|

U.S. wireless carriers have made significant strides in rolling out 5G services across major cities, but all are on different paces using varying spectrum strategies to reach both consumers and business end-users. According to a recent article on SDxCentral, "Earlier this month, T-Mobile US leapfrogged all of its competitors with a nationwide 5G network running on 600 MHz spectrum. The operator’s low-band 5G network covers about 200 million people, or about 61% of the total population, spanning a geographic range of more than 1 million square miles." They also share that AT&T will reach part of 30 cities by early 2020 with AT&T confusing some in the industry by using the term “5G E” brand in select cities, while using “5G” brand for 5G running over low-band spectrum, and “5G+” for those running on mmWave spectrum. Verizon recently announced reaching 30 cities and 14 NFL stadiums by the end of this year. Lastly, Sprint started out 2019 with a strong leading roll-out of 5G but is expected to end the year covering roughly 11 million people. Also, U.S. Cellular shares it will launch 5G service in Q1 of 2020.

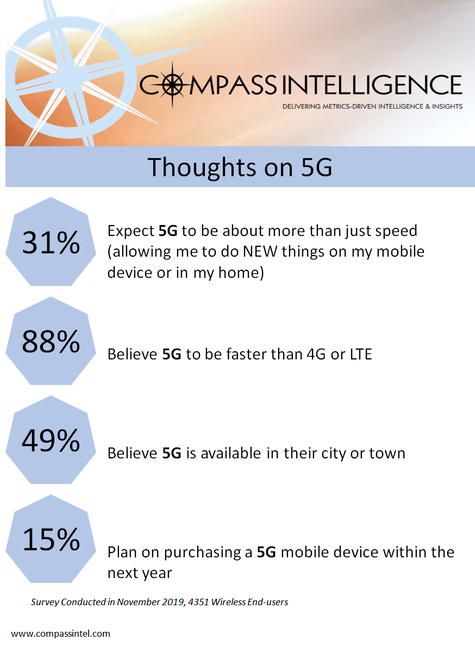

Meanwhile, a recent survey conducted by Compass Intelligence shows roughly 49% of those 4K+ wireless end-users surveyed across the U.S. believe 5G is available within their city or town, with 15% planning on purchasing a 5G enabled smartphones or devices in 2020. As consumers plan upgrades, phone replacements, and trade-ins on their smartphones, it only makes sense to make sure your device is 5G ready or enabled. Most wireless end-users, 88% of the 4,351 surveyed, believe 5G will be faster than 4G or LTE, with 31% believing 5G will be much more than just a faster or speed upgrade when compared to 4G or LTE services. Wireless carriers have not really been effective at communicating what these other advantages are to consumers at this stage, as most of the marketing and communication has been about the coming advantages to business solutions yet consumers will see brand new customer experiences with 5G like they have not seen in the past. As for now, experiences within venues like airports, stadiums and event venues, shopping/retail, and engaging within a city has the potential to offer brand new real-time and personalized experiences. Many ideas have been shared at a high-level, but think about seamless buying and shopping catered to your needs and wants with better location, routing, checkout, and service. Within a city, interacting with public transportation or city services may be enhanced as 5G brings speeds that better leverage video, virtual reality (think 3D virtual city tours or interactive Uber ride experiences), and immersive experiences. Stay tuned next week to the latest in plans to switch carriers ...survey research rocks! This holiday season and the heightened economy has given rise to purchasing and this holiday season saw a spike in spending overall. According to recent tracking, "Retailers have much to cheer about this holiday season. According to Mastercard SpendingPulseTM, holiday retail sales increased 3.4 percent (ex auto) with online sales growing 18.8 percent compared to 2018." Online purchasing of electronic devices have also seen promising results including Black Friday, Cyber Monday, and overall Christmas shopping. Consumers are spending and this provided opportunities for those selling smartphones, tablets, and computing devices.

Compass Intelligence recently completed a survey with over four-thousand wireless end-users (4,351) and dove into a number of topics including planned purchases, perceptions of 5G, current ownership of devices, payment structures, and other related wireless services including insurance, prepaid, and leasing. This survey highlight included a snapshot of plans to purchase for smartphones, tablets, and computing devices. As shown, below is a roundup of purchasing plans for the next 3 to 4 months:

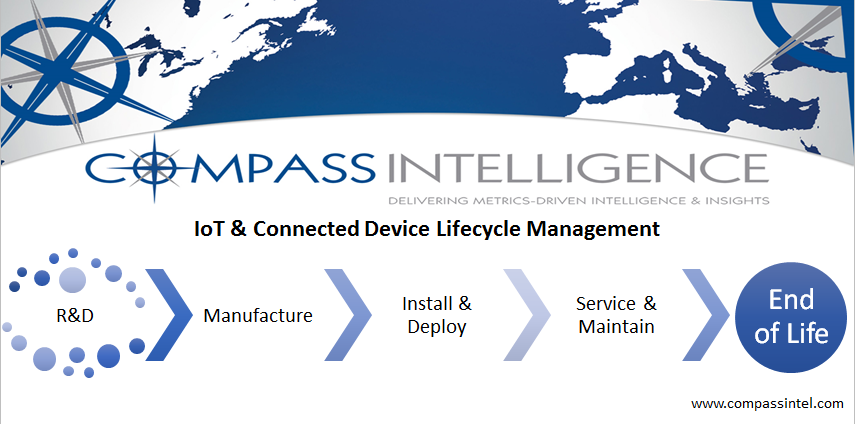

Note: Online survey conducted in late November 2019 with 4,351 (18 and older) wireless end-users in the United States. Compass Intelligence has covered the traditional device lifecycle market trends (smartphones, tablets, PCs, laptops), research, and intelligence for more than a decade, and now we are finally entering into real discussions around IoT device lifecycle management. What happens to the repair, maintenance, insurance, warranty, replacement, and end of life services that need to be provided for the billions of connected devices being managed globally, and who will be responsible for providing those services. When thinking about connected devices, let's just focus in on industrial and machine-to-machine connected devices. These may include devices used for tracking, monitoring, alerting, diagnostics, distribution, logistics management, digital content display, surveillance, inspection, safety response, machine communications, and many other core applications. Each of these applications will have common and unique IoT device lifecycle patterns and processes that start from the R&D/manufacturing stage and move to end of life and recycling stage. A depiction of Compass Intelligence's IoT device lifecycle view is shown below: Research & Development

The R&D phase includes areas such as testing, trial and error, refinement, embedded security, and other requirements, along with production runs for review and improvements. This phase is where many of the engineers work their magic, and this is also the area we are hearing needs to increase their review and processes for embedded security for supporting improved security of the device once it is deployed and operational. Manufacture This phase includes the production of connected devices. Install and Deploy This phase includes installation, integration, set-up, kitting, dispatching, and other services to get the connected devices working and communicating with other systems, software, and business tools. Service and Maintain This phase is where we expect to see a need for additional services. As devices malfunction, breakdown, become compromised (security, weather, aged), we will need better options for fast and reliable repair, warranty, and even insurance to cover business loss in case of short-term or long-term disruption of business or operations. Just as we have warranty, repair, and insurance related services for the devices we carry, we will have a growing need (especially in business or corporate) to have assurances for zero to little down-time of operations and business services. This phase is also important as it is focused on the management of all IoT and connected devices including providing physical and network security of the device, providing visibility of the devices (platform, portal, moves-adds-changes, troubleshooting), configuration, software updates management, and much more. As this phase becomes the longest phase and the most vital to operations, we expect to see services rolled out by the carriers, IoT vendors, integrators, and other tech companies, as well as see future IoT companies launch or evolve that are dedicated solely to IoT device lifecycle management. End of Life This phase is also an area that I believe is under-looked but will present huge opportunities for the market. What happens to older versions, retired models, aging equipment, and end of life connected devices. Just as we have a secondary market for smartphones and tablets, we will also see an opportunity for secondary markets for connected devices. This may be in both consumer and commercial application areas. In addition, as we deem equipment as not suitable for the secondary market, there will also be a market for recycling precious metals, parts, batteries, and other materials. Again, we are talking billions of devices that will need to be recycled to protect our resources. For more research and information on the IoT Market, please visit our IoT Store. For more information on our advisory services, please visit our IoT Advisory page. Written by Stephanie Atkinson, @stephatkins Compass Intelligence CEO |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed