|

Reposted from IoT Analytics Disclaimer: This article does not provide guidance or intend to compare technical features of different IoT platforms. It looks at the market and compares platforms purely on a market meta level. Key findings of the IoT Platform Comparison:

In the recent update to our IoT Platform Company List for 2017, we compared more than 450 companies that have an IoT Platform in their offering. After including 260 IoT Platforms in our 2015 analysis and 360 in 2016 analysis, the 450 companies assessed in our latest research set a new record. This IoT Platform comparison looked at 5 types of different IoT platforms:

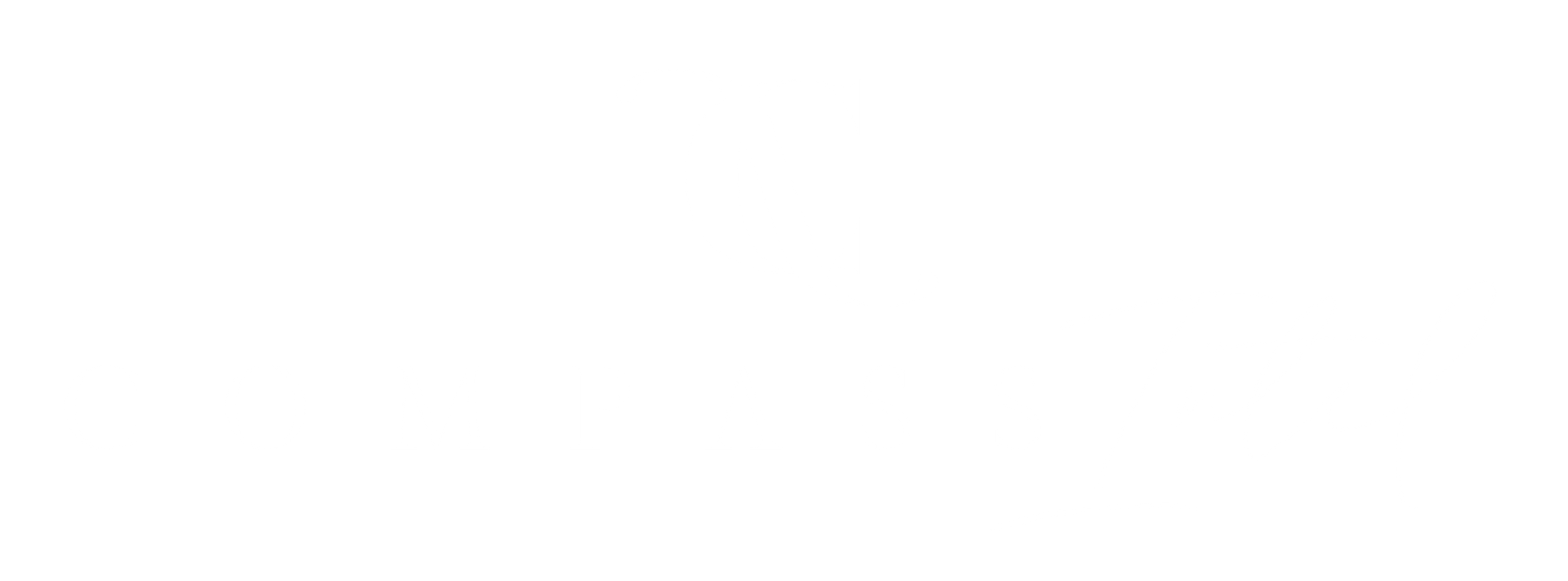

IoT Platform Comparison Insight 1: Market remains fragmented Although some firms claim billion-dollar revenue streams through IoT, our IoT Platform Comparison continues to show that these claims are mostly pure marketing. In the last year, we followed-up at least two such claims with larger vendors and found that they claimed new “IoT” revenue that had actually been relabelled from previously existing revenue. Furthermore, the sales figures included expensive hardware equipment and only very little software revenue. “Half of all IoT Platform companies made less than $1M in 2016” We believe, only 7% of the 450 IoT Platform companies generated revenues in excess of $10M with their IoT Platforms in 2016. Furthermore, more than half of all companies made less than $1M, most of them smaller startups. The firms leading the pack are mainly made up of large cloud players, legacy device management and connectivity backend platforms as well as a handful of heavily backed Silicon Valley startups that are scaling faster than most of their counterparts around the world. Successful startup examples include predictive analytics firm Uptake and the open Smart Home Platform SmartThings, acquired by Samsung in 2014 and now acting as their subsidiary. Note: The IoT Platform Revenue was estimated based on various indicators and public announcements. It only includes software generated sales for real IoT deployments, including merely external solutions and not internal deployments e.g., on a company’s own equipment. IoT Platform Comparison Insight 2: Leading providers are growing at 50%+ The consensus growth estimate for IoT markets, as provided by various analyst firms, lies between 25% and 40% annual growth for the next 5 years. Many of the IoT Platform Companies, however currently report numbers well above the forecast. A few smaller startups have stated that they are currently doubling revenue each year – but even leading providers recently reported growth rates above 50%. Three examples:

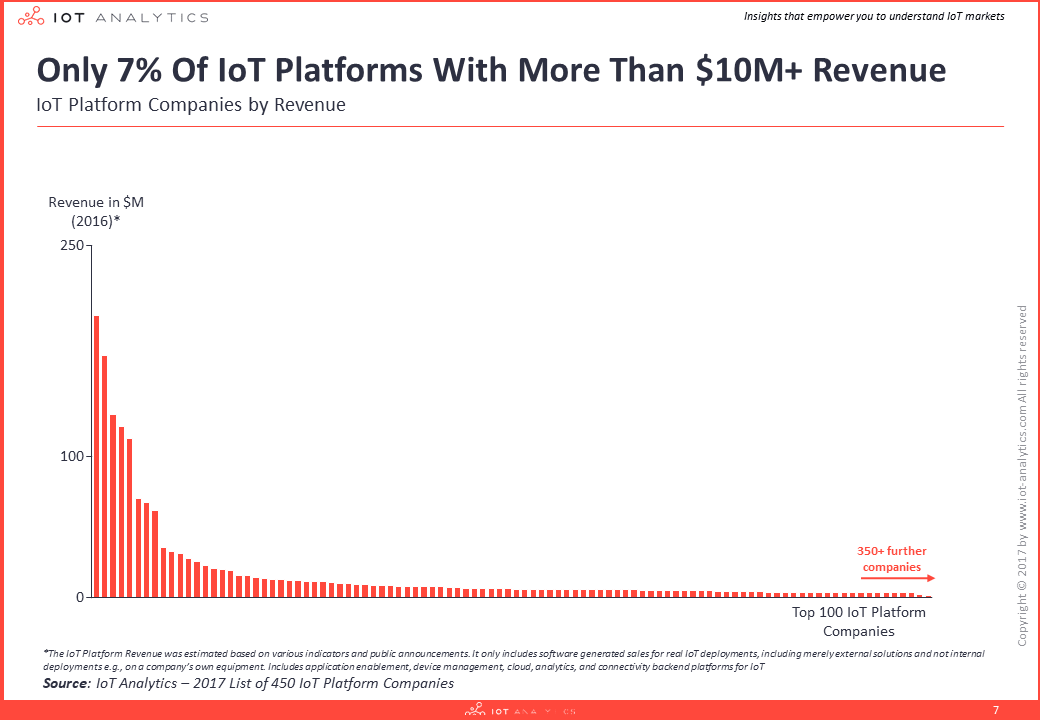

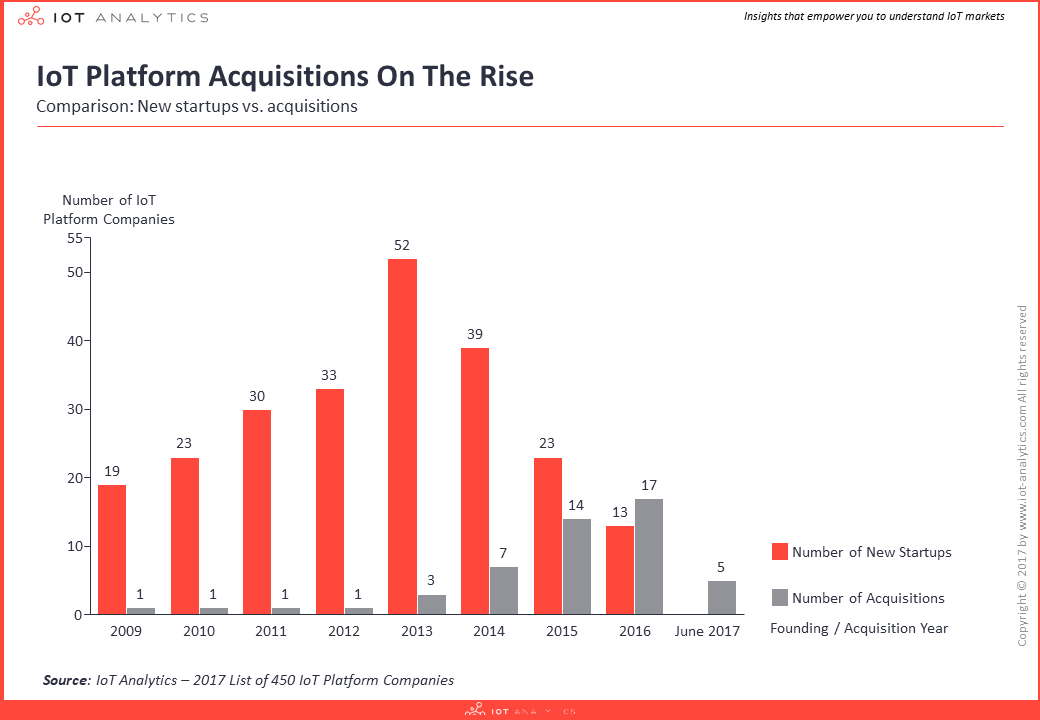

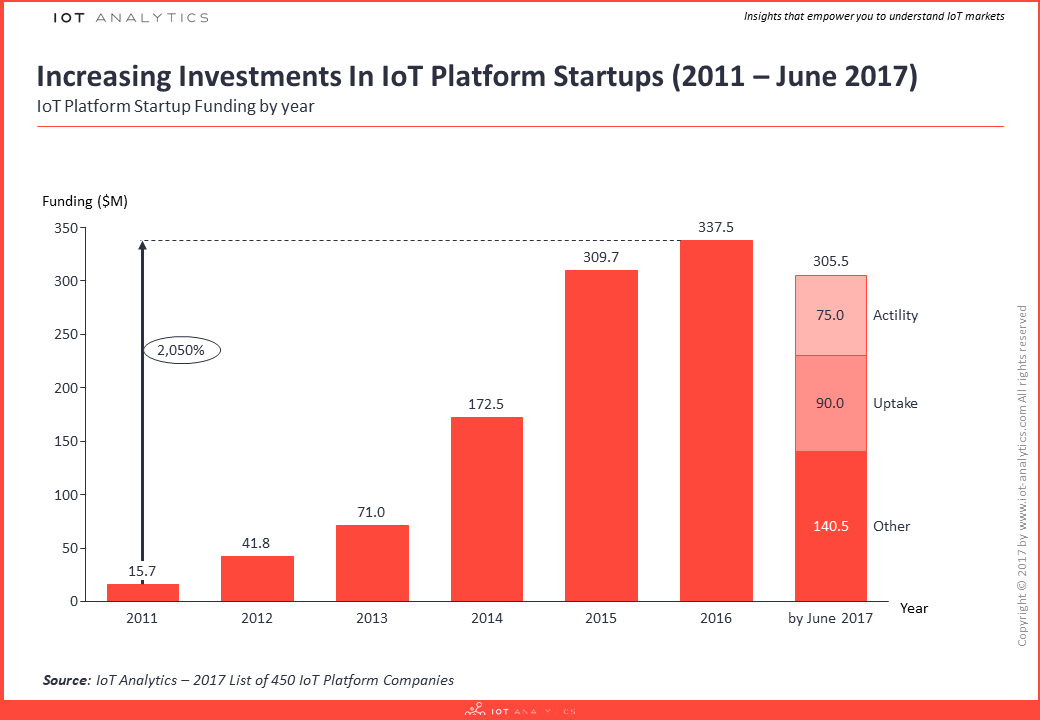

IoT Platform Comparison Insight 3: One third of platforms cater to the Industrial / manufacturing segment There are generally more IoT Platform Companies focusing on Business/Enterprise IoT than Consumer IoT. The most popular segment for IoT Platforms lies in manufacturing and industrial solutions. 32% of the IoT Platform Companies offer solutions for this market including industrial automation firms like Siemens, ABB, Schneider or Bosch but also software vendors like IBM, PTC or Microsoft. Typical supported use cases include production performance management, manufacturing analytics, predictive maintenance and remote service. The IoT Platform Comparison reveals that the other large segments are Smart Cities (22%), Smart Home (21%) and Energy (21%). Customer Health is the least popular segment for IoT Platforms, with only 5% of all IoT Platforms offering solutions. These results concur with our analysis of the top IoT application areas, in which the 4 leading segments were Connected Industry, Smart City, Smart Energy and Connected Car. IoT Platform Comparison Insight 4: Increasing M&A activity – 17 deals last year According to our analysis, the number of new IoT Platform startups reached its peak in 2013, with numbers going down ever since. Startups coming to market in 2016 have a different focus than those that started in 2013 or earlier: Back then many of the startups had a horizontal, cross-industry approach to IoT while nowadays there seems to be a higher numbers of niche IoT Platforms that are specialized by vertical, technology or use case. Examples are: Axonize, an IoT platform for System Integrators or Tachyus, an IoT Platform for the Oil & Gas Industry. Meanwhile the number of acquisitions in the IoT Platform market is on the rise. 2016 was the first year in which the number of newly acquired companies (17) rose higher than the number of startups we identified (13)*. The deal value of the 6 acquisitions that disclosed the purchasing price lies around $11B. Most of the acquisitions are performed by tech firms that play in the vicinity of IoT but lack IoT platform capabilities. The acquisition of Cumulocity by Software AG earlier in 2017 is a good example for an analytics and enterprise software focused company completing their offering by acquiring a pure-play IoT Platform vendor. Our IoT Platform Comparison shows that there are a total of 31 IoT Platform companies, which have been acquired and whose platform is still available today, operating under the original name. Furthermore, there are 21 companies whose platform is no longer available after having been acquired. All acquisitions can be found in a separate tab in our 2017 IoT Platforms Database. *Note: Many startups only become visible after a few years IoT Platform Comparison Insight 5: Startup investment remains comparably insignificant Funding for IoT Platform startups has risen sharply between 2011 and 2016.

“IoT Platform funding is insignificant. Ride sharing platform Uber received 14x more funding in 2016 than all IoT Platforms combined” However, IoT Platform funding is insignificant compared to mature tech topics. Just consider that in 2016, ride sharing platform Uber received 14x more funding than all IoT platforms combined in the same year ($4.9B vs. $338M). Half of the IoT Platform funding issued in 2017 so far went to two companies (Actility and Uptake). Neither of them are pure-play IoT Platform firms. Actility, a LPWA solution provider that runs the Thingpark platform which caters mostly to Lora deployments, received funding of $50M in April 2017. Cisco investments is one of the named investors. Uptake, an analytics platform which was founded in 2014, achieved the impressive funding round of $90M in Series B. Notable investors in the IoT Platform space besides Cisco Investments (e.g., invested in Actility, Ayla Networks, EVRYTHNG, Relayr, Sensity Systems) include Intel Capital, GE Ventures, New Enterprise Associates (NEA) and Kleiner Perkins Caufield & Byers (KPCB). For more information or to get access to the full report, please visit our STORE. |

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Categories

All

|

RSS Feed

RSS Feed