|

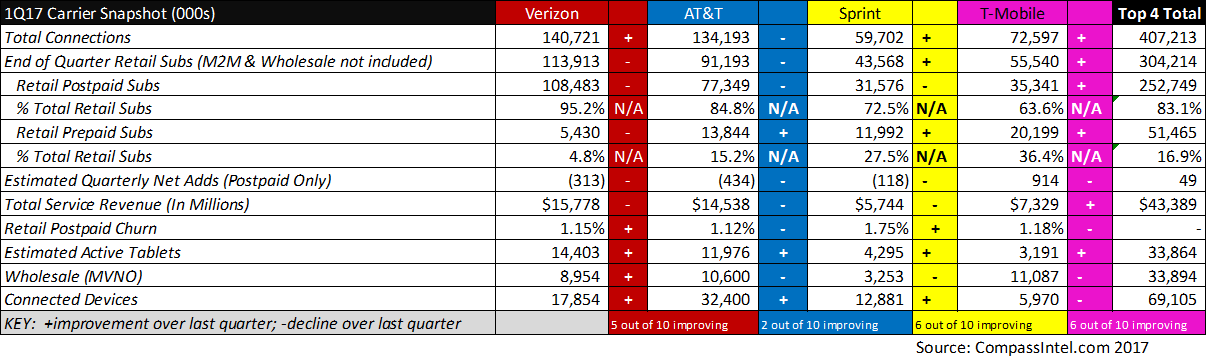

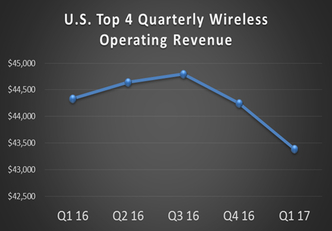

Q1 2017 and End of Year Assessment of the “Top 4 Mobile Carriers” Who is winning and starting the year off right? It is a busy time of year and we are still playing catch up, so we apologize for the delay in getting this update out. Compass Intelligence just completed the final assessment of Q1 2017 and the evaluation and comparisons to previous quarters in 2016 in terms of improvements and declines. We do this each quarter to understand the subscriber and share changes, as well as evaluate the key trends taking place in the wireless industry for both consumer and B2B. We have been tracking the quarterly metrics since 2007. Some metrics are our own internal modeling and estimates, as the market does not report in all categories. A few highlights from Q1 include:

Below are additional thoughts and insights based on the quarter and annual performance:

Comments are closed.

|

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed