- Mobile & Wireless

- >

- 5G, IoT, and Mobile Edge Computing 2019 – 2024

5G, IoT, and Mobile Edge Computing 2019 – 2024

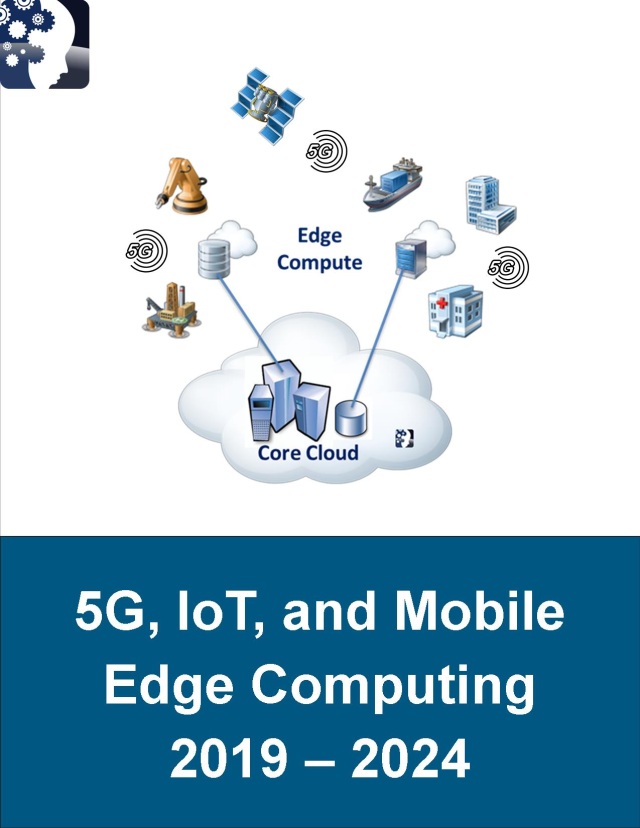

This research assesses 5G technologies and solutions in support of IoT. The report evaluates certain key solutions such as 5G enabled Mobile Edge Computing (MEC) and managed services for devices and other IoT “things”. The report also analyzes the impact of 5G in IoT across infrastructure components including hardware, processors, embedded devices, software, and cloud-based service platforms. It also evaluates the telecom and IT ecosystem in support of MEC including communications and computing infrastructure providers, managed services vendors, carriers and OTT providers.

The edge computing portion of this market analysis includes a focus on company strategies and offerings relative to current and anticipated future market needs. It also provides quantitative analysis of the MEC market including segmentation by industry vertical, region of the world, application and services. It also provides forecasts for MEC based streaming data and real-time data analytics. It also includes analysis focused on the role and importance of edge computing for both industry-specific implementations, such as private wireless in industrial automation, and public edge application support, such as consumer virtual reality.

As the size of IoT systems grow to large scale, their scope will also increase in terms of the impact on enterprise systems and consumers everyday lives. 5G will optimize IoT networks by way of radio frequency management that meets the needs of both narrowband IoT applications as well as those that require higher bandwidth, which may be on an on-demand basis. IoT solutions will benefit greatly from the implementation of 5G as cellular providers deploy Low Power WAN (LPWAN) IoT network capabilities. Initial deployments of IoT LPWANs have been non-cellular solutions based on proprietary technologies.

Published: December 2019

Pages: 403

Pricing by License - Global Enterprise License: $ 7,000 USD

Overview:

This research assesses 5G technologies and solutions in support of IoT. The report evaluates certain key solutions such as 5G enabled Mobile Edge Computing (MEC) and managed services for devices and other IoT “things”. The report also analyzes the impact of 5G in IoT across infrastructure components including hardware, processors, embedded devices, software, and cloud-based service platforms. It also evaluates the telecom and IT ecosystem in support of MEC including communications and computing infrastructure providers, managed services vendors, carriers and OTT providers.

The edge computing portion of this market analysis includes a focus on company strategies and offerings relative to current and anticipated future market needs. It also provides quantitative analysis of the MEC market including segmentation by industry vertical, region of the world, application and services. It also provides forecasts for MEC based streaming data and real-time data analytics. It also includes analysis focused on the role and importance of edge computing for both industry-specific implementations, such as private wireless in industrial automation, and public edge application support, such as consumer virtual reality.

As the size of IoT systems grow to large scale, their scope will also increase in terms of the impact on enterprise systems and consumers everyday lives. 5G will optimize IoT networks by way of radio frequency management that meets the needs of both narrowband IoT applications as well as those that require higher bandwidth, which may be on an on-demand basis. IoT solutions will benefit greatly from the implementation of 5G as cellular providers deploy Low Power WAN (LPWAN) IoT network capabilities. Initial deployments of IoT LPWANs have been non-cellular solutions based on proprietary technologies.

The industry will see emerging standards such as Narrowband IoT (NB-IoT) assuming a dominant role for certain IoT applications. We see many industry verticals willing to pay a premium over non-cellular LPWAN, enhanced flexibility, and improved capabilities associated with IoT on 5G networks. The use of 5G for Industrial IoT (IIoT) networks in particular will be of great importance to enterprise IIoT in certain industry verticals such as agriculture, logistics, and manufacturing. For example, we see IIoT in agriculture benefitting through the use of Unmanned Aerial Vehicle (UAV) operation over 5G networks due to ultra-low latency and high capacity availability.

Deployed in conjunction with 5G, Mobile Edge Computing (MEC),will facilitate an entirely new class of low-power devices for IoT networks and systems. These devices will rely upon MEC equipment for processing. Stated differently, some IoT devices will be very light-weight computationally speaking, relying upon edge computing nodes for most of their computation needs. MEC is also important to 5G for non-IoT applications as support for improved mobile broadband (ultra-fast and high definition video, enhanced web browsing, etc.) and Ultra Reliable Low Latency Communications (URLLC) dependent apps (virtual reality, UAV operation, autonomous vehicles, robotics, etc.).

Select Research Findings:

- 5G and IoT enabled smart machines represent a $1.2B global opportunity by 2024

- Device-level SLAs will be crucial for ensuring enterprise and industrial QoS requirements

- 5G is a must for in-building private wireless networks in support of ultra-reliable IoT applications

- Application revenue for edge computing in 5G will reach 40% of infrastructure spending by 2024

- Driven by edge computing, micro-datacenters represent a $1.9B USD opportunity globally by 2024

- Virtualized servers in support of the multi access edge computing market will become nearly a $100M market by 2024

- Breaking down the market by category of use, edge accelerated Web browsing will represent a $54.4M market by 2024

- Driven by enterprise hosted deployment, the mobile edge computing as a service market will reach nearly $73M by 2024

- Driven by private LTE and 5G networks for the industrial segment, the largest industrial vertical for MEC will by manufacturing

- Driven by smart factories, the multi access edge computing market in support of manufacturing in Asia will reach $194.4M by 2024

Target Audience:

- Industrial services providers

- Broadband wireless suppliers

- IoT equipment and service providers

- Mobile network operators and VNOs

- Managed communication service providers

- Enterprise verticals offering mission critical services

- Manufacturing and automation companies of all types

Table of Contents:

5G in IoT by Connectivity, Infrastructure, Sensors, Devices (Type, Sector, Verticals), and Things 2019 – 2024

1 Executive Summary

2 Introduction

2.1 5G Technology and Spectrum Development

2.2 IoT Market Overview

2.3 5G Supported IoT

2.4 IoT Edge Computing in 5G

2.5 LPWAN Faceoff: Cellular vs. Non-Cellular IoT Network

2.6 LPWAN Public vs. Private IoT Network

2.7 5G NR Infrastructure and Massive IoT

2.8 CAT M for 5G

2.9 Enterprise Mobility and Cloud Development

2.10 Supporting Networks of “Things”

3 5G IoT Ecosystem Analysis

3.1 5G IoT Value Chain

3.1.1 Wireless Network Infrastructure

3.1.2 IoT Infrastructure

3.1.3 IoT Application

3.2 5G IoT Applications in Industry Verticals

3.2.1 Retail and Consumer Electronics Application

3.2.2 Healthcare Applications

3.2.3 Industrial Automation Applications

3.2.4 Intelligent Building Automation Applications

3.2.5 Automotive and Transportation Applications

3.2.6 Home Automation Applications

3.2.7 Financial Institution Applications

3.2.8 Energy and Utility Applications

3.2.9 Public Safety Applications

3.2.10 Military Applications

3.2.11 Oil and Gas Applications

3.2.12 Mining Applications

3.2.13 Agriculture Applications

4 Managing the “Things” in IoT

4.1 Important Things Management Considerations

4.1.1 IoT Components will Grow Exponentially

4.1.2 Edge Devices and Analytics will play Critical Role

4.1.3 Network and Connectivity will be a Tough Choice

4.1.4 Regulatory and Standardization Effort will Start Shaping the IoT Market

4.1.5 Security and Privacy will continue as High Concerns

4.1.6 Smart City and Smart Home will Spike the IoT Growth

4.2 SLAs are Key to Things Management

4.2.1 SLA in IoT

4.2.1.1 IoT SLAs for Networks, Devices, and Data

4.2.1.2 IoT SLAs for Availability and Performance

4.2.1.3 SLA Support of IoT Orchestration and Mediation

4.2.1.4 SLA Support IoT Authentication, Authorization, and Accounting

4.2.2 IoT SLA Support of IoT Data as a Service

4.2.2.1 IoT Data as a Service Model

4.2.2.2 IoT DaaS SLAs

5 Managing Devices in Support of IoT “Things”

5.1 Introduction to IoT Device Management Systems

5.2 Key Requirements for IoT Device Management Systems

5.2.1 Device Management Agent

5.2.2 Device Management in a Service/Cloud Environment

5.3 Fundamentals of Device Management Systems

5.3.1 Enrollment and Provisioning

5.3.2 Configuration and Association

5.3.3 Monitoring and Diagnostics

5.3.4 Management and Control

5.3.5 Software Updates

5.4 Commercialization of IoT Device Management Systems

5.5 IoT Device Management System Demand by Industry

5.5.1 Smart Cities

5.5.2 Fleet Management and Transportation

5.5.3 Automotive

5.5.4 Manufacturing

5.5.5 Utilities

5.5.6 Oil & Gas Industry

5.6 IoT Device Management Challenges

5.6.1 Anticipating Cause and Effect

5.6.2 Handling Device Management Needs by Specific Industry / Function

5.7 IoT Device Registry

6 5G in IoT Market Analysis and Forecasts 2020 – 2024

6.1 5G IoT Market 2020 – 2024

6.1.1 Global 5G IoT Market 2020 – 2024

6.1.2 Global 5G IoT Market by Segment 2020 – 2024

6.1.2.1 Global 5G IoT Market by Infrastructure Type 2020 – 2024

6.1.2.1.1 Global 5G IoT Market by Cloud Infrastructure Type 2020 – 2024

6.1.2.1.2 Global 5G IoT Market by Hardware Type 2020 – 2024

6.1.2.1.3 Global 5G IoT Market by Embedded Device Type 2020 – 2024

6.1.2.1.4 Global 5G IoT Market by Hardware Component Type 2020 – 2024

6.1.2.1.5 Global 5G IoT Market by Sensor Component Type 2020 – 2024

6.1.2.1.6 Global 5G IoT Market by Processor Component Type 2020 – 2024

6.1.2.1.7 Global 5G IoT Market by Connectivity IC Component Type 2020 – 2024

6.1.2.1.8 Global 5G IoT Market by Platform Type 2020 – 2024

6.1.2.1.9 Global 5G IoT Market by Connectivity Type 2020 – 2024

6.1.2.2 Global 5G IoT Market by Application Type 2020 – 2024

6.1.2.3 Global 5G IoT Market by Service Type 2020 – 2024

6.1.2.3.1 Global 5G IoT Market by Service Deployment Type 2020 – 2024

6.1.3 Global 5G IoT Market by Sector 2020 – 2024

6.1.4 Global 5G IoT Market by Industry Vertical 2020 – 2024

6.1.5 5G IoT Market by Region 2020 – 2024

6.1.5.1 North America 5G IoT Market by Country 2020 – 2024

6.1.5.2 Europe 5G IoT Market by Country 2020 – 2024

6.1.5.3 APAC 5G IoT Market by Country 2020 – 2024

6.1.5.4 Middle East and Africa 5G IoT Market by Country 2020 – 2024

6.1.5.5 Latin America 5G IoT Market by Country 2020 – 2024

6.2 5G Infrastructure Market 2020 – 2024

6.2.1 Global 5G Telecom Infrastructure Investment 2020 – 2024

6.2.2 Global 5G Telecom Infrastructure Investment by Type 2020 – 2024

6.2.3 Global 5G Telecom Infrastructure Investment by NR Network 2020 – 2024

6.3 5G R&D Investment 2019 – 2025

6.4 5G Edge Computing Market in IoT 2020 – 2024

6.4.1 Global 5G Edge Computing Market in IoT 2020 – 2024

6.4.2 Global 5G Edge Computing Market in IoT by Segment 2020 – 2024

6.4.2.1 Global 5G Edge Computing Market in IoT by Infrastructure Type 2020 – 2024

6.4.2.2 Global 5G Edge Computing Market in IoT by Service Type 2020 – 2024

6.4.3 Global 5G Edge Computing Market in IoT by Industry Vertical 2020 – 2024

6.4.4 5G Edge Computing Market in IoT by Region 2020 – 2024

6.4.4.1 North America 5G Edge Computing Market in IoT by Country 2020 – 2024

6.4.4.2 Europe 5G Edge Computing Market in IoT by Country 2020 – 2024

6.4.4.3 APAC 5G Edge Computing Market in IoT by Country 2020 – 2024

6.4.4.4 Middle East and Africa 5G Edge Computing Market in IoT by Country 2020 – 2024

6.4.4.5 Latin America 5G Edge Computing Market in IoT by Country 2020 – 2024

7 5G IoT Device and Things Market Analysis and Forecasts 2020 – 2024

7.1 5G Connected IoT Device 2020 – 2024

7.1.1 Global 5G Connected IoT Devices 2020 – 2024

7.1.2 Global 5G Connected IoT Device by Type 2020 – 2024

7.1.3 Global 5G Connected IoT Device by Sector 2020 – 2024

7.1.4 Global 5G Connected IoT Device by Industry Vertical 2020 – 2024

7.1.5 5G Connected IoT Device by Region 2020 – 2024

7.1.5.1 North America 5G Connected IoT Device by Country 2020 – 2024

7.1.5.2 Europe 5G Connected IoT Device by Country 2020 – 2024

7.1.5.3 APAC 5G Connected IoT Device by Country 2020 – 2024

7.1.5.4 Middle East and Africa 5G Connected IoT Device by Country 2020 – 2024

7.1.5.5 Latin America 5G Connected IoT Device by Country 2020 – 2024

7.2 5G Connected IoT “Things” 2020 – 2024

7.2.1 Global 5G Connected IoT “Things” 2020 – 2024

7.2.2 Global 5G Connected IoT “Things” by Sector 2020 – 2024

7.2.3 Global 5G Connected IoT “Things” by Industry Vertical 2020 – 2024

7.2.4 5G Connected IoT “Things” by Region 2020 – 2024

7.2.4.1 North America 5G Connected IoT “Things” by Country 2020 – 2024

7.2.4.2 Europe 5G Connected IoT “Things” by Country 2020 – 2024

7.2.4.3 APAC 5G Connected IoT “Things” by Country 2020 – 2024

7.2.4.4 Middle East and Africa 5G Connected IoT “Things” by Country 2020 – 2024

7.2.4.5 Latin America 5G Connected IoT “Things” by Country 2020 – 2024

7.3 Edge Solution Connected 5G IoT Device 2020 – 2024

7.3.1 Global Edge Solution Connected 5G IoT Device 2020 – 2024

7.3.2 Global Edge Solution Connected 5G IoT Device by Type 2020 – 2024

7.3.3 Global Edge Solution Connected 5G IoT Device by Sector 2020 – 2024

7.3.4 Global Edge Solution Connected 5G IoT Device by Industry Vertical 2020 – 2024

7.3.5 Edge Solution Connected 5G IoT Device by Region 2020 – 2024

7.3.5.1 North America Edge Solution Connected 5G IoT Device by Country 2020 – 2024

7.3.5.2 Europe Edge Solution Connected 5G IoT Device by Country 2020 – 2024

7.3.5.3 APAC Edge Solution Connected 5G IoT Device by Country 2020 – 2024

7.3.5.4 Middle East and Africa Edge Solution Connected 5G IoT Device by Country 2020 – 2024

7.3.5.5 Latin America Edge Solution Connected 5G IoT Device by Country 2020 – 2024

7.4 Edge Solution Connected 5G IoT “Things” 2020 – 2024

7.4.1 Global Edge Solution Connected 5G IoT “Things” 2020 – 2024

7.4.2 Global Edge Solution Connected 5G IoT “Things” by Sector 2020 – 2024

7.4.3 Global Edge Solution Connected 5G IoT “Things” by Industry Vertical 2020 – 2024

7.4.4 Edge Solution Connected 5G IoT “Things” by Region 2020 – 2024

7.4.4.1 North America Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

7.4.4.2 Europe Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

7.4.4.3 APAC Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

7.4.4.4 Middle East and Africa Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

7.4.4.5 Latin America Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

8 Company Analysis

8.1 Cisco Systems Inc.

8.1.1 Company Overview

8.1.2 Products and Solutions

8.2 Nokia Networks

8.2.1 Company Overview

8.2.2 Products and Solutions

8.3 Samsung Electronics Co. Ltd.

8.3.1 Company Overview

8.3.2 Products and Solutions

8.4 Ericsson AB

8.4.1 Company Overview

8.4.2 Products and Solutions

8.5 Qualcomm Incorporated

8.5.1 Company Overview

8.5.2 Products and Solutions

8.6 Huawei Technologies Co. Ltd.

8.6.1 Company Overview

8.6.2 Products and Solutions

8.7 Intel Corporation

8.7.1 Company Overview

8.7.2 Products and Solutions

8.8 AT&T Inc.

8.8.1 Company Overview

8.8.2 Products and Solutions

8.9 SK Telecom Co. Ltd.

8.9.1 Company Overview

8.9.2 Products and Solutions

8.10 LG Electronics Inc.

8.10.1 Company Overview

8.10.2 Products and Solutions

8.11 Verizon Communications

8.11.1 Company Overview

8.11.2 Products and Solutions

8.12 T-Mobile US Inc.

8.12.1 Company Overview

8.12.2 Products and Solutions

8.13 KT Corporation

8.13.1 Company Overview

8.13.2 Products and Solutions

8.14 China Mobile

8.14.1 Company Overview

8.14.2 Products and Solutions

8.15 NEC Corporation

8.15.1 Company Overview

8.15.2 Products and Solutions

8.16 Fujitsu Ltd.

8.16.1 Company Overview

8.16.2 Products and Solutions

8.17 ZTE Corporation

8.17.1 Company Overview

8.17.2 Products and Solutions

8.18 Deutsche Telekom AG

8.18.1 Company Overview

8.18.2 Products and Solutions

8.19 NTT DoCoMo Inc.

8.19.1 Company Overview

8.19.2 Products and Solutions

8.20 NTT DATA Corporation

8.20.1 Company Overview

8.20.2 Products and Solutions

8.21 Broadcom Corporation

8.21.1 Company Overview

8.21.2 Products and Solutions

8.22 LG Uplus Corp.

8.22.1 Company Overview

8.22.2 Products and Solutions

8.23 SingTel

8.23.1 Company Overview

8.23.2 Products and Services

9 Conclusions and Recommendations

9.1 MNO Strategy for 5G IoT

9.2 CSP Strategy for 5G IoT

10 Appendix: 5G Supporting Technologies

10.1 Massive MIMO

10.2 Cognitive Radio Capabilities

10.3 Self-Organizing Networks

10.4 Visible Light Communications: Alternative to Radio Frequency

10.5 Millimeter Wave Radio Frequency

10.6 M2M Communications in IoT and the Role of 5G

10.7 C-RAN Architecture

10.8 Role and Importance of Heterogeneous Networks

10.9 H-CRAN Solutions

10.10 Large-Scale Cooperative Spatial Signal Processing

10.11 SDN and NFV Technologies and Solutions

10.12 Software Defined Radio Considerations

10.13 Other Considerations: Spectrum Issues and Satellite Solutions

Figures

Figure 1: 5G Network Features

Figure 2: 5G Interim Spectrum Evolution and Timeline

Figure 3: 5G Technology Architecture

Figure 4: IoT System Functional Diagram

Figure 5: Consumer IoT Hardware and Device Vendor Company

Figure 6: Enterprise/Industrial IoT Hardware and Device Vendor Company

Figure 7: IoT Component and Equipment Vendor Company

Figure 8: IoT Platform and Automation Vendor Company

Figure 9: IoT Software and Service Vendor Company

Figure 10: 5G IoT Architecture

Figure 11: 5G NR Access Network Architecture

Figure 12: IoT SLAs for Networks, Devices, and Data

Figure 13: IoT SLAs for Availability and Performance

Figure 14: SLAs and IoT Mediation and Orchestration

Figure 15: IoT SLA Support of AAA

Figure 16: IoT Data as a Service Model

Figure 17: Monitoring and Reporting Economic Impact of IoT SLAs

Figure 18: IoT Device Management Solution Overview

Figure 19: IoT Device Registry and DB Services

Figure 20: Global 5G IoT Market 2020 – 2024

Figure 21: Global 5G Infrastructure Investment 2019 – 2024

Figure 22: Global 5G R&D Investment 2017 – 2025

Figure 23: Global 5G Edge Computing Market in IoT 2020 – 2024

Figure 24: Global 5G Connected IoT Device 2020 – 2024

Figure 25: Global 5G Connected IoT “Things” 2020 – 2024

Figure 26: Global Edge Solution Connected 5G IoT Device 2020 – 2024

Figure 27: Global Edge Solution Connected 5G IoT “Things” 2020 – 2024

Figure 28: Nokia 5G Requirement Vision 2020

Figure 29: Nokia 5G Network Design Functional Requirement

Figure 30: Nokia Network IoT Solution Ecosystem

Figure 31: Samsung Tizen IoT Ecosystem

Figure 32: Ericsson 5G Collaboration

Figure 33: Qualcomm Model to Leverage 4G Investment

Figure 34: Huawei 5G Spectrum Vision

Figure 35: Intel IoT Platform Framework

Figure 36: Intel 5G Vision

Figure 37: NEC 5G Vision

Figure 38: Fujitsu Smart Workplace Ecosystem

Figure 39: ZTE 5G Vision

Figure 40: Xrosscloud M2M Platform Architecture

Figure 41: Massive MIMO Architecture

Figure 42: Self-Organizing Networks in H-RAN

Figure 43: H-RAN Application of 5G Systems

Figure 44: Centralized and Distribution LS-CSSP in H-CRANs

Figure 45: NFV in H-RAN Solution

Figure 46: SDN Architecture

Figure 47: NFV and SDN Security Framework

Figure 48: Software Defined Radio Network

Figure 49: Hybrid Architecture of SDN and SDR in 5G Networks

Figure 50: Role of Satellite in 5G Communication Systems

Tables

Table 1: 5G Spectrum Bands: Low vs. Mid vs. High

Table 2: Global 5G IoT Market by Segment 2020 – 2024

Table 3: Global 5G IoT Market by Infrastructure Type 2020 – 2024

Table 4: Global 5G IoT Market by Cloud Infrastructure Type 2020 – 2024

Table 5: Global 5G IoT Market by Hardware Type 2020 – 2024

Table 6: Global 5G IoT Market by Embedded Device Type 2020 – 2024

Table 7: Global 5G IoT Market by Hardware Component Type 2020 – 2024

Table 8: Global 5G IoT Market by Sensor Component Type 2020 – 2024

Table 9: Global 5G IoT Market by Processor Component Type 2020 – 2024

Table 10: Global 5G IoT Market by Connectivity IC Component Type 2020 – 2024

Table 11: Global 5G IoT Market by Platform Type 2020 – 2024

Table 12: Global 5G IoT Market by Connectivity Type 2020 – 2024

Table 13: Global 5G IoT Market by Application Type 2020 – 2024

Table 14: Global 5G IoT Market by Service Type 2020 – 2024

Table 15: Global 5G IoT Market by Service Deployment Type 2020 – 2024

Table 16: Global 5G IoT Market by Sector 2020 – 2024

Table 17: Global 5G IoT Market by Industry Vertical 2020 – 2024

Table 18: 5G IoT Market by Region 2020 – 2024

Table 19: North America 5G IoT Market by Country 2020 – 2024

Table 20: Europe 5G IoT Market by Country 2020 – 2024

Table 21: APAC 5G IoT Market by Country 2020 – 2024

Table 22: Middle East and Africa 5G IoT Market by Country 2020 – 2024

Table 23: Latin America 5G IoT Market by Country 2020 – 2024

Table 24: Global 5G Infrastructure Investment by Type 2020 – 2024

Table 25: Global 5G Infrastructure Investment by NR Network Type 2020 – 2024

Table 26: Global 5G Edge Computing Market in IoT by Segment 2020 – 2024

Table 27: Global 5G Edge Computing Market in IoT by Infrastructure Type 2020 – 2024

Table 28: Global 5G Edge Computing Market in IoT by Service Type 2020 – 2024

Table 29: Global 5G Edge Computing Market in IoT by Industry Vertical 2020 – 2024

Table 30: 5G Edge Computing Market in IoT by Region 2020 – 2024

Table 31: North America 5G Edge Computing Market in IoT by Country 2020 – 2024

Table 32: Europe 5G Edge Computing Market in IoT by Country 2020 – 2024

Table 33: APAC 5G Edge Computing Market in IoT by Country 2020 – 2024

Table 34: Middle East and Africa 5G Edge Computing Market in IoT by Country 2020 – 2024

Table 35: Latin America 5G Edge Computing Market in IoT by Country 2020 – 2024

Table 36: Global 5G Connected IoT Device by Type 2020 – 2024

Table 37: Global 5G Connected IoT Device by Sector 2020 – 2024

Table 38: Global 5G Connected IoT Device by Industry Vertical 2020 – 2024

Table 39: 5G Connected IoT Device by Region 2020 – 2024

Table 40: North America 5G Connected IoT Device by Country 2020 – 2024

Table 41: Europe 5G Connected IoT Device by Country 2020 – 2024

Table 42: APAC 5G Connected IoT Device by Country 2020 – 2024

Table 43: Middle East and Africa 5G Connected IoT Device by Country 2020 – 2024

Table 44: Latin America 5G Connected IoT Device by Country 2020 – 2024

Table 45: Global 5G Connected IoT “Things” by Sector 2020 – 2024

Table 46: Global 5G Connected IoT “Things” by Industry Vertical 2020 – 2024

Table 47: 5G Connected IoT “Things” by Region 2020 – 2024

Table 48: North America 5G Connected IoT “Things” by Country 2020 – 2024

Table 49: Europe 5G Connected IoT “Things” by Country 2020 – 2024

Table 50: APAC 5G Connected IoT “Things” by Country 2020 – 2024

Table 51: Middle East and Africa 5G Connected IoT “Things” by Country 2020 – 2024

Table 52: Latin America 5G Connected IoT “Things” by Country 2020 – 2024

Table 53: Global Edge Solution Connected 5G IoT Device by Type 2020 – 2024

Table 54: Global Edge Solution Connected 5G IoT Device by Sector 2020 – 2024

Table 55: Global Edge Solution Connected 5G IoT Device by Industry Vertical 2020 – 2024

Table 56: Edge Solution Connected 5G IoT Device by Region 2020 – 2024

Table 57: North America Edge Solution Connected 5G IoT Device by Country 2020 – 2024

Table 58: Europe Edge Solution Connected 5G IoT Device by Country 2020 – 2024

Table 59: APAC Edge Solution Connected 5G IoT Device by Country 2020 – 2024

Table 60: Middle East and Africa Edge Solution Connected 5G IoT Device by Country 2020 – 2024

Table 61: Latin America Edge Solution Connected 5G IoT Device by Country 2020 – 2024

Table 62: Global Edge Solution Connected 5G IoT “Things” by Sector 2020 – 2024

Table 63: Global Edge Solution Connected 5G IoT “Things” by Industry Vertical 2020 – 2024

Table 64: Edge Solution Connected 5G IoT “Things” by Region 2020 – 2024

Table 65: North America Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

Table 66: Europe Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

Table 67: APAC Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

Table 68: Middle East and Africa Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

Table 69: Latin America Edge Solution Connected 5G IoT “Things” by Country 2020 – 2024

Table 70: Intel NAMD System

Table 71: MTC features in 3GPP Standard

Mobile Edge Computing Market by Infrastructure, Equipment Category, Deployment Models, Computing as a Service Offerings, Network Connectivity, Applications, Analytics Types, and Industry Verticals 2019 – 2024

1.0 Executive Summary

1.1 Global Market for Multi Access Edge Computing

1.2 Regional Markets for Multi Access Edge Computing

2.0 Introduction

2.1 Understanding Multi-access Edge Computing

2.1.1 Edge Computing in an ICT Context

2.1.2 Proximity Computing: The Edge in Physical and Logical Context

2.1.3 Edge Computing vs. Other Computational Approaches

2.1.4 Multi-access Edge Computing

2.2 Important Characteristics of MEC

2.2.1 Processing at the Edge

2.2.2 Low Latency

2.2.3 Context Based

2.2.4 Location and Analytics

2.3 Multi Access Edge Computing Benefits

2.3.1 Business Benefits

2.3.2 Technical Benefits

2.3.3 Mobile Network Operator Benefits

2.3.4 Key Element of Carrier Heterogeneous Network Strategy

3.0 MEC Technology, Platforms, and Architecture

3.1 MEC Platform Architecture Building Blocks

3.1.1 MEC Infrastructure

3.1.2 MEC Application Platforms

3.1.3 MEC Management Framework

3.2 The Edge Cloud Computing Value Chain

3.3 MEC Technology Building Blocks

3.3.1 Radio Network Information Service

3.3.2 Traffic Offload Function

3.3.3 MEC Interfaces

3.3.4 Configuration Management

3.3.5 Application Lifecycle Management

3.3.6 VM Operations and Management

3.3.7 Hardware Virtualization and Infrastructure Management

3.3.8 Core Network Elements

3.3.9 Open Standards

3.4 MEC Technology Enablers

3.4.1 Mobile Computing to Mobile Cloud Computing

3.4.2 Cloudlet based Mobile Cloud Computing

3.4.3 Cloudlet to Cloud

3.4.4 PacketCloud Open Platform for Cloudlets

3.4.5 Enterprise Cloud Architecture

3.4.6 Cloudlet Solutions

3.4.7 Cloudlet Storage Frameworks

3.5 MEC Deployment Considerations

3.5.1 MEC Implementation Challenges

3.5.2 MEC Operational Challenges

4.0 MEC Market Drivers and Opportunities

4.1 Limitations of Cloud Convergence

4.2 IT and Telecom Network Convergence

4.3 Base Station Evolution

4.4 Cell Aggregation

4.5 Virtualization in the Cloud

4.6 Continually Improving Server Capacity

4.7 Data Center to Network Interactions

4.8 Open and Flexible App and Service Ecosystem

4.9 Fifth Generation (5G) Wireless

4.10 Edge Cloud and Data Transferability

4.11 Proximate Cloud Computing

4.12 Increasingly Faster Content Delivery

4.13 Advantages of MEC Small Cell Deployment

4.14 Overall Mobile Data Demand

4.15 Low Latency Applications

4.16 Integration of MEC with Cloud RAN

4.17 MEC Enhances Real-time Data and Analytics

4.17.1 Why Data at the Edge?

4.17.2 Convergence of Distributed Cloud and Big Data

5.0 MEC Ecosystem

5.1 The Overall Edge Computing Ecosystem

5.2 MEC Ecosystem Players

5.2.1 ETSI MEC ISG

5.2.2 Software and ASPs

5.2.3 OTT Service and Content Providers

5.2.4 Network Infrastructure and Equipment Providers

5.2.5 Mobile Network Operators

5.3 Individual Company Analysis

5.3.1 ADLINK Technology Inc.

5.3.2 Advantech

5.3.3 Affirmed Networks

5.3.4 Akamai Technologies

5.3.5 Allot Communications

5.3.6 Advanced Micro Devices

5.3.7 Brocade Communications Systems

5.3.8 Cavium Networks

5.3.9 Ceragon Networks

5.3.10 Cisco Systems

5.3.11 Cloudify

5.3.12 Cradlepoint

5.3.13 EdgeConneX

5.3.14 Edgeworx

5.3.15 Ericsson

5.3.16 Fujitsu Technology Solutions

5.3.17 Hewlett Packard Enterprise

5.3.18 Huawei Technologies Co. Ltd.

5.3.19 IBM Corporation

5.3.20 Integrated Device Technology

5.3.21 Intel Corporation

5.3.22 InterDigital Inc.

5.3.23 Juniper Networks

5.3.24 MobiledgeX

5.3.25 NEC Corporation

5.3.26 Nokia Corporation

5.3.27 PeerApp Ltd.

5.3.28 Pixeom

5.3.29 Pluribus Networks

5.3.30 Quortus

5.3.31 Redhat, Inc.

5.3.32 Saguna Networks

5.3.33 Samsung Electronics Co., Ltd.

5.3.34 Sony Corporation

5.3.35 SpiderCloud Wireless

5.3.36 Vapor IO

5.3.37 Vasona Networks

5.3.38 Xilinx, Inc.

5.3.39 Yaana Ltd.

5.3.40 ZTE Corporation

6.0 MEC Application and Service Strategies

6.1 Optimizing the Mobile Cloud

6.1.1 Mobile Network Operator Strategies

6.1.2 Service Strategies and End-user Demand

6.2 Context Aware Services

6.2.1 Commerce

6.2.2 Education

6.2.3 Gaming

6.2.4 Healthcare

6.2.5 Location-based Services

6.2.6 Public Safety

6.2.7 Connected Vehicles

6.2.8 Wearables

6.3 Data Services and Analytics

6.3.1 Localized Real-time Data Becomes King

6.3.2 Anonymizing Local and Real-time Data for Third-party Usage

6.3.3 Increasing Demand for Data as a Service (DaaS) in MEC Environment

7.0 Multi Access Edge Computing Deployment

8.0 Multi Access Edge Computing Market Analysis and Forecasts

8.1 Mobile Edge Computing Markets by Components

8.1.1 Mobile Edge Computing Cloud Server Market by Category

8.1.2 Mobile Edge Computing Equipment Market by Category ($ Millions)

8.1.3 Mobile Edge Computing Platform Market by Category ($ Millions)

8.1.4 Mobile Edge Computing Software & API Market in Vertical Segment ($ Millions)

8.1.5 Mobile Edge Computing As a Service Market by Type

8.2 Forecasts by Number of Mobile Edge Computing Users by Supporting Network

8.3 Mobile Edge Computing Markets by the End Use Technology

8.3.1 Mobile Edge Computing Markets by Analytics Type

8.4 Mobile Edge Computing Markets by Applications

8.5 Mobile Edge Computing Markets by End-Users

8.6 Mobile Edge Computing Markets by Industry

8.7 Geographical Markets for Mobile Edge Computing

8.7.1 North America

8.7.1.1 Mobile Edge Computing Market Size by Segment

8.7.1.2 Mobile Edge Computing Cloud Server Market by Category

8.7.1.3 Mobile Edge Computing Equipment Market by Category

8.7.1.4 Mobile Edge Computing Platform Market by Category

8.7.1.5 Mobile Edge Computing Software & API Market in Vertical Segment

8.7.1.6 Mobile Edge Computing as a Service Market by Type

8.7.1.1 Mobile Edge Computing Markets by Industry

8.7.2 Europe

8.7.2.1 Mobile Edge Computing Market Size by Segment

8.7.2.2 Mobile Edge Computing Cloud Server Market by Category

8.7.2.3 Mobile Edge Computing Equipment Market by Category

8.7.2.4 Mobile Edge Computing Platform Market by Category

8.7.2.5 Mobile Edge Computing Software & API Market in Vertical Segment

8.7.2.6 Mobile Edge Computing as a Service Market by Type

8.7.2.1 Mobile Edge Computing Markets by Industry

8.7.3 APAC

8.7.3.1 Mobile Edge Computing Market Size by Segment

8.7.3.2 Mobile Edge Computing Cloud Server Market by Category

8.7.3.3 Mobile Edge Computing Equipment Market by Category

8.7.3.4 Mobile Edge Computing Platform Market by Category

8.7.3.5 Mobile Edge Computing Software & API Market in Vertical Segment

8.7.3.6 Mobile Edge Computing as a Service Market by Type

8.7.3.1 Mobile Edge Computing Markets by Industry

9.0 Conclusions and Recommendations

9.1 Anticipated Market Needs and Opportunities

9.1.1 The need for MEC Integration with Public Cloud Platforms

9.1.2 Enterprise (Dedicated and Shared Resources) MEC Integration

9.1.3 Dedicated MEC Public Safety and Homeland Security Infrastructure

9.2 Insights into Future Market Dynamics

9.2.1 MEC will Facilitate Downward Price Pressure on Non-real-time Data

9.2.2 MEC will Drive Demand for Virtual Network Operators

9.2.3 MEC will Drive the Need for New Players as well as M&A

9.2.4 MEC Deployment will be Very Different across Market Segments

9.2.5 Anticipated MEC Business Models

10.0 Appendix One: Real-time Data Analytics Revenue

10.1 Global Streaming Data Analytics Revenue

10.2 Global Real-time Data Analytics Revenue by App, Software, and Services

10.3 Global Real-time Data Analytics Revenue in Industry Verticals

10.3.1 Real-time Data Analytics Revenue in Retail

10.3.1.1 Real-time Data Analytics Revenue by Retail Segment

10.3.1.2 Real-time Data Analytics Retail Revenue by App, Software, and Service

10.3.2 Real-time Data Analytics Revenue in Telecom and IT

10.3.2.1 Real-time Data Analytics Revenue by Telecom and IT Segment

10.3.2.2 Real-time Data Analytics Revenue by Telecom & IT App, Software, and Service

10.3.3 Real-time Data Analytics Revenue in Energy and Utility

10.3.3.1 Real-time Data Analytics Revenue by Energy and Utility Segment

10.3.3.2 Real-time Data Analytics Energy and Utilities Revenue by App, Software, and Service

10.3.4 Real-time Data Analytics Revenue in Government

10.3.4.1 Real-time Data Analytics Revenue by Government Segment

10.3.4.2 Real-time Data Analytics Government Revenue by App, Software, and Service

10.3.5 Real-time Data Analytics Revenue in Healthcare and Life Science

10.3.5.1 Real-time Data Analytics Revenue by Healthcare Segment

10.3.6 Real-time Data Analytics Revenue in Manufacturing

10.3.6.1 Real-time Data Analytics Revenue by Manufacturing Segment

10.3.6.2 Real-time Data Analytics Manufacturing Revenue by App, Software, and Service

10.3.7 Real-time Data Analytics Revenue in Transportation and Logistics

10.3.7.1 Real-time Data Analytics Revenue by Transportation & Logistics Segment

10.3.7.2 Real-time Data Analytics Transportation & Logistics Revenue by App, Software, and Service

10.3.8 Real-time Data Analytics Revenue in Banking and Finance

10.3.8.1 Real-time Data Analytics Revenue by Banking and Finance Segment

10.3.8.2 Real-time Data Analytics Revenue by Banking & Finance App, Software, and Service

10.3.9 Real-time Data Analytics Revenue in Smart Cities

10.3.9.1 Real-time Data Analytics Revenue by Smart City Segment

10.3.9.2 Real-time Data Analytics Revenue by Smart City App, Software, and Service

10.3.10 Real-time Data Analytics Revenue in Automotive

10.3.10.1 Real-time Data Analytics Revenue by Automobile Industry Segment

10.3.10.2 Real-time Data Analytics Revenue by Automotive Industry App, Software, and Service

10.3.11 Real-time Data Analytics Revenue in Education

10.3.11.1 Real-time Data Analytics Revenue by Education Industry Segment

10.3.11.2 Real-time Data Analytics Revenue by Education Industry App, Software, and Service

10.3.12 Real-time Data Analytics Revenue in Outsourcing Services

10.3.12.1 Real-time Data Analytics Revenue by Outsourcing Segment

10.3.12.2 Real-time Data Analytics Revenue by Outsourcing Industry App, Software, and Service

10.4 Real-time Data Analytics Revenue by Leading Vendor Platform

10.4.1 Global Investment in Data by Industry Sector

11.0 Appendix Two: 5G Technology and Solution Outlook

11.1 Market Definition of 5G

11.2 Evolution of Mobile Communication Standards (1G to 5G)

11.3 Introduction to 5G Technology

11.4 5G Spectrum Options and Utilization

11.5 What can 5G Technology Offer?

11.5.1 5G Network will Facilitate Faster and Less Expensive Services

11.6 Key Advantages and Growth Drivers of 5G

11.7 Challenges for 5G

11.7.1 Consistent Growth in Technology Requirements and Service Characteristics

11.7.2 Standardization Challenges

11.7.3 Network Challenges

11.7.4 Mobile Device Challenges

11.7.5 Application Challenges

11.8 5G Roadmap

11.8.1 5G Requirements

11.8.2 5G Wireless Subsystem

11.8.3 Network Virtualization & Software Networks

11.8.4 Converged Connectivity

11.9 5G Use Cases

11.9.1 5G in M2M and IoT

11.9.2 5G in Robotics

11.9.3 5G in Augmented and Virtual Reality

11.9.4 5G in Home Internet

11.9.5 5G in Wireless Office

11.9.6 Other Use Cases

11.9.6.1 High Speed Train

11.9.6.2 Remote Computing

11.9.6.3 Non-Stationary Hot Spots

11.9.6.4 3D Connectivity: Aircraft

11.9.6.5 Natural Disaster

11.9.6.6 Public Safety

11.9.6.7 Context Aware Service

11.10 Business Opportunities

Figures

Figure 1: Global Markets for Mobile Edge Computing 2019 – 2024

Figure 2: Regional Markets for Mobile Edge Computing 2019 – 2024

Figure 3: Mobile Edge Computing Users by Region 2019 – 2024

Figure 4: MEC Operational Benefits Analysis

Figure 5: MEC Value Chain for Edge Cloud Computing

Figure 6: Extreme Outdoor Server

Figure 7: Cloudlet based PacketCloud Framework

Figure 8: MEC and C-RAN Architecture

Figure 9: Mobile Edge Computing Network

Figure 10: MEC Network and Application Clients

Figure 11: ETSI MEC ISG Members

Figure 12: MEC enabled Applications and Services

Figure 13: MEC enables Many Cloud-based Apps

Figure 14: Multi Access Edge Computing Deployment Options

Figure 15: Mobile Edge Computing Markets by Components 2019 – 2024

Figure 16: Mobile Edge Computing Markets by Category 2019 – 2024

Figure 17: Mobile Edge Computing Equipment Markets by Category 2019 – 2024

Figure 18: Mobile Edge Computing Platform Markets by Category 2019 – 2024

Figure 19: Mobile Edge Computing Software and API Market in Vertical Segment 2019 – 2024

Figure 20: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Figure 21: Number of Mobile Edge Computing Users by Supporting Network 2019 – 2024

Figure 22: Mobile Edge Computing Markets by the End Use Technology2019 – 2024

Figure 23: Mobile Edge Computing Markets by Analytics Type 2019 – 2024

Figure 24: Mobile Edge Computing Markets by Applications 2019 – 2024

Figure 25: Mobile Edge Computing Markets by End-Users 2019 – 2024

Figure 26: Mobile Edge Computing Markets by Industry 2019 – 2024

Figure 27: North America: Mobile Edge Computing Market Size by Segments 2019 – 2024

Figure 28: North America: Mobile Edge Computing Server Market by Category 2019 – 2024

Figure 29: North America: Mobile Edge Computing Equipment Market by Category 2019 – 2024

Figure 30: North America: Mobile Edge Computing Platform Market by Category 2019 – 2024

Figure 31: North America: Mobile Edge Computing Software & API Market in Vertical Segment 2019 – 2024

Figure 32: North America: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Figure 33: North America: Mobile Edge Computing Markets by Industry 2019 – 2024

Figure 34: Europe: Mobile Edge Computing Market Size by Segments 2019 – 2024

Figure 35: Europe: Mobile Edge Computing Server Market by Category 2019 – 2024

Figure 36: Europe: Mobile Edge Computing Equipment Market by Category 2019 – 2024

Figure 37: Europe: Mobile Edge Computing Platform Market by Category 2019 – 2024

Figure 38: Europe: Mobile Edge Computing Software & API Market in Vertical Segment 2019 – 2024

Figure 39: Europe: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Figure 40: Europe: Mobile Edge Computing Markets by Industry 2019 – 2024

Figure 41: APAC: Mobile Edge Computing Market Size by Segments 2019 – 2024

Figure 42: APAC: Mobile Edge Computing Server Market by Category 2019 – 2024

Figure 43: APAC: Mobile Edge Computing Equipment Market by Category 2019 – 2024

Figure 44: APAC: Mobile Edge Computing Platform Market by Category 2019 – 2024

Figure 45: APAC: Mobile Edge Computing Software & API Market in Vertical Segment 2019 – 2024

Figure 46: APAC: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Figure 47: APAC: Mobile Edge Computing Markets by Industry 2019 – 2024

Figure 48: MEC Deployment by Carrier, Enterprise, and Industrial Sites

Figure 49: Global Real-time Data Analytics

Figure 50: Evolution of Mobile Communication Standards (1G to 5G)

Figure 51: Evolution from LTE Advanced to 5G

Figure 52: Sample Specifications for 5G

Figure 53: 5G Mobile Device

Figure 54: 5G Challenges: Mobile SoC Performance vs. Energy Efficiency

Figure 55: Potential 5G Service Chart and Bandwidth & Latency Requirement

Figure 56: New Service Capabilities in 5G Environment

Tables

Table 1: Global Markets for Mobile Edge Computing 2019 – 2024

Table 2: Regional Markets for Mobile Edge Computing 2019 – 2024

Table 3: Number of Mobile Edge Computing Users by Region 2019 – 2024

Table 4: Mobile Edge Computing Markets by Components 2019 – 2024

Table 5: Mobile Edge Computing Markets by Category 2019 – 2024

Table 6: Mobile Edge Computing Equipment Markets by Category 2019 – 2024

Table 7: Mobile Edge Computing Platform Markets by Category 2019 – 2024

Table 8: Mobile Edge Computing Software and API Market in Vertical Segment 2019 – 2024

Table 9: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Table 10: Number of Mobile Edge Computing Users by Supporting Network 2019 – 2024

Table 11: Mobile Edge Computing Markets by the End Use Technology2019 – 2024

Table 12: Mobile Edge Computing Markets by Analytics Type 2019 – 2024

Table 13: Mobile Edge Computing Markets by Applications 2019 – 2024

Table 14: Mobile Edge Computing Markets by End-Users 2019 – 2024

Table 15: Mobile Edge Computing Markets by Industry 2019 – 2024

Table 16: North America: Mobile Edge Computing Market Size by Segments 2019 – 2024

Table 17: North America: Mobile Edge Computing Server Market by Category 2019 – 2024

Table 18: North America: Mobile Edge Computing Equipment Market by Category 2019 – 2024

Table 19: North America: Mobile Edge Computing Platform Market by Category 2019 – 2024

Table 20: North America: Mobile Edge Computing Software & API Market in Vertical Segment 2019 – 2024

Table 21: North America: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Table 22: North America: Mobile Edge Computing Markets by Industry 2019 – 2024

Table 23: Europe: Mobile Edge Computing Market Size by Segments 2019 – 2024

Table 24: Europe: Mobile Edge Computing Server Market by Category 2019 – 2024

Table 25: Europe: Mobile Edge Computing Equipment Market by Category 2019 – 2024

Table 26: Europe: Mobile Edge Computing Platform Market by Category 2019 – 2024

Table 27: Europe: Mobile Edge Computing Software & API Market in Vertical Segment 2019 – 2024

Table 28: Europe: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Table 29: Mobile Edge Computing Markets by Industry 2019 – 2024

Table 30: APAC: Mobile Edge Computing Market Size by Segments 2019 – 2024

Table 31: APAC: Mobile Edge Computing Server Market by Category 2019 – 2024

Table 32: APAC: Mobile Edge Computing Equipment Market by Category 2019 – 2024

Table 33: APAC: Mobile Edge Computing Platform Market by Category 2019 – 2024

Table 34: APAC: Mobile Edge Computing Software & API Market in Vertical Segment 2019 – 2024

Table 35: APAC: Mobile Edge Computing as a Service Market by Type 2019 – 2024

Table 36: APAC: Mobile Edge Computing Markets by Industry 2019 – 2024

Table 37: Global Real-time Data Analytics Revenue by App, Software, and Service

Table 38: Global Real-time Data Analytics Revenue in Industry Vertical

Table 39: Retail Real-time Data Analytics Revenue by Retail Segment

Table 40: Retail Real-time Data Analytics Revenue by App, Software, and Services

Table 41: Telecom & IT Real-time Data Analytics Rev by Segment

Table 42: Telecom & IT Real-time Data Analytics Rev by App, Software, and Services

Table 43: Energy & Utilities Real-time Data Analytics Rev by Segment

Table 44: Energy & Utilities Real-time Data Analytics Rev by App, Software, and Services

Table 45: Government Real-time Data Analytics Revenue by Segment

Table 46: Government Real-time Data Analytics Revenue by App, Software, and Services

Table 47: Healthcare & Life Science Real-time Data Analytics Revenue by Segment

Table 48: Healthcare & Life Science Real-time Data Analytics Revenue by App, Software, and Services

Table 49: Manufacturing Real-time Data Analytics Revenue by Segment

Table 50: Manufacturing Real-time Data Analytics Revenue by App, Software, and Services

Table 51: Transportation & Logistics Real-time Data Analytics Revenue by Segment

Table 52: Transportation & Logistics Real-time Data Analytics Revenue by App, Software, and Services

Table 53: Banking and Finance Real-time Data Analytics Revenue by Segment

Table 54: Banking & Finance Real-time Data Analytics Revenue by App, Software, and Services

Table 55: Smart Cities Real-time Data Analytics Revenue by Segment

Table 56: Smart Cities Real-time Data Analytics Revenue by App, Software, and Services

Table 57: Automotive Real-time Data Analytics Revenue by Segment

Table 58: Automotive Real-time Data Analytics Revenue by Apps, Software, and Services

Table 59: Education Real-time Data Analytics Revenue by Segment

Table 60: Education Real-time Data Analytics Revenue by App, Software, and Services

Table 61: Outsourcing Service Real-time Data Analytics Revenue by Segment

Table 62: Outsourcing Service Real-time Data Analytics Revenue by App, Software, and Services

Table 63: Real-time Data Analytics Revenue by Leading Vendor Platforms

Table 64: Investment in Data by Industry Vertical

Table 65: 5G Spectrum Band Options, Merits and Licenses

Table 66: Roadmap for 5G Requirements

Table 67: Roadmap for 5G Wireless Subsystem

Table 68: Roadmap for Virtualization and Software Networks

Table 69: Roadmap for Converged Connectivity