|

On October 20th, a large group of industry analysts joined 5G Americas staff and members to discuss the state of 5G. Neville Ray of T-Mobile, Chair of 5G Americas, kicked off the event after a warm welcome and a setting of the stage by Chris Pearson (President of 5G Americas). Ray stated we are “In the next phase of 5G networks,” and “5G is finally starting to gain real traction.” A wide range of stats were shared along with some important factoids showing we are moving the needle in the Americas. Participating companies included Airspan, Cisco, Qualcomm, Samsung, T-Mobile, AT&T, Ciena, Mavenir, Nokia, Ericsson,Crown Castle, VMware, and Intel. While the foundational layer in 5G is located in the low band spectrum, mid-band 5G in the United States is now real…..but as all of us know, we need more mid-band spectrum to reach full potential of 5G use cases and applications. Currently, more than 66% of the geographic land mass is covered by 5G, while this same percentage of the population has access to 5G. Having a 5G enabled device is a bit underwhelming, with less than half of the U.S. population having access to a device with a 5G radio. With an investment of more than $100 billion over the last few years, 5G phones and subscriptions reached a total of 140 million, which remains less than half of the North American population. The most significant finding is that 5G is about increased data consumption, as Neville shared we are about 2.5 to 3 times higher data consumption with 5G compared to LTE. When thinking about the networks and advancements being made, we must remember we will rely on 4G/LTE for quite some time even though 5G networks are continuing to be deployed and improved. There are currently 14 total 5G networks running that enable streaming, gaming, social media and communications, and other business or enterprise-based applications. Outside of all of these data-intensive categories, Neville Ray mentioned for the industry to NOT forget about voice….yes, voice is still important for 5G and the advancements are really all around Voice over NR or New Radio (pronounced Vonar, aka Vo5G/Voice over 5G) (Related News: https://techblog.comsoc.org/2022/06/04/t-mobile-launches-voice-over-5g-nr-using-5g-sa-core-network/). 5G Americas noteworthy trends revolve around the following highlighted areas:

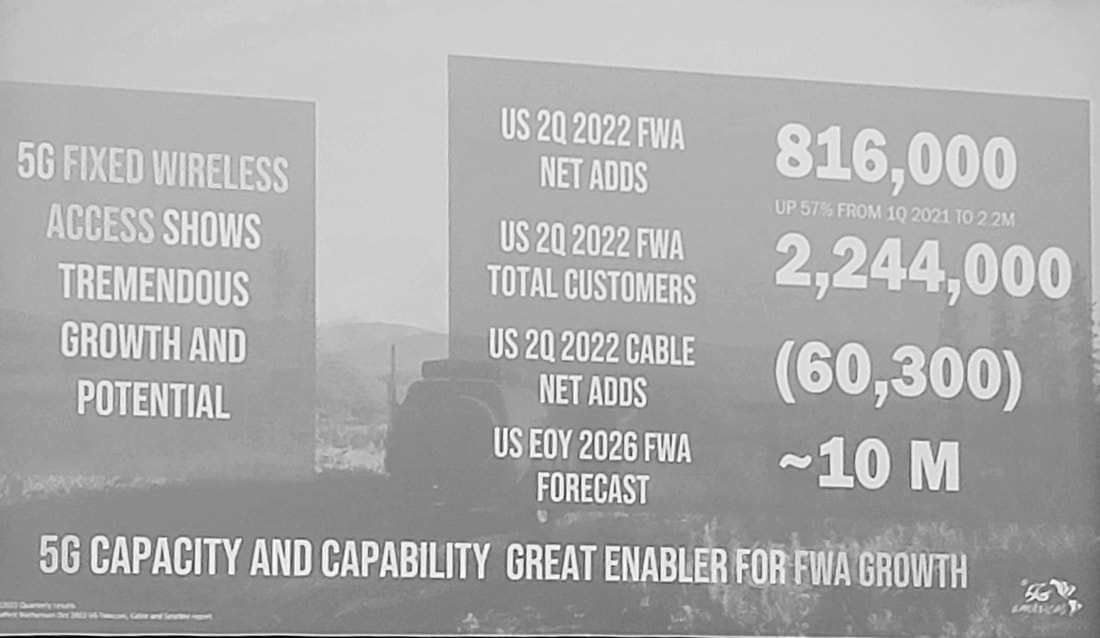

Fixed wireless access or FWA is being seen as an alternative to wired broadband and Wi-Fi (See Wi-Fi6) connectivity for a number of reasons. In many cases, the WISPs leveraged unlicensed spectrum to reach rural communities who lacked quality broadband, but over the past year the conversation has shifted to enterprise interest. Some believe it to be a complement or to augment existing connectivity options (especially cable). While FWA is creating capacity and new capabilities, especially for business use, additional and new spectrum is coming. FWA will continue to remain an available option for businesses in the US and internationally, but will continue to be squeezed by fiber and funding that may benefit fiber build out (Further Reading: WISPs embrace fiber as they face do or die moment). The carriers have been busy when it comes to FWA, especially in terms of their announcements and overall growth. Of course with that comes a bit of a reverse, as the overhype of FWA is now settling. “Verizon Communications…touted the addition of 234,000 fixed wireless access residential customers in the third quarter and another 108,000 FWA subscribers on the business-services side, upping its total FWA base to over 1 million users,” as seen on NextTV. T-Mobile will have their Q3 earnings call tomorrow but as Forbes shared, “T-Mobile has also made a dent in the broadband space, with its fixed wireless broadband offering adding an industry-leading 560,000 new broadband subscribers (last quarter),” while today they have more than 1.5 million FWA subscribers. Ericsson also shared, “UScellular was the first service provider to offer consumers and enterprise Fixed Wireless Access (FWA) services, using 5G extended-range millimeter-wave (mmWave) to target digital divide areas in rural America, reaching coverage of over 5 km.” While the activity for fixed wireless has expanded over the past year, spectrum access and fiber will remain critical factors for continued growth. Below is a slide that was shared at 5G Americas that highlights some of the overall FWA stats (Source: 5G Americas & Their Members). While some of you may be tired of tech acronyms, it is the way we lazy people essentially describe long-winded tech terms. Enter C-V2X or Cellular Vehicle-to-Everything). C-V2X is considered a mid-term opportunity and is expected to open up a range of opportunities driven by low latency, high performance 5G network services. Think about your car becoming your hub or essentially just like any other device. This hub will speak to the road, to traffic lights, to city traffic bodies, to public safety, to you and your passengers, to your auto dealership, to your car manufacturer and even to all your favorite content providers. In addition, these hubs will speak to each other building a network of communications across many sources. A range of entertainment, safety, location and routing, and interactive services will be launched and made available to drivers and passengers as a result. Your car needs reliable, high-speed wireless connectivity and 5G gets us there. We are in the earlier stages, but we do expect ongoing announcements well into 2023 to directly address the opportunities of 5G in C-V2X.

Network slicing is a near term focus across low, mid, and high-band spectrum. Enterprise and consumer applications focused on improved throughput, low latency, and other requirements see network slicing as a way to “carve out dimensional experiences,” shared Neville Ray. While we are in the early game of network slicing, we have yet to truly understand all the potential advantages and improvements that may come as we purpose-build the network. Aside from the key trends, and even more important, are the actual use cases for 5G. While the Analyst Forum had a strong emphasis on 5G for consumer and the growth in experiences there, I believe the true opportunity will lie with the enterprise and government sectors. Consumer 5G revolves around things like wearables, gaming, social communications, metaverse (not my favorite word), shopping, navigation, health/wellness, and sports. On the enterprise side, 5G presents new connectivity options for mass IoT and autonomous transportation, especially in use cases where the assets (fleets, products, equipment, people, machines, etc.) are mobile or meaning they are moving. These assets need to be monitored, measured, tracked, repaired, and acted upon for a variety of purposes and for reasons specific to the industry. Some of the vertical markets or industries where 5G opportunities exist include manufacturing, utilities, transportation, remote health care, digital cities, and education. For factories or logistics applications for example, mmWave is being used to enhance connectivity performance in robotics, as well as being used for sensing in agriculture or for farming applications. While 5G has been met with a sense of excitement and overall hype, we remain in the stage of improving overall network performance and build-out to meet enterprise and new customer experience expectations. There will always be hesitation for 5G adoption as a replacement to fiber, but for now we should think about applications where 5G is the only solution or where 5G will augment connectivity to provide better performance for things like robotics, transportation, supply chain monitoring, customer/digital experiences, etc. Lastly, the industry will continue to seek out additional mid-band spectrum as is needed to scale and to reach performance expectations. Special thank you to the 5G Americas team for hosting all of us analysts and for putting together great content. Contact Stephanie directly to learn more about other panel sessions and content that was shared at the event. Recommendations for further reading and research: Open RAN, Spectrum Policy and FCC Activities, mmWave, RedCap (Reduced Capacity) New Radio, Dynamic Spectrum Sharing, Unlicensed Spectrum. Please visit 5G Americas to learn more and to get access to their whitepapers and studies. To get access to further wireless research including 5G, please visit our WIRELESS RESEARCH store. Written by Stephanie Atkinson A week ago, I sat down virtually with Brandon Branham, Chief Technology Officer and Assistant City Manager of Peachtree Corners (PTC, one of the first cities in the United States powered by real-world smart city infrastructure, which also features ‘Curiosity Lab at Peachtree Corners’) to get an update on all of the progress being made in making the city smarter, more interactive, and inviting to technology innovators around the globe. Peachtree Corners launched an innovative living smart city lab about 1 year back that leverages autonomous technology, IoT, AI, machine learning, edge computing, virtual reality, and other advanced technologies to advance city operations, mobility, and introduce economic development. Some of the more interesting key facts about PTC include the following:

The innovation being embraced at PTC comes with the value it is placing in partnerships, leading technology company initiatives, and the live testing environment it provides to tech companies, OEMs, and startups around the globe. They currently have roughly 10 vendors with 15 different device types generating data across their network across around 15 or so different software systems. On the embracing of global companies, it is also working with a Tel Aviv company called IPgallery, that brings together city insights and intelligence using a real-time AI data platform that provides visualization (visual map) across PTC to monitor, analyze and secure all IoT devices across the ecosystem, buses, cameras, applications, etc. In addition, traffic flow and pattern data are being collected to adjust and make real-time rerouting decisions to improve public transportation.

PTC recently announced a partnership with Bosch, where they are implementing a sensor connected intersection and intelligent traffic management system to capture video including vehicle identification, vehicle recognition of objects (car, bus, scooters with drivers or without, pedestrians, etc. using machine vision). This partnership will allow real-time adjustments to traffic signaling, share the flow of traffic activity, and identify the type of vehicle in that flow for improved traffic management. PTC's Curiosity Lab will allow for a living city environment for Bosch to leverage its leading edge solution within a live, real municipality. A few other projects on the horizon include the following:

All of these activities would not be anywhere without the public-private partnerships (3Ps) in place. PTC has a process to test in their live environment, receive funding from 3rd parties or commercial entities (for some projects), decide on whether the project is scalable, and then the city decides and will invest as needed. This is a prime example of how business and government can and should work together to advance the smart city vision. On a final note, below is a list of key differentiators that enable PTC be the groundbreaking innovator in smart city solutions:

Platform A few weeks back, we discussed where we are today with the two waves of "The Connected Vehicle." 1st we focused on bringing WiFi and 4G/LTE to the vehicle. Now let's jump into the power of the Autonomous Vehicle, the 2nd wave.

According to Techopedia, the definition of Autonomous Vehicles is, "An autonomous car is a vehicle that can guide itself without human conduction. This kind of vehicle has become a concrete reality and may pave the way for future systems where computers take over the art of driving. An autonomous car is also known as a driverless car, robot car, self-driving car or autonomous vehicle." For many out there, these concepts are so far out there that is is challenging to understand what this means to both us as consumers, as well as industry and businesses. Let's call the market AV for short, since we will be discussing scenarios throughout this blog. The AV market has the chance to disrupt industries in the transportation marketplace, as well as disrupt the way goods and services get transported and delivered throughout the world. Before we get too technical, lets focus on what this really means to us as consumers, consumers who drive our vehicles every day to work, school, leisure places, and events. Below are some real-world scenarios on how AV will impact the consumer, imagine this...

Recent Related News on AV:

For further reading, please check out the related blog regarding the 1st wave of The Connected Vehicle. For more information, please visit our RESEARCH page to explore other technologies and market indicators. Written by Stephanie Atkinson, CEO of Compass Intelligence, LLC |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed