- IoT & M2M

- >

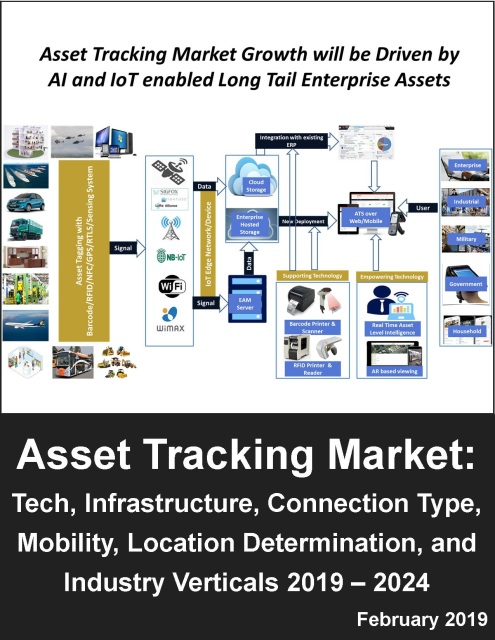

- Asset Tracking Market by Technology, Infrastructure, Connection Type, Mobility, Location Determination, and Industry Verticals 2019 – 2024

Asset Tracking Market by Technology, Infrastructure, Connection Type, Mobility, Location Determination, and Industry Verticals 2019 – 2024

This report evaluates asset tracking technologies, solutions, and ecosystem including major players. The report assesses the impacts of various use case specific considerations in terms of asset technology and solution selection. The report also analyzes the market outlook for asset tracking globally, regionally, and by major country in each region.

The report provides analysis and forecasts by infrastructure such as asset tracking by software, which includes: Cost Management, Audit Management, Procurement Management, Condition Monitoring, Inventory Management, and more. This report evaluates the market for asset tracking technology components including M2M Communication, Embedded, On-board and Remote Computing Systems. The report also assesses the impact of AI (including Machine Learning, Image and Patter Recognition, Neural Networking, and more), blockchain, and big data (including storage and data analytics) in support of asset tracking solutions. The report also evaluates cloud (including central and edge computing) vs. non-cloud based solutions.

This report also assesses asset tracking by category, such as fleet management. This is further broken down by land and non-land vehicles and vehicle types with great details for commercial trucks, vans, cars, and special-purpose vehicles. In terms of non-roadway vehicles, the report assesses aviation, railway, and water-based vehicle market potential. For the aviation market, it includes asset tracking for planes, helicopters, and ground support equipment. The report also analyzes the non-fleet tracking market including assets in smart buildings and smart workplaces.

The report provides forecasting for the aforementioned as wells by region and country for market sizing by revenue as well as unit deployment from 2019 through 2024. This includes quantitative data and projections with market segmentation by technology, technology components and integration, infrastructure, connection type, range of mobility, location requirements, and by industry vertical from 2019 to 2024.

Published: February 2019

Pages: 280

Global Enterprise License: $ 4,995 USD

Overview:

The asset tracking market has witnessed substantial economies of scale improvements in recently years due to inexpensive connectivity and Machine-to-Machine (M2M) communications equipment and services. The advent of advanced Internet of Things (IoT) solutions leveraging M2M and other supporting technologies enables anytime, anywhere, any type of asset tracking. In addition, advancements in miniaturization and communications have made lower value asset tracking more practical, expanding the range of potential industries and asset types.

There are substantial factors to consider when approaching the broader asset tracking market, which include asset class, value, and degree of mobility. Whereas asset tracking has historically been largely fleet-focused (commercial trucks, trailers, vans, and cars), there is great potential for expansion towards non-vehicle related assets. However, the market is currently constrained by the relatively low number of enterprise connected assets across certain important asset classes. Leading asset tracking solution companies are focusing on the asset value to a business or governmental organization rather than the book value of the asset itself. A consultative marketing and sales approach is necessary to inform enterprise, first of the value of interconnecting business assets, and secondly demonstrative asset tracking outcomes the bring value straight to the bottom line.

There are also opportunities for technology integration, such as leveraging Artificial Intelligence (AI) for enhanced decision making. There are many roles that AI may play, ranging from machine learning and analytics to improved cybersecurity for connected enterprise assets. By way of example, the recent Blackberry acquisition of Cylance represents a cybersecurity play that may be parlayed into IoT device security and combined with asset tracking solutions for greater overall enterprise security.

This report evaluates asset tracking technologies, solutions, and ecosystem including major players. The report assesses the impacts of various use case specific considerations in terms of asset technology and solution selection. The report also analyzes the market outlook for asset tracking globally, regionally, and by major country in each region.

The report provides analysis and forecasts by infrastructure such as asset tracking by software, which includes: Cost Management, Audit Management, Procurement Management, Condition Monitoring, Inventory Management, and more. This report evaluates the market for asset tracking technology components including M2M Communication, Embedded, On-board and Remote Computing Systems. The report also assesses the impact of AI (including Machine Learning, Image and Patter Recognition, Neural Networking, and more), blockchain, and big data (including storage and data analytics) in support of asset tracking solutions. The report also evaluates cloud (including central and edge computing) vs. non-cloud based solutions.

This report also assesses asset tracking by category, such as fleet management. This is further broken down by land and non-land vehicles and vehicle types with great details for commercial trucks, vans, cars, and special-purpose vehicles. In terms of non-roadway vehicles, the report assesses aviation, railway, and water-based vehicle market potential. For the aviation market, it includes asset tracking for planes, helicopters, and ground support equipment. The report also analyzes the non-fleet tracking market including assets in smart buildings and smart workplaces.

The report provides forecasting for the aforementioned as wells by region and country for market sizing by revenue as well as unit deployment from 2019 through 2024. This includes quantitative data and projections with market segmentation by technology, technology components and integration, infrastructure, connection type, range of mobility, location requirements, and by industry vertical from 2019 to 2024.

Key Findings:

- Rapid growth of Real-time Location Systems (RTLS): 17.4% CAGR through 2024

- Global asset tracking market will reach $32.0B by 2024, growing at 14.9% CAGR

- Blockchain will become an important part of asset tracking software and services

- Asset tracking solutions are becoming viable for sub-$1,000 book value asset tracking

- Global asset tracking market for AI in embedded devices will grow at 28.2% through 2024

- Leading companies will combine asset tracking and device security as a combined solution

- IoT supported asset tracking market will account for 93% of all enterprise and industrial solutions

- There is anticipated to be substantial vendor consolidation in the asset tracking market through 2024

Target Audience:

- AI companies

- Blockchain companies

- M2M and IoT companies

- Logistics services companies

- Systems integration companies

- Smart city integration companies

- Data management and analytics companies

- Asset tracking software and services companies

Companies in Report:

- Actsoft Inc.

- Advantrack

- Alphabet

- Apptricity

- ARI Fleet

- Arvento

- ASAP Systems

- AssetPanda

- AT&T

- Azuga Fleet

- BlackBerry (Radar, QNX)

- Brilliant Info Systems Pvt. Ltd.

- CalAmp

- Carmalink

- Chekhra Business Solutions

- ClearPath GPS

- Datalogic S.P.A

- DriveFactor (or CCC Drive)

- Entigral Systems Inc.

- Epicor Software Corporation

- Estrack

- Fleet Complete

- Fleet Safety Institute

- Fleetilla

- Fleetistics

- FleetManager

- FleetMind (Safe Fleet Holdings)

- Fleetup

- Freshworks

- Geotab

- GigaTrack

- Globalstar

- Go Fleet

- GPS Insight

- GPS Trackit

- GSAttrack (Global Satellite Engineering)

- Gurtam

- Honeywell International Inc.

- IBM Corporation

- Impinj Inc.

- Inseego

- IntouchGPS (GPSTrackit)

- JDA Software Group Inc.

- Jolly Technologies Inc.

- Litum IoT

- Lojack

- Lowry Solutions Inc.

- Lytx

- M2M in Motion

- Microsoft Corporation

- Mix Telematics

- Mojix Inc.

- Momentum IoT

- NexTraq (Michelin)

- NimbeLink

- Northrop Grumman

- Omnitracs

- OnAsset Intelligence Inc.

- Oracle Corporation

- ORBCOMM

- Particle

- Passtime

- PcsInfinity

- Pedigree Technologies

- PTC (ThingWorx)

- QBurst

- Quantum Aviation Solutions

- Raven Connected (KlashWerks Inc.)

- RedBeam Inc.

- Rhino Fleet

- Roambee

- SafeFleet

- Samsara

- SAP SE

- Sato Holdings Corporation

- Sendum Wireless Corporation

- Senseaware (Fedex)

- Sensitech Inc.

- Sequans

- Sierra Wireless Inc. (Numerex)

- Skybitz

- Smart Asset Manager Limited

- Smart Path GPS

- Sortly Inc.

- Speedshield Technologies (Adaptalift Group)

- Spireon Inc.

- Sprint Corporation

- Stanley Black & Decker Inc.

- Starcom

- Targa Telematics SPA

- Telefonica

- Telit

- Teltrac Navman

- Tenna

- T-Mobile

- TomTom International BV

- Topcon Corporation

- TrackX

- Trimble Inc.

- TVL Inc. (WiseTrack)

- Ubisense Group Plc.

- UpKeep Maintenance Management

- Verizon Wireless

- Vodafone Limited

- Wasp Barcode Technologies Inc.

- Windward Software

- Zebra Technologies

- Zerion Software Inc.

- Zonar Systems (Continental AG)

- Zubie

Table of Contents:

1.0 Executive Summary

2.0 Introduction

2.1 Asset Tracking Overview

2.1.1 Asset Tracking Functions

2.1.2 Asset Tracking Systems

2.2 Asset Types

2.2.1 Fixed, Portable, and Mobile Assets

2.2.2 High, Medium, and Low Assets

2.3 Asset Tracking Market Segmentation

2.4 Business Drivers for Asset Tracking

2.4.1 Connected Devices

2.4.1.1 Connected Consumer Devices

2.4.1.2 Connected Enterprise Assets

2.4.1.3 Connected Industrial Assets

2.4.2 Optimizing Enterprise and Industrial Device Management

2.4.3 Smart Cities, Buildings, and Workplaces

2.5 Asset Tracking Technologies

2.5.1 Mobility Management and Connectivity Technology

2.5.2 5G and Multi-access Edge Computing

2.5.3 Machine to Machine (M2M) and Internet of Things (IoT)

2.5.4 Artificial Intelligence in Asset Tracking

2.5.5 Advanced Data Analytics Support of Asset Tracking

2.5.6 Blockchain Technology and Asset Tracking

3.0 Asset Tracking Solutions

3.1 Solution Considerations

3.1.1 Fixed vs. Portable vs. Mobile Assets

3.1.2 Asset Value

3.1.2.1 High Value

3.1.2.2 Medium Value

3.1.2.3 Low Value

3.2 Solution Needs

3.2.1 Inventory Management

3.2.2 Asset Control and Redirection

3.2.3 Asset Tracking vs. Asset Control

3.2.3.1 Real-time vs. Non-real time Tracking and Location

3.2.3.2 Asset Location Precision and Movement Frequency

3.2.3.3 Alignment with Workforce (Human Assets)

3.3 Specific Solutions

3.3.1 Facility Management

3.3.2 Vehicle Tracking

3.3.3 Commercial Fleet Tracking

3.3.4 Asset Tracking in Smart Workplaces

3.3.5 Asset Tracking in Smart Cities

3.4 Asset Tracking Infrastructure and Services

3.4.1 Asset Tracking Software and Platforms

3.4.2 Asset Tracking System Deployment and Services

4.0 Asset Tracking in Industry Verticals

4.1 Aviation and Aerospace

4.2 Automotive and Transportation Systems

4.3 Healthcare

4.4 Manufacturing and Industrial Automation

4.5 Warehousing, Logistics, and Shipping

4.6 Government (State and Local)

4.7 Travel and Hospitality

4.8 Consumer Electronics

4.9 Agriculture and Livestock Management

4.10 Extraction and Energy: Oil, Gas, Timber, and Mining

4.11 Food and Beverages

4.12 Education and Training

4.13 Construction and Building Automation

4.14 Robotics and Drones

4.15 Financial Services

4.16 Information and Communications Technology

4.17 Energy Exploration and Distribution

4.18 Textiles and Chemicals

5.0 Company Analysis

5.1 Actsoft Inc.

5.2 ASAP Systems

5.3 AssetPanda

5.4 AT&T

5.5 CalAmp

5.6 Fleet Complete

5.7 GigaTrack

5.8 Microsoft Corporation

5.9 OnAsset Intelligence Inc.

5.10 Oracle Corporation

5.11 Spireon Inc.

5.12 Sprint Corporation

5.13 Tenna

5.14 Trimble Inc.

5.15 Verizon Wireless

5.16 Zebra Technologies

5.17 SAP SE

5.18 Epicor Software Corporation

5.19 JDA Software Group Inc.

5.20 Stanley Black & Decker Inc.

5.21 Honeywell International Inc.

5.22 Ubisense Group Plc.

5.23 Topcon Corporation

5.24 Datalogic S.P.A

5.25 Mojix Inc.

5.26 Impinj Inc.

5.27 Sato Holdings Corporation

5.28 TomTom International BV

5.29 IBM Corporation

5.30 Telit

5.31 Apptricity

5.32 Entigral Systems Inc.

5.33 NimbeLink

5.34 Sierra Wireless Inc. (Numerex)

5.35 ORBCOMM

5.36 Particle

5.37 PTC (ThingWorx)

5.38 Sendum Wireless Corporation

5.39 Senseaware (Fedex)

5.40 Sensitech Inc.

5.41 Sequans

5.42 Starcom

5.43 Telefonica

5.44 TrackX

5.45 Vodafone Limited

5.46 Chekhra Business Solutions

5.47 Lowry Solutions Inc.

5.48 RedBeam Inc.

5.49 TVL Inc. (WiseTrack)

5.50 Wasp Barcode Technologies Inc.

5.51 Jolly Technologies Inc.

5.52 Windward Software

5.53 Brilliant Info Systems Pvt. Ltd.

5.54 Freshworks

5.55 Sortly Inc.

5.56 QBurst

5.57 Northrop Grumman

5.58 Targa Telematics SPA

5.59 Speedshield Technologies (Adaptalift Group)

5.60 Smart Asset Manager Limited

5.61 Quantum Aviation Solutions

5.62 UpKeep Maintenance Management

5.63 PcsInfinity

5.64 Zerion Software Inc.

5.65 Litum IoT

5.66 Advantrack

5.67 Alphabet

5.68 ARI Fleet

5.69 Arvento

5.70 Azuga Fleet

5.71 Blackberry (Radar, QNX)

5.72 Carmalink

5.73 ClearPath GPS

5.74 DriveFactor (or CCC Drive)

5.75 Estrack

5.76 Fleet Safety Institute

5.77 Fleetilla

5.78 Fleetistics

5.79 FleetManager

5.80 FleetMind (Safe Fleet Holdings)

5.81 Fleetup

5.82 Geotab

5.83 Globalstar

5.84 Go Fleet

5.85 GPS Insight

5.86 GPS Trackit

5.87 GSAttrack (Global Satellite Engineering)

5.88 Gurtam

5.89 Inseego

5.90 IntouchGPS (GPSTrackit)

5.91 Lojack

5.92 Lytx

5.93 M2M in Motion

5.94 Mix Telematics

5.95 Momentum IoT

5.96 NexTraq (Michelin)

5.97 Omnitracs

5.98 Passtime

5.99 Pedigree Technologies

5.100 Raven Connected (KlashWerks Inc.)

5.101 Rhino Fleet

5.102 Roambee

5.103 SafeFleet

5.104 Samsara

5.105 Skybitz

5.106 Smart Path GPS

5.107 Teltrac Navman

5.108 T-Mobile

5.109 Zonar Systems (Continental AG)

5.110 Zubie

6.0 Asset Tracking Market Forecasts 2019 – 2024

6.1 Aggregate Global Asset Tracking Market

6.2 Asset Tracking Market by Segment

6.2.1 Asset Tracking Market by Hardware, Software, and Services

6.2.2 Asset Tracking Market by RTLS Type

6.2.3 Asset Tracking Market by RFID

6.2.3.1 Asset Tracking Market by RFID Readers and Tags/Objects

6.2.3.2 Asset Tracking Market by Barcode Type

6.2.3.3 Asset Tracking Market by Barcode Scanner Type

6.2.3.4 Asset Tracking Market by Stationary Barcode Scanner Deployment

6.2.3.5 Asset Tracking Market by Barcode Scanner Technology Labels

6.2.3.6 Asset Tracking Market by Barcode Sticker Type

6.2.3.7 Asset Tracking Market by RFID Type

6.2.3.8 Asset Tracking Market by RFID Tag Type: Passive and Active

6.2.4 Asset Tracking Market by Sensor Type

6.2.5 Asset Tracking Market by Software

6.2.6 Asset Tracking Market by Platform Type

6.2.7 Asset Tracking Market by Service

6.2.8 Asset Tracking Market by Professional Service Type

6.3 Asset Tracking Market by Asset Type

6.4 Asset Tracking Market by Function

6.5 Asset Tracking Market by Application

6.6 Asset Tracking Market by Deployment Type

6.7 Asset Tracking Market by Mobility: Fixed, Portable, and Mobile

6.8 Asset Tracking Market by Wireless Device Type

6.9 Asset Tracking Market by Connectivity Type: Wired and Wireless

6.9.1 Asset Tracking Market by Wired Connectivity

6.9.2 Asset Tracking Market by Wireless Connectivity

6.9.3 Asset Tracking Market by Cellular Connectivity: 3G, LTE, and 5G

6.9.4 Asset Tracking Market by Wireless Connectivity Standard

6.10 Asset Tracking Market by Enterprise Type

6.11 Asset Tracking Market by Industry Vertical

6.12 Asset Tracking Market by Device Segmentation

6.12.1 Asset Tracking Market by Embedded Segment

6.12.2 Asset Tracking Market by Wearable Devices

6.13 Asset Tracking Market by Solution

6.13.1 Asset Tracking Market by Asset Category

6.13.2 Asset Tracking Market by Property Management Category

6.13.3 Asset Tracking Market by Facility Management Category

6.13.4 Asset Tracking Market by Fleet Management

6.13.4.1 Fleet Tracking Market by Land and Non-Land Based Vehicles

6.13.4.2 Asset Tracking Market by Fleet Land Based Vehicle Type

6.13.4.3 Asset Tracking Market by Commercial/Industrial Fleet Type

6.13.4.4 Asset Tracking Market in Fleets by Truck and Van Type

6.13.4.5 Asset Tracking Market in Fleets by Long Haul Tracking Type

6.13.4.6 Asset Tracking Market in Fleets by Truck Wheel Size

6.13.4.7 Asset Tracking Market in Fleets by Truck Length

6.13.4.8 Asset Tracking Market by Fleet Service Vehicle Type

6.13.4.9 Asset Tracking Market by Fleet Trailer Type

6.13.4.10 Asset Tracking Market in Fleets by Bus Type

6.13.4.11 Asset Tracking Market in Fleets by Service Bus Type

6.13.4.12 Asset Tracking Market by Consumer/Personal Fleet

6.13.4.13 Asset Tracking Market by Special Purpose Fleet

6.13.5 Asset Tracking in Specialized Market Segments

6.13.5.1 Asset Tracking in Smart Buildings Market

6.13.5.2 Asset Tracking in Smart Workplace Market

6.13.5.3 Asset Tracking in Smart Cities Market

6.13.6 Asset Tracking Market by Non-Roadway Based Vehicle Type

6.13.6.1 Asset Tracking Market by Aviation Vehicle and Support Equipment

6.13.6.2 Asset Tracking Market by Railway Vehicle and Equipment

6.13.6.3 Asset Tracking Market by Water Based Vehicle Type

6.14 Asset Tracking Market by Technology Components

6.15 Asset Tracking Market by Technology Support and Integration

6.15.1 AI Algorithm Driven Asset Tracking Market

6.15.1.1 AI Algorithm Driven Asset Tracking Embedded Market

6.15.1.2 Asset Tracking Market by AI Technology Type

6.15.2 Big Data Storage and Analytics Market in Asset Tracking

6.15.3 Asset Tracking Software Market

6.15.4 Blockchain Supported Asset Tracking Market

6.15.5 Asset Tracking Market by Cloud Deployment

6.15.6 Asset Tracking in 5G Market

6.16 Asset Tracking Market by Region

6.16.1 APAC Asset Tracking Market by Country

6.16.2 North America Asset Tracking Market by Country

6.16.3 Europe Asset Tracking Market by Country

6.16.4 Middle East and Africa Asset Tracking Market by Country

6.16.5 Latin America Asset Tracking Market by Country

6.17 Asset Tracking Market by Unit Deployment

6.17.1 Asset Tracking Market Unit Deployment by Segment

6.17.2 Asset Tracking Unit Deployment by Location Determination

6.17.2.1 Asset Tracking Unit Deployment by RFID

6.17.2.1.1 Asset Tracking Unit Deployment by Readers and Tags

6.17.2.1.2 Asset Tracking Unit Deployment by Barcode Type

6.17.2.1.3 Asset Tracking Unit Deployment by Barcode Scanner Type

6.17.2.1.4 Asset Tracking Unit Deployment by Barcode Scanner Deployment Type

6.17.2.1.5 Asset Tracking Unit Deployment by Barcode Scanner Technology Labels

6.17.2.1.6 Asset Tracking Unit Deployment by Barcode Sticker Type

6.17.2.1.7 Asset Tracking Unit Deployment by RFID Type

6.17.2.1.8 Asset Tracking Unit Deployment by RFID Tags Type

6.17.3 Asset Tracking Unit Deployment by Sensors Type

6.17.4 Asset Tracking Unit Deployment by Software Type

6.17.5 Asset Tracking Software Unit Deployment by Platform Type

6.17.6 Asset Tracking Unit Deployment by Embedded Systems

6.17.6.1 Asset Tracking Unit Deployment by Wearable Device

6.17.6.2 Asset Tracking Unit Deployment by Embedded System

6.17.7 Asset Tracking Market Unit Deployment by Asset Category

6.17.7.1 Asset Tracking Unit Deployment by Property Management

6.17.7.2 Asset Tracking Unit Deployment by Facility Management

6.17.7.3 Asset Tracking Unit Deployment by Fleet Management

6.17.7.3.1 Fleet Tracking Unit Deployment by Land and Non-Land Vehicle

6.17.7.3.2 Asset Tracking Unit Deployment by Land Based Vehicle Type

6.17.7.3.3 Asset Tracking Unit Deployment by Commercial Fleet Type

6.17.7.3.4 Asset Tracking Unit Deployment by Truck and Van Type

6.17.7.3.5 Asset Tracking Unit Deployment by Long Haul Tracking Type

6.17.7.3.6 Asset Tracking Unit Deployment by Truck Number of Wheels

6.17.7.3.7 Asset Tracking Unit Deployment by Truck Length

6.17.7.3.8 Asset Tracking Unit Deployment by Service Vehicle Type

6.17.7.3.9 Asset Tracking Unit Deployment by Trailer Type

6.17.7.3.10 Asset Tracking Unit Deployment by Bus Type

6.17.7.3.11 Asset Tracking Unit Deployment by Service Bus Type

6.17.7.3.12 Asset Tracking Unit Deployment by Consumer/Personal Fleet Type

6.17.7.3.13 Asset Tracking Unit Deployment by Special Purpose Fleet Type

6.17.7.3.14 Asset Tracking Unit Deployment by Roadway Based Vehicle Type

6.17.7.3.15 Asset Tracking Unit Deployment by Aviation Vehicle and Machinery Type

6.17.7.3.16 Asset Tracking Unit Deployment by Railway Vehicle and Equipment Type

6.17.7.3.17 Asset Tracking Unit Deployment by Water Based Vehicle Type

6.17.8 AI Supported Asset Tracking Unit Deployment

6.17.8.1 AI Embedded Asset Tracking Unit Deployment

6.17.8.2 AI Embedded Asset Tracking Unit Deployment by Segment

6.17.8.3 AI Embedded Asset Tracking Unit Deployment by Technology

6.17.9 Asset Tracking Unit Deployment by Region

6.17.9.1 APAC Asset Tracking Unit Deployment by Country

6.17.9.2 North America Asset Tracking Unit Deployment by Country

6.17.9.3 Europe Asset Tracking Unit Deployment by Country

6.17.9.4 Middle East and Africa Asset Tracking Unit Deployment by Country

6.17.9.5 Latin America Asset Tracking Unit Deployment by Country

7.0 Conclusions and Recommendations

7.1 Advertisers and Media Companies

7.2 Artificial Intelligence Providers

7.3 Automotive Companies

7.4 Broadband Infrastructure Providers

7.5 Communication Service Providers

7.6 Computing Companies

7.7 Data Analytics Providers

7.8 Immersive Technology (AR, VR, and MR) Providers

7.9 Equipment (Asset Tracking) Providers

7.10 Networking Equipment Providers

7.11 Networking Security Providers

7.12 Semiconductor Companies

7.13 IoT Suppliers and Service Providers

7.14 Software Providers

7.15 Smart City System Integrators

7.16 Automation System Providers

7.17 Social Media Companies

7.18 Workplace Solution Providers

7.19 Enterprise and Government

Figures

Figure 1: Asset Tracking System

Figure 2: Asset Tracking Technology Timeline

Figure 3: 3D Simulation Platform

Figure 4: Multi-Site Asset Location Tracking

Figure 5: Real Time GPS Satellite based Vehicle Tracking

Figure 6: GPS based Industrial Fleet Tracking

Figure 7: Asset Tracking Industry Adoption Trends

Figure 8: In-Flight Asset Management

Figure 9: Public Infrastructure Tracking

Figure 10: Medical Inventory Tracking and Management

Figure 11: RFID Tag based Industrial Asset Tracking

Figure 12: Satellite based Disaster Tracking Management

Figure 13: Construction Asset Tracking

Figure 14: NimbeLink Asset Tracking System

Figure 15: Global Consolidated Asset Tracking Market 2019 – 2024

Figure 16: Global IoT Driven Asset Tracking Market 2019 – 2024

Figure 17: Global Asset Tracking in Smart Buildings Market 2019 – 2024

Figure 18: Global Asset Tracking Market in Smart Workplace 2019 – 2024

Figure 19: Global Asset Tracking Software in Smart Building 2019 – 2024

Figure 20: Global Asset Tracking Market in Smart Cities 2019 – 2024

Figure 21: Global AI Algorithm Driven Asset Tracking Market 2019 – 2024

Figure 22: Global Big Data Storage and Analytics in Asset Tracking Market 2019 – 2024

Figure 23: Global Asset Tracking Software Market 2019 – 2024

Figure 24: Global Blockchain Supported Asset Tracking Market 2019 – 2024

Figure 25: Global Asset Tracking Market by Aggregate Cloud Deployment 2019 – 2024

Figure 26: Global Asset Tracking Market in Edge Networks 2019 – 2024

Figure 27: Global Asset Tracking Market in 5G 2019 – 2024

Figure 28: Global Asset Tracking Unit Deployment 2019 – 2024

Figure 29: Global IoT Driven Asset Tracking Unit Deployment 2019 – 2024

Figure 30: Global AI Embedded Asset Tracking Unit Deployment 2019 – 2024

Figure 31: Future of Asset Tracking Market is Long Tail Assets

Tables

Table 1: Global Asset Tracking Market by H/W, S/W, and Services 2019 – 2024

Table 2: Global Asset Tracking Market by RTLS Type 2019 – 2024

Table 3: Global Asset Tracking Market by RFID Readers and Tags/Objects 2019 – 2024

Table 4: Global Asset Tracking Market by Barcode Type 2019 – 2024

Table 5: Global Asset Tracking Market by Barcode Scanner Type 2019 – 2024

Table 6: Global Asset Tracking Market by Stationary Barcode Scanner Deployment Type 2019 – 2024

Table 7: Global Asset Tracking Market by Barcode Scanner Technology Labels 2019 – 2024

Table 8: Global Asset Tracking Market by Barcode Sticker Type 2019 – 2024

Table 9: Global Asset Tracking Market by RFID Type 2019 – 2024

Table 10: Global Asset Tracking Market by RFID Tags Type 2019 – 2024

Table 11: Global Asset Tracking Market by Sensor Type 2019 – 2024

Table 12: Global Asset Tracking Market by Software Type 2019 – 2024

Table 13: Global Asset Tracking Market by Platform Type 2019 – 2024

Table 14: Global Asset Tracking Market by Service Type 2019 – 2024

Table 15: Global Asset Tracking Market by Professional Service Type 2019 – 2024

Table 16: Global Asset Tracking Market by Asset Types 2019 – 2024

Table 17: Global Asset Tracking Market by Functions 2019 – 2024

Table 18: Global Asset Tracking Market by Application 2019 – 2024

Table 19: Global Asset Tracking Market by Deployment Type 2019 – 2024

Table 20: Global Asset Tracking Market by Cloud Deployment Type 2019 – 2024

Table 21: Global Asset Tracking Market by Mobility Type 2019 – 2024

Table 22: Global Asset Tracking Market by Wireless Device Type 2019 – 2024

Table 23: Global Asset Tracking Market by Connectivity Type 2019 – 2024

Table 24: Global Asset Tracking Market by Wired Connectivity Type 2019 – 2024

Table 25: Global Asset Tracking Market by Wireless Connectivity Type 2019 – 2024

Table 26: Global Asset Tracking Market by Cellular Connectivity Type 2019 – 2024

Table 27: Global Asset Tracking Market by Connectivity Standard 2019 – 2024

Table 28: Global Asset Tracking Market by Enterprise Type 2019 – 2024

Table 29: Global Asset Tracking Market by Industry Vertical 2019 – 2024

Table 30: Global IoT Driven Asset Tracking Market by Embedded Segment 2019 – 2024

Table 31: Global IoT Driven Asset Tracking Market by Wearable Device Type 2019 – 2024

Table 32: Global IoT Driven Asset Tracking Market by Asset Category 2019 – 2024

Table 33: Global IoT Driven Asset Tracking Market by Property Management Category 2019 – 2024

Table 34: Global IoT Driven Asset Tracking Market by Facility Management Category 2019 – 2024

Table 35: Global IoT Driven Asset Tracking Market by Fleet Management Category 2019 – 2024

Table 36: Global IoT Driven Asset Tracking Market by Land Based Vehicle Type 2019 – 2024

Table 37: Global IoT Driven Asset Tracking Market by Commercial/Industrial Fleet Type 2019 – 2024

Table 38: Global IoT Driven Asset Tracking Market by Trucks and Van Type 2019 – 2024

Table 39: Global IoT Driven Asset Tracking Market by Long Haul Tracking (LHT) Type 2019 – 2024

Table 40: Global IoT Driven Asset Tracking Market by LHT Wheeler Type 2019 – 2024

Table 41: Global IoT Driven Asset Tracking Market by LHT Length Type 2019 – 2024

Table 42: Global IoT Driven Asset Tracking Market by Service Vehicle Type 2019 – 2024

Table 43: Global IoT Driven Asset Tracking Market by Fleet Trailers Type 2019 – 2024

Table 44: Global IoT Driven Asset Tracking Market by Bus Type 2019 – 2024

Table 45: Global IoT Driven Asset Tracking Market by Service Bus Type 2019 – 2024

Table 46: Global IoT Driven Asset Tracking Market by Consumer/Personal Fleet Type 2019 – 2024

Table 47: Global IoT Driven Asset Tracking Market by Special Purpose Fleet Type 2019 – 2024

Table 48: Global IoT Driven Asset Tracking Market by Non-Land Based Vehicle Type 2019 – 2024

Table 49: Global IoT Driven Asset Tracking Market by Aviation Vehicle and Machinery Type 2019 – 2024

Table 50: Global IoT Driven Asset Tracking Market by Railway Vehicle and Equipment Type 2019 – 2024

Table 51: Global IoT Driven Asset Tracking Market by Water Based Vehicle Type 2019 – 2024

Table 52: Global IoT Driven Asset Tracking Market by Technology Component Type 2019 – 2024

Table 53: Global AI Algorithm Driven Asset Tracking Market by Embedded Systems 2019 – 2024

Table 54: Global AI Algorithm Driven Asset Tracking Market by Technology 2019 – 2024

Table 55: Global Big Data Storage and Analytics in Asset Tracking Market by Segment 2019 – 2024

Table 56: Global Asset Tracking Market in 5G by Segment 2019 – 2024

Table 57: Global Asset Tracking Market by Region 2019 – 2024

Table 58: APAC Asset Tracking Market by Leading Country 2019 – 2024

Table 59: North America Asset Tracking Market by Leading Country 2019 – 2024

Table 60: Europe Asset Tracking Market by Leading Country 2019 – 2024

Table 61: MEA Asset Tracking Market by Leading Country 2019 – 2024

Table 62: Latin America Asset Tracking Market by Leading Country 2019 – 2024

Table 63: Global Asset Tracking Unit Deployment by Segment 2019 – 2024

Table 64: Global Asset Tracking Unit Deployment by Location Determination Hardware Type 2019 – 2024

Table 65: Global Asset Tracking Unit Deployment by RTLS Type 2019 – 2024

Table 66: Global Asset Tracking Unit Deployment by Barcode Type 2019 – 2024

Table 67: Global Asset Tracking Unit Deployment by Barcode Scanner Type 2019 – 2024

Table 68: Global Asset Tracking Unit Deployment by Barcode Scanner Deployment Type 2019 – 2024

Table 69: Global Asset Tracking Unit Deployment by Barcode Scanner Technology Labels 2019 – 2024

Table 70: Global Asset Tracking Unit Deployment by Barcode Sticker Type 2019 – 2024

Table 71: Global Asset Tracking Unit Deployment by RFID Type 2019 – 2024

Table 72: Global Asset Tracking Unit Deployment by RFID Tags Type 2019 – 2024

Table 73: Global Asset Tracking Unit Deployment by Sensors Type 2019 – 2024

Table 74: Global Asset Tracking Unit Deployment by Software Type 2019 – 2024

Table 75: Global Asset Tracking Software Unit Deployment by Platform Type 2019 – 2024

Table 76: Global IoT Driven Asset Tracking Unit Deployment by Segment 2019 – 2024

Table 77: Global IoT Driven Asset Tracking Unit Deployment by Embedded Device Type 2019 – 2024

Table 78: Global IoT Driven Asset Tracking Unit Deployment by Embedded System Type 2019 – 2024

Table 79: Global IoT Driven Asset Tracking Unit Deployment by Property Management Category 2019 – 2024

Table 80: Global IoT Driven Asset Tracking Unit Deployment by Facility Management Category 2019 – 2024

Table 81: Global IoT Driven Asset Tracking Unit Deployment by Fleet Management Category 2019 – 2024

Table 82: Global IoT Driven Asset Tracking Unit Deployment by Land Based Vehicle Type 2019 – 2024

Table 83: Global IoT Driven Asset Tracking Unit Deployment by Commercial/Industrial Fleet Type 2019 – 2024

Table 84: Global IoT Driven Asset Tracking Unit Deployment by Trucks and Van Type 2019 – 2024

Table 85: Global IoT Driven Asset Tracking Unit Deployment by Long Haul Tracking (LHT) Type 2019 – 2024

Table 86: Global IoT Driven Asset Tracking Unit Deployment by LHT Wheeler Type 2019 – 2024

Table 87: Global IoT Driven Asset Tracking Unit Deployment by LHT Length Type 2019 – 2024

Table 88: Global IoT Driven Asset Tracking Unit Deployment by Service Vehicle Type 2019 – 2024

Table 89: Global IoT Driven Asset Tracking Unit Deployment by Fleet Trailers Type 2019 – 2024

Table 90: Global IoT Driven Asset Tracking Unit Deployment by Types of Bus 2019 – 2024

Table 91: Global IoT Driven Asset Tracking Unit Deployment by Service Bus Types 2019 – 2024

Table 92: Global IoT Driven Asset Tracking Unit Deployment by Consumer/Personal Fleet Types 2019 – 2024

Table 93: Global IoT Driven Asset Tracking Unit Deployment by Special Purpose Fleet Types 2019 – 2024

Table 94: Global IoT Driven Asset Tracking Unit Deployment by Non-Land Based Vehicle Types 2019 – 2024

Table 95: Global IoT Driven Asset Tracking Unit Deployment by Aviation Vehicle and Machinery Types 2019 – 2024

Table 96: Global IoT Driven Asset Tracking Unit Deployment by Railway Vehicle and Equipment Types 2019 – 2024

Table 97: Global IoT Driven Asset Tracking Unit Deployment by Water Based Vehicle Types 2019 – 2024

Table 98: Global AI Embedded Asset Tracking Unit Deployment by Segment 2019 – 2024

Table 99: Global AI Embedded Asset Tracking Unit Deployment by Technology 2019 – 2024

Table 100: Asset Tracking Unit Deployment by Region 2019 – 2024

Table 101: APAC Asset Tracking Unit Deployment by Country 2019 – 2024

Table 102: North America Asset Tracking Unit Deployment by Country 2019 – 2024

Table 103: Europe Asset Tracking Unit Deployment by Country 2019 – 2024

Table 104: Middle East and Africa Asset Tracking Unit Deployment by Country 2019 – 2024

Table 105: Latin America Asset Tracking Unit Deployment by Country 2019 – 2024