|

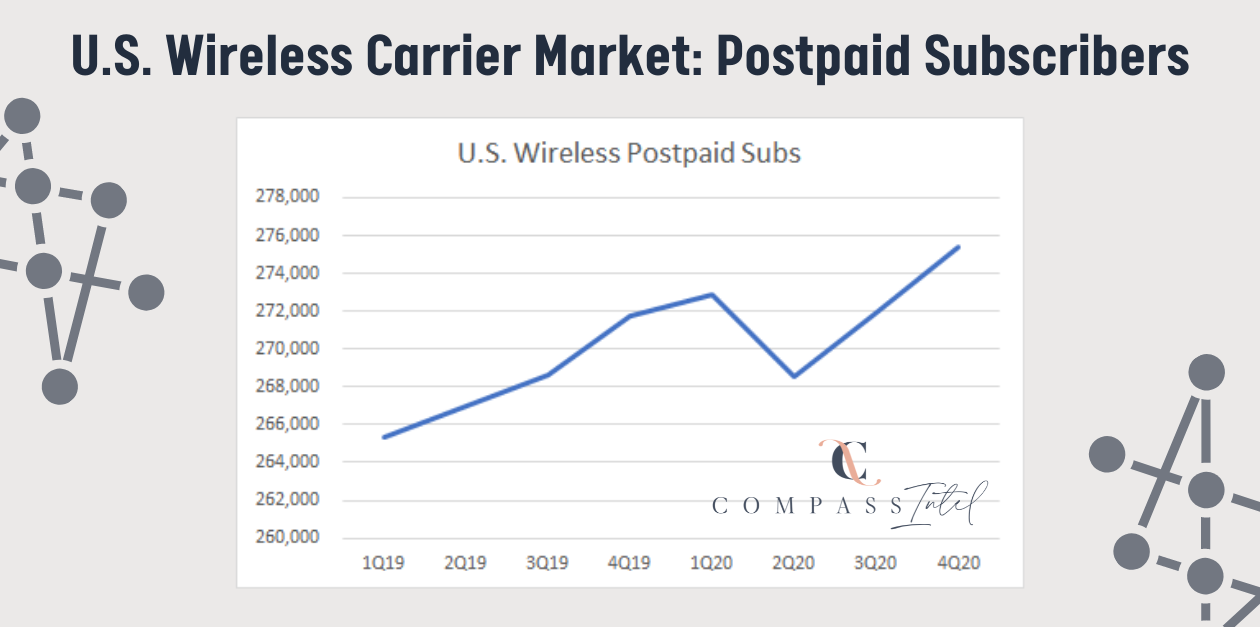

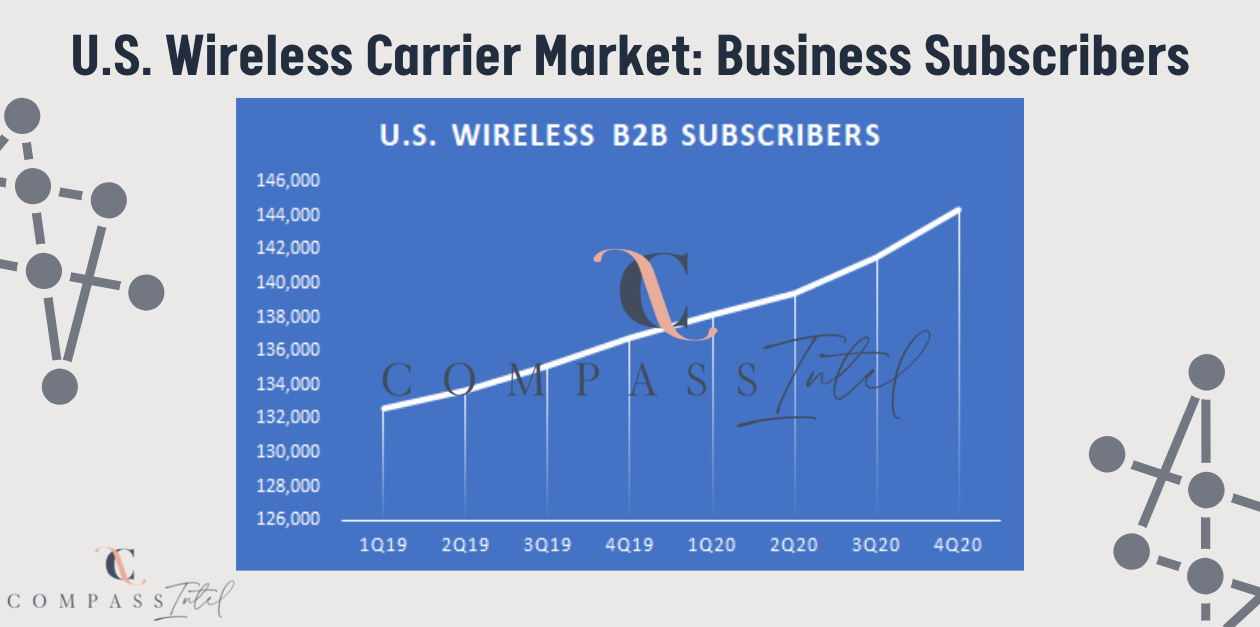

As we gear up to update our Q1 numbers for B2B Wireless subscriber data (business wireless), we will share some insights on how the top three carriers ended their year in 2020. For this, we focus on just the business market including corporate liable (company gets and pays the bill) and business individually liable (employee gets partially or fully reimbursed, use of phone 50% or more of the time for business purposes) subscribers. But before we do that, let's take a look at the postpaid subscriber dip (shown above) the market experienced in 2020, driven by a complete halt on IT and tech spending due to the pandemic and COVID-19 impact. Postpaid subscribers for the top 3 reached roughly 275 million by the end of 2020. At the same time, in Q1 of 2020, the T-Mobile/Sprint merger was also finalized and Q2 began the recording of the NEW company with consolidated subscriber numbers. Each carrier has its strength in the business sector, and the fight is on in 2021 as T-Mobile takes direct charge at being the "underdog" and is expected to push the "un-carrier" move in the B2B sector. Verizon has dominated enterprise and government subscribers for decades, but experienced a very rough 1st half of 2020 and in fact ended the year with only a 43.2% share of all business subscribers, yet still very respectable. AT&T has found strength in its FirstNet client base and has garnered power in the federal sector, where Verizon traditionally dominated. AT&T experienced more of a roller-coaster of up and downs on their quarterly business wireless subscriber numbers, and ended the year with about 53K business subscribers (corporate liable and business individually liable). T-Mobile continues to push through and push up market (mid-sized and enterprise sized companies), where it traditionally found its base in the very small business and SOHO sector of the U.S. business market. At the end of 2020, T-Mobile (after the merger with Sprint) reached a 13.4% market share in just the Corporate Liable market alone. Corporate Liable is where you get to the nitty gritty, as this is where loyalty, discounting, customer experience, and business relationships lie (including recurring revenue). As the mobility and work-from-home characteristics of customers witnessed in 2020 and into 2021, businesses will need to rethink their CL policies, preferred brands and carriers, and reimbursement structures as many employees are using personal devices for work purposes. As with corporate liable accounts, your company or organization pays for your bill and they may even provide you with a discount or partially reimburse you for the device itself. Compass Intelligence expects the rest of 2021 to see continued competition in the CL space, as T-Mobile pushes the "un-carrier" business narrative even further into larger corporate accounts and will seek to steal Small Business share away from the other two. In addition, Compass Intelligence will continue to watch the market closely as changes in budget, priorities, and reimbursement for employee technology is impacted in 2021. At the end of 2020, corporate liable subscribers reached 54 million, while total business subscribers reached roughly 144 million in the U.S. Compass Intelligence has a complete BUSINESS WIRELESS tracker that our clients access and we break apart or segment the data by a number of ways for our carrier and OEM/handset clients:

Comments are closed.

|

Inside MobileCovering hot topics in the industry, new research, trends, and event coverage. Newsletter Signup

For Email Newsletters you can trust. Categories

All

|

RSS Feed

RSS Feed