|

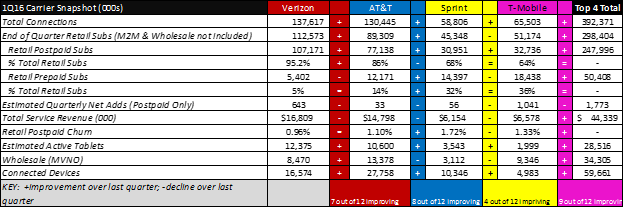

All four carriers have finished up their earnings calls, and Compass Intelligence just completed the final assessment of Q1 and also evaluated the comparisons to Q4 2015 in terms of improvements and declines. We do this each quarter to understand the subscriber and share changes, as well as evaluate the key trends taking place in the wireless industry for both consumer and B2B. We have been tracking the quarterly metrics since 2007. Some metrics are our own internal modeling and estimates, as the market does not report in all categories. A snapshot of Q1 2016 is below. Compass Intelligence compared last quarter’s results to this quarter to show which metrics showed improvement over others (denoted by + or -). Source: Compass Intelligence Below are additional thoughts and insights based on the quarter and annual performance:

Final Word – The industry is experiencing growth slowdown, especially in terms of smartphone subscriber additions. Most of the growth continues to come from connected devices, and at this point most of these connections bring little overall revenue for the carriers as shown in their declining service revenues. Carriers will need to expand their offerings to include additional services to the enterprise to provide new revenue streams. Many of the carriers have pushed new promotions by partnering with content providers, which is really doing nothing more than to reduce churn and support the existing customer base. Compass Intelligence also expects the cable operators to begin launching their own mobile initiatives through partnerships and other wholesale relationships. This is expected to further disrupt the market, as businesses and consumers seek to simplify their existing services and vendors. To DOWNLOAD this full report, click HERE. Compass Intelligence, LLC 8055 State Highway 173 N Bandera, TX 78003 www.compassintelligence.com 830.796.4498 Comments are closed.

|

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed