairman and CTO of T-Mobile US, Neville Ray (@NevilleRay). Just a few highlights to start off with regarding Neville's keynote, which clearly showcased the global and nationwide competitive angle 5G is being championed for and towards (also heard at MWCA in LA).

ARTIFICIAL INTELLIGENCE AND 5G

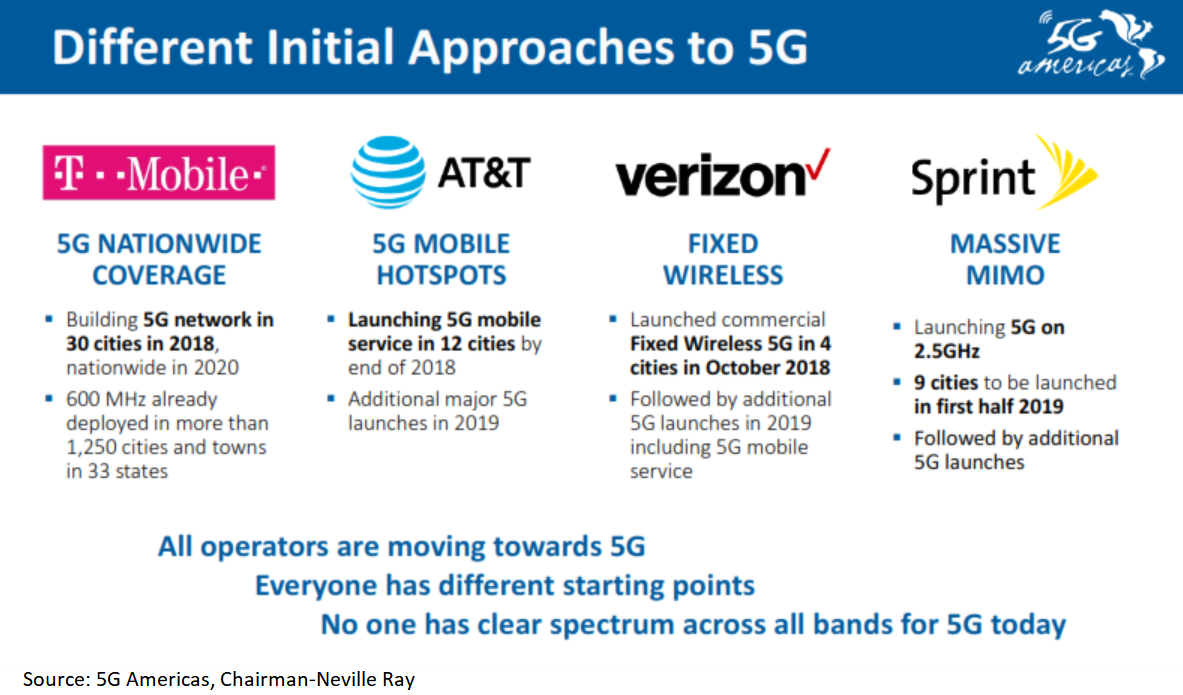

One of the first sessions I sat in on was focused around the impact of Artificial Intelligence (AI) to 5G and future growth in IoT. Ericsson is utilizing AI tools and software to improve their radio access network (RAN) specific to configuration and optimization, while Samsung mentioned heavily investing (see Softbank news on AI investments) in AI at the cloud level to support in new customer experiences (cX) and improve video content services (noted example of having video content follow users). Cisco's perspective was a bit different as they are looking at AI to support in new learning algorithms (inference and information theory) around operations, as well as using AI tools and software for social impact initiatives. Lastly, Sprint mentioned leveraging AI to improve data quality, enhance machine learning tools, generating automatic code, and simplifying for categorization (think automated text categorization, read more here). Sprint also mentioned there may be a challenge with the human input and training is an issue. 5G AND ENTERPRISE IoT On the low band, 5G is expected to support in scaling massive IoT, specific to low latency connected and sensor solutions, specific to industrial, infrastructure, operations, and even smart cities. The use cases revolve around asset tracking and monitoring, fleet tracking and monitoring, some transportation and container tracking, and applications specific to agriculture, factory automation/manufacturing (mass production), and others. DEVICE ECOSYSTEM Enhanced Mobile Broadband (eMBB) has been a focus for companies like AT&T, as they made announcements this year. As shown earlier, the carriers all have different approaches to device roll-out, yet 5G smartphones is not expected until mid-2019. On another note, there are some upcoming changes to 5G devices and antenna placement. Devices may have 3 to 4 mmWave antennas as part of 5G enhancements, and this will help to manage hand cover up issues from a user experience perspective. Qualcomm mentioned that some devices still have 2G, and that the OEMs they work with are choosing what bands to include in the devices. The 3G to 4G shift was more concentrated around power management, while that will not be as much of an issue for the shift from 4G to 5G. New RF modules will be an area of focus for 5G devices. This session had participants from Qualcomm, Samsung, and Sprint. 5G, MORE USE CASES Focusing beyond MBB, the industry participants mentioned we need to look above and beyond broadband and smartphone devices. Sprint is focused around the mid-band, so 5G smartphones is key to their 5G strategy. Sprint is currently looking at the partnership model for 5G use cases. The foundational use cases are centered around mobility and fixed wireless. Many are in the exploratory stage from an ecosystem perspective and are seeking support from partners, research analysts, advisors, and customers. Carriers will be seeking use cases to better monetize traffic, as current smartphone revenues and the growth trajectory remains fairly stable or flat. Consumer is behind overall, and Enterprise is leading in 5G use cases at this time. Smart cities is an area to explore as well, and CityBrain (by Alibaba) was mentioned as a good use case to explore in terms of true ROI. MY TWO CENTS

Related 5G Research and Reports: 5G Optimization: Mobile Edge Computing and Network Slicing 2018 – 2023 Voice over 5G (Vo5G) Market 5G Security Market: Technologies, Solutions, and Market Outlook 2018 - 2023 A few weeks back, we discussed where we are today with the two waves of "The Connected Vehicle." 1st we focused on bringing WiFi and 4G/LTE to the vehicle. Now let's jump into the power of the Autonomous Vehicle, the 2nd wave.

According to Techopedia, the definition of Autonomous Vehicles is, "An autonomous car is a vehicle that can guide itself without human conduction. This kind of vehicle has become a concrete reality and may pave the way for future systems where computers take over the art of driving. An autonomous car is also known as a driverless car, robot car, self-driving car or autonomous vehicle." For many out there, these concepts are so far out there that is is challenging to understand what this means to both us as consumers, as well as industry and businesses. Let's call the market AV for short, since we will be discussing scenarios throughout this blog. The AV market has the chance to disrupt industries in the transportation marketplace, as well as disrupt the way goods and services get transported and delivered throughout the world. Before we get too technical, lets focus on what this really means to us as consumers, consumers who drive our vehicles every day to work, school, leisure places, and events. Below are some real-world scenarios on how AV will impact the consumer, imagine this...

Recent Related News on AV:

For further reading, please check out the related blog regarding the 1st wave of The Connected Vehicle. For more information, please visit our RESEARCH page to explore other technologies and market indicators. Written by Stephanie Atkinson, CEO of Compass Intelligence, LLC |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed