|

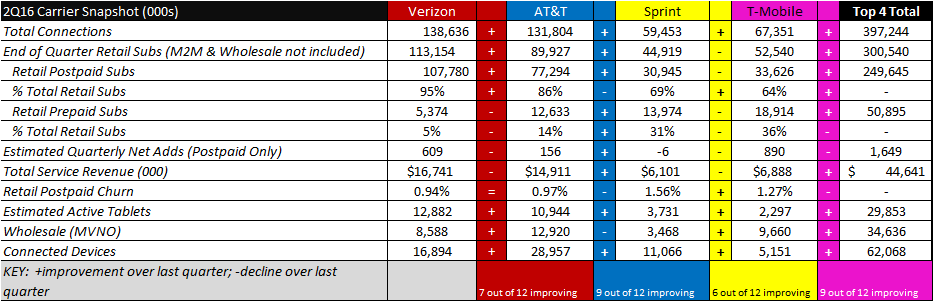

Compass Intelligence just completed the final assessment of Q2 subscribers and connections including the comparisons to Q1 2016 in terms of improvements and declines for the U.S, Wireless Carrier market. We do this each quarter to understand the subscriber and share changes, as well as evaluate the key trends taking place in the wireless industry for both consumer and B2B. We have been tracking the quarterly metrics since 2007. Some metrics are our own internal modeling and estimates, as the market does not report in all categories. A snapshot of Q2 2016 is below. Compass Intelligence compared last quarter’s results to this quarter to show which metrics showed improvement over others (denoted by + or -). Source: Compass Intelligence, 2016 Below are additional thoughts and insights based on the quarter and annual performance:

Final Word – The industry has reached 73% saturation among smartphone subscribers and overall service revenue has declined by 1.9%. Two avenues for major growth are centered around IoT and content. Content drives access to applications, which in turn provides increased growth and usage of data, video, and other more interactive services. The industry is seeking out new avenues for revenue and profit, including through new content revenue streams demonstrated by the recent acquisitions of Verizon with Yahoo! (and AOL) and AT&T with DirecTV. IoT growth has primarily been driven around the connected vehicle and connected home, but the industry becomes even more interesting as the carriers leverage their new content partners to offer new offerings to entice through the use of media, games, sports, streaming TV/music, news, weather, and much more. Expect to see exciting announcements in Q3 and Q4 in how the carriers will leverage content to reduce churn, and offer new revenue streams that may be noticed on the backend, meaning customers may require MORE data. As for IoT and connected devices, the industry is experiencing an overall 17.9% growth in reported numbers from a year ago but we have yet to really hear on a quarterly basis the overall revenue generated from IoT alone. Verizon reported about 3 quarters back and we have seen some anecdotal tidbits here and there, but the industry and Wall Street will be pushing for more of that detail in the near future. Also, keep in mind, that some of the reported numbers for connected devices also include activated tablets (for example at US Cellular). IoT, M2M, and connected devices reached 62.4M in Q2 just in the U.S. alone. Comments are closed.

|

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed